Posted 26 Nov 2017

I just got back from a two week vacation without Internet as I was scouring some archeological ruins. I hardly thought about Bitcoin at all because there were so many other interesting things and it would be there when I got back.

Jimmy Song suggested I do an article on the current state of Bitcoin. A great suggestion but he is really smart (he worked on Armory after all!) so I better be thorough and accurate!

Therefore, this article will be pretty lengthy and meticulous.

As I completely expected, the 2X movement from the New York Agreement that was supposed to happen during the middle of my vacation flopped on its face because Jeff Garzik was driving the clown car with passengers willfully inside like Coinbase, Blockchain.info, Bitgo and Xapo and there were massive bugS and here in the code and miners like Bitmain did not want to allocate $150-350m to get it over the difficulty adjustments.

I am very disappointed in their lack of integrity with putting their money where their mouths are; myself and many others wanted to sell a lot of B2X for BTC!

On 7 December 2015, with Bitcoin trading at US$388.40, I wrote The Rise of the Fourth Great Bitcoin Bubble. On 4 December 2016, with Bitcoin trading at US$762.97, I did this interview:

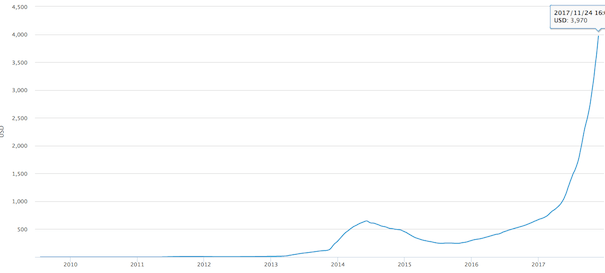

As of 26 November 2017, Bitcoin is trading around US$9,250.00. That is an increase of about 2,400% since I wrote the article prognosticating this fourth great Bitcoin bull market. I sure like being right, like usual (19 Dec 2011, 1 Jul 2013), especially when there are financial and economic consequences.

With such massive gains in such a short period of time the speculative question becomes: Buy, Hold or Sell?

Bitcoin is the decentralized censorship-resistant Internet Protocol for transferring value over a communications channel.

The Bitcoin network can use traditional Internet infrastructure. However, it is even more resilient because it has custom infrastructure including, thanks to Bitcoin Core developer Matt Corrallo, the FIBRE network and, thanks to Blockstream, satellites which reduce the cost of running a full-node anywhere in the world to essentially nothing in terms of money or privacy. Transactions can be cheaply broadcast via SMS messages.

The Bitcoin network has a difficulty of 1,347,001,430,559 which suggests about 9,642,211 TH/s of custom ASIC hardware deployed.

At a retail price of approximately US$105/THs that implies about $650m of custom ASIC hardware deployed (35% discount applied).

This custom hardware consumes approximately 30 TWh per year. That could power about 2.8m US households or the entire country of Morocco which has a population of 33.85m.

This Bitcoin mining generates approximately 12.5 bitcoins every 10 minutes or approximately 1,800 per day worth approximately US$16,650,000.

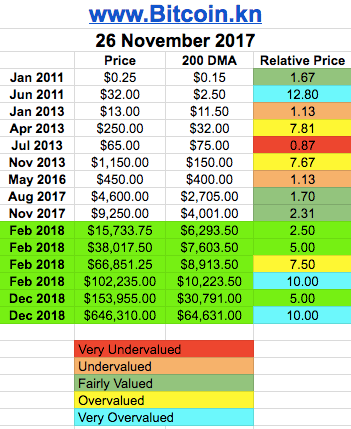

Bitcoin currently has a market capitalization greater than $150B which puts it solidly in the top-30 of M1 money stock countries and a 200 day moving average of about $65B which is increasing about $500m per day.

Average daily volumes for Bitcoin is around US$5B. That means multi-million dollar positions can be moved into and out of very easily with minimal slippage.

When my friend Andreas Antonopolous was unable to give his talk at a CRYPSA event I was invited to fill in and delivered this presentation, impromptu, on the Seven Network Effects of Bitcoin.

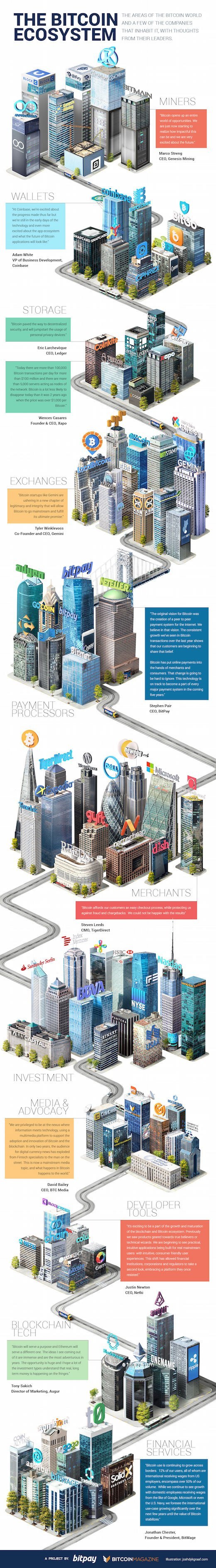

These seven network effects of Bitcoin are (1) Speculation, (2) Merchants, (3) Consumers, (4) Security [miners], (5) Developers, (6) Financialization and (7) Settlement Currency are all taking root at the same time and in an incredibly intertwined way.

With only the first network effect starting to take significant root; Bitcoin is no longer a little experiment of magic Internet money anymore. Bitcoin is monster growing at a tremendous rate!!

For the Bitcoin price to remain at $9,250 it requires approximately US$16,650,000 per day of capital inflow from new hodlers.

Bitcoin is both a Giffen good and a Veblen good.

A Giffen good is a product that people consume more of as the price rises and vice versa — seemingly in violation of basic laws of demand in microeconomics such as with substitute goods and the income effect.

Veblen goods are types of luxury goods for which the quantity demanded increases as the price increases in an apparent contradiction of the law of demand.

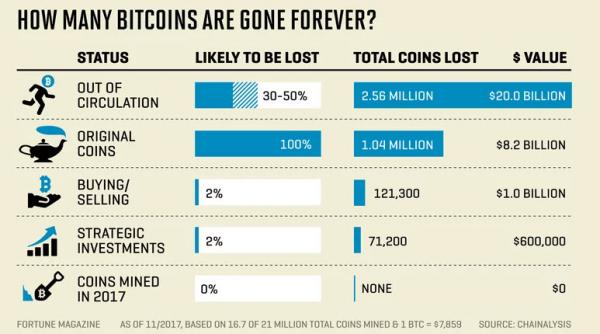

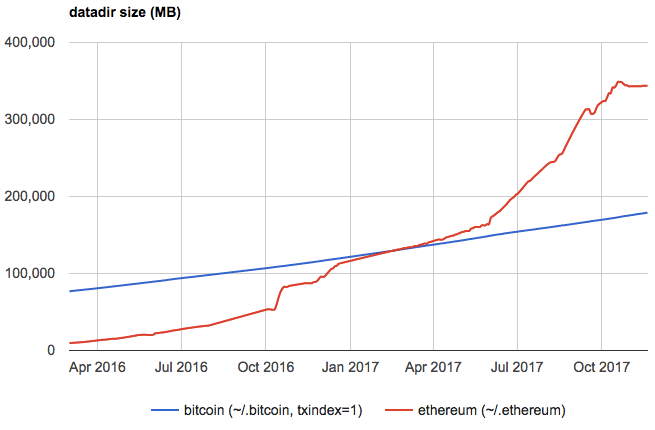

There are approximately 16.5m bitcoins of which ~4m are lost, ~4-6m are in deep cold storage, ~4m are in cold storage and ~2-4m are salable.

And forks like BCash (BCH) should not be scary but instead be looked upon as an opportunity to take more territory on the Bitcoin blockchain by trading the forks for real bitcoins which dries up more salable supply by moving it, likely, into deep cold storage.

According to Wikipedia, there are approximately 15.4m millionaires in the United States and about 12m HNWIs ($30m+ net worth) in the world. In other words, if every HNWI in the world wanted to own an entire bitcoin as a 'risk-free asset' that cannot be confiscated, seized or have the balance other wise altered then they could not.

For wise portfolio management, these HNWIs should have at least about 2-5% in gold and 0.5-1% in bitcoin.

Why? Perhaps some of the 60+ Saudis with 1,700 frozen bank accounts and about $800B of assets being targetted might be able to explain it to you.

In other words, everyone loves to chase the rabbit and once they catch it then know that it will not get away.

There are approximately 150+ significant Bitcoin exchanges worldwide. Kraken, according to the CEO, was adding about 6,000 new funded accounts per day in July 2017.

Supposedly, Coinbase is currently adding about 75,000 new accounts per day. Based on some trade secret analytics I have access to; I would estimate Coinbase is adding approximately 17,500 new accounts per day that purchase at least US$100 of Bitcoin.

If we assume Coinbase accounts for 8% of new global Bitcoin users who purchase at least $100 of bitcoins (just pulled out of thin error and likely very conservative as the actual number is perhaps around 2%) then that is approximately $21,875,000 of new capital coming into Bitcoin every single day just from retail demand from 218,750 total new accounts.

What I have found is that most new users start off buying US$100-500 and then after 3-4 months months they ramp up their capital allocation to $5,000+ if they have the funds available.

After all, it takes some time and practical experience to learn how to safely secure one's private keys.

To do so, I highly recommend Bitcoin Core (network consensus and full validation of the blockchain), Armory (private key management), Glacier Protocol (operational procedures) and a Puri.sm laptop (secure non-specialized hardware).

There has been no solution for large financial fiduciaries to invest in Bitcoin. This changed November 2017.

LedgerX, whose CEO I interviewed 23 March 2013, began trading as a CFTC regulated Swap Execution Facility and Derivatives Clearing Organization.

The CME Group announced they will begin trading in Q4 2017 Bitcoin futures.

The CBOE announced they will begin trading Bitcoin futures soon.

By analogy, these institutional products are like connecting a major metropolis's water system (US$90.4T and US$2 quadrillion) via a nanoscopic shunt to a tiny blueberry ($150B) that is infinitely expandable.

This price discovery could be the most wild thing anyone has ever experienced in financial markets.

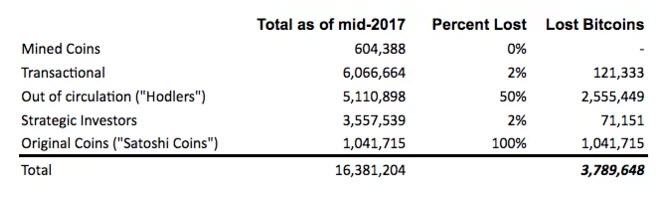

The same week Bitcoin was released I published my book The Great Credit Contraction and asserted it had now begun and capital would burrow down the liquidity pyramid into safer and more liquid assets.

Thus, the critical question becomes: Is Bitcoin a possible solution to the Great Credit Contraction by becoming the safest and most liquid asset?

At all times and in all circumstances gold remains money but, of course, there is always exchange rate risk due to price ratios constantly fluctuating. If the metal is held with a third-party in allocated-allocated storage (safest possible) then there is performance risk (Morgan Stanley gold storage lawsuit).

But, if properly held then, there should be no counter-party risk which requires the financial ability of a third-party to perform like with a bank account deposit. And, since gold exists at a single point in space and time therefore it is subject to confiscation or seizure risk.

Bitcoin is a completely new asset type. As such, the storage container is nearly empty with only $150B.

And every Bitcoin transaction effectively melts down every BTC and recasts it; thus ensuring with 100% accuracy the quantity and quality of the bitcoins. If the transaction is not on the blockchain then it did not happen. This is the strictest regulation possible; by math and cryptography!

This new immutable asset, if properly secured, is subject only to exchange rate risk. There does exist the possibility that a software bug may exist that could shut down the network, like what has happened with Ethereum, but the probability is almost nil and getting lower everyday it does not happen.

Thus, Bitcoin arguably has a lower risk profile than even gold and is the only blockchain to achieve security, scalability and liquidity.

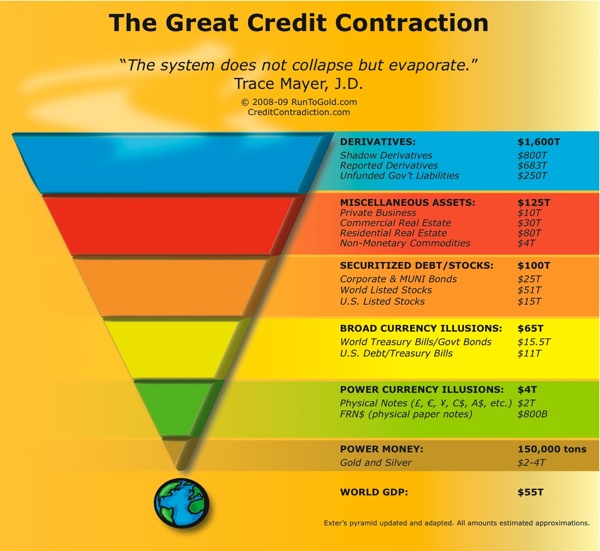

To remain decentralized, censorship-resistant and immutable requires scalability so as many users as possible can run full-nodes.

Some people, probably mostly those shilling alt-coins, think Bitcoin has a scalability problem that is so serious it requires a crude hard fork to solve.

On the other side of the debate, the Internet protocol and blockchain geniuses assert the scalability issues can, like other Internet Protocols have done, be solved in different layers which are now possible because of Segregated Witness which was activated in August 2017.

Whose code do you want to run: the JV benchwarmers or the championship Chicago Bulls?

As transaction fees rise, certain use cases of the Bitcoin blockchain are priced out of the market. And as the fees fall then they are economical again.

Additionally, as transaction fees rise, certain UTXOs are no longer economically usable thus destroying part of the money supply until fees decline and UTXOs become economical to move.

There are approximately 275,000-350,000 transactions per day with transaction fees currently about $2m/day and the 200 DMA is around $1.08m/day.

What I like about transaction fees is that they somewhat reveal the financial health of the network.

The security of the Bitcoin network results from the miners creating solutions to proof of work problems in the Bitcoin protocol and being rewarded from the (1) coinbase reward which is a form of inflation and (2) transaction fees which is a form of usage fee.

The higher the transaction fees then the greater implied value the Bitcoin network provides because users are willing to pay more for it.

I am highly skeptical of blockchains which have very low transaction fees. By Internet bubble analogy, Pets.com may have millions of page views but I am more interested in EBITDA.

Bitcoin and blockchain programming is not an easy skill to acquire and master. Most developers who have the skill are also financially independent now and can work on whatever they want.

The best of the best work through the Bitcoin Core process. After all, if you are a world class mountain climber then you do not hang out in the MacDonalds play pen but instead climb Mount Everest because that is where the challenge is.

However, there are many talented developers who work in other areas besides the protocol. Wallet maintainers, exchange operators, payment processors, etc. all need competent developers to help build their businesses.

Consequently, there is a huge shortage of competent developers. This is probably the largest single scalability constraint for the ecosystem.

Nevertheless, the Bitcoin ecosystem is healthier than ever before.

There are no significant global reserve settlement currency use cases for Bitcoin yet.

Perhaps the closest is Blockstream's Strong Federations via Liquid.

There is a tremendous amount of disagreement in the marketplace about the value proposition of Bitcoin. Price discovery for this asset will be intense and likely take many cycles of which this is the fourth.

Since the supply is known the exchange rate of Bitcoins is composed of (1) transactional demand and (2) speculative demand.

On 4 May 2017, Lightspeed Venture Partners partner Jeremy Liew who was among the early Facebook investors and the first Snapchat investor laid out their case for bitcoin exploding to $500,000 by 2030.

On 2 November 2017, Goldman Sachs CEO Lloyd Blankfein said, "Now we have paper that is just backed by fiat...Maybe in the new world, something gets backed by consensus."

On 12 Sep 2017, JP Morgan CEO called Bitcoin a 'fraud' but conceded that "Bitcoin could reach $100,000".

Thus, it is no surprise that the Bitcoin chart looks like a ferret on meth when there are such widely varying opinions on its value proposition.

I have been around this space for a long time. In my opinion, those who scoffed at the thought of $1 BTC, $10 BTC (Professor Bitcorn!), $100 BTC, $1,000 BTC are scoffing at $10,000 BTC and will scoff at $100,000 BTC, $1,000,000 BTC and even $10,000,000 BTC.

Interestingly, the people who understand it the best seem to think its financial dominance is destiny.

Meanwhile, those who understand it the least make emotionally charged, intellectually incoherent bearish arguments. A tremendous example of worldwide cognitive dissonance with regards to sound money, technology and the role or power of the State.

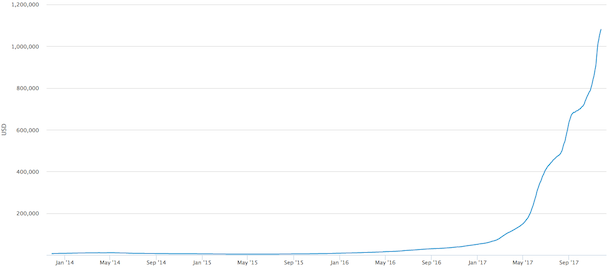

Consequently, I like looking at the 200 day moving average to filter out the daily noise and see the long-term trend.

Well, that chart of the long-term trend is pretty obvious and hard to dispute. Bitcoin is in a massive secular bull market.

The 200 day moving average is around $4,001 and rising about $30 per day.

So, what do some proforma situations look like where Bitcoin may be undervalued, average valued and overvalued? No, these are not prognostications.

Maybe Jamie Dimon is not so off his rocker after all with a $100,000 price prediction.

We are in a very unique period of human history where the collective globe is rethinking what money is and Bitcoin is in the ring battling for complete domination. Is or will it be fit for purpose?

As I have said many times before, if Bitcoin is fit for this purpose then this is the largest wealth transfer in the history of the world.

Well, this has been a brief analysis of where I think Bitcoin is at the end of November 2017.

The seven network effects are taking root extremely fast and exponentially reinforcing each other. The technological dominance of Bitcoin is unrivaled.

The world is rethinking what money is. Even CEOs of the largest banks and partners of the largest VC funds are honing in on Bitcoin's beacon.

While no one has a crystal ball; when I look in mine I see Bitcoin's future being very bright.

Currently, almost everyone who has bought Bitcoin and hodled is sitting on unrealized gains as measured in fiat currency. That is, after all, what uncharted territory with daily all-time highs do!

But perhaps there is a larger lesson to be learned here.

Riches are getting increasingly slippery because no one has a reliable defined tool to measure them with. Times like these require incredible amounts of humility and intelligence guided by macro instincts.

Perhaps everyone should start keeping books in three numéraires: USD, gold and Bitcoin.

Both gold and Bitcoin have never been worth nothing. But USD is a fiat currency and there are thousands of those in the fiat currency graveyard. How low can the world reserve currency go?

After all, what is the risk-free asset? And, whatever it is, in The Great Credit Contraction you want it!

What do you think? Disagree with some of my arguments or assertions? Please, eviscerate them on Twitter!