Posted 31 Jan 2013

Bitcoin, a censorship-resistant crypto-currency, will absorb any regulatory interference and only grow stronger as a result. Blowback baby! The cost of using credit cards is being dragged out of the shadows.

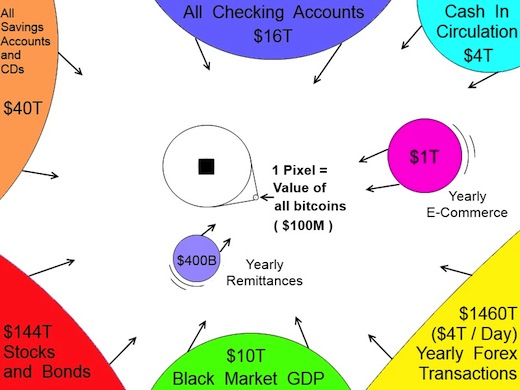

Germany has demanded their physical gold be moved back to the Homeland in anticipation of a currency crisis and capital controls. And the Bitcoin juggernaut continues to gain mass and momentum having reached $21.43 today.![]()

[pullquote]Bitcoin, with a pitbull like grip, has attached itself to Leviathan's carotid artery.[/pullquote]BITCOIN HAS SEBASTIAN SHAW-LIKE CHARACTERISTICS

Jon Matonis recently wrote how a government ban on Bitcoin would fail miserably. Sebastian Shaw is a mutant villain in X-Men: First Class and leader of the Hellfire Club. Shaw has the mutant ability to absorb energy or force and then focus it in a counter-attack.

Thus, the idle threat of force from regulators at 0:17 'Put that man down or we will open fire.'

[leadplayer_vid id="510B17C747A91"]

If there were proposed regulation I can already see Bitcoin's smirk coupled with the satirical response, 'Promise?'

I would go into more depth about why this is the case but I should give you some reason to attend on May 17-19th, with about 1,500 others, the Bitcoin Conference 2013 in San Jose, California. Plus, Jon Matonis has graciously invited me to give a presentation on Bitcoin: Regulation, privacy and taxes. It should be fun and interesting!

Gold, a physical element, is the same today as it was 500,000 year ago. But Bitcoin is so much more than it was a mere four years ago when first released to the public!

By analogy, the blockchain is like DNA and the market participants of the open-source Bitcoin community are like ribosomes that read the DNA in order to craft proteins necessary to adapt to and function within whatever environment or circumstance are encountered. This organic proliferation of software code by crypto-warriors who are changing the world is a beautiful thing and a simple time function with exponential effects.

Crypto-Ancapistan is already here. It seems most do not recognize it though because it is neither across an ocean nor does it have borders.

Its citizens neither secede nor declare independence plus there are no permanent residence visas or passports required. They build this new virtual nation line of code by line of code. There are even some publicly traded companies with $10m+ market capitalizations; two which earned 5k and 17k bitcoins in Jan. Cipherspace is a place where heroes live and where people who want to be heroes live.

[leadplayer_vid id="510B315058AFD"]

THE COST OF USING CREDIT CARDS

Yesterday I flew around a volcano in southern Chile. I even saw magma! Then it came time to settle the bill so I got out a credit card. The proprietor stated, 'Using a credit card will be an extra 5%.' For a 200,000 peso flight that comes out to about $21.33!

Tonight I enjoyed a delicious congrio dinner. The waiter brought the handwritten bill. So I got out the credit card. He responded fairly vehemently, 'No tarjeta. Pesos or dollares.' So I scraped together a few pesos.

Well, get used to it. Many credit card merchant agreements included a clause that prevented merchants from charging a fee to use credit cards for payment. But as part of a $7.3B class action settlement starting 27 JAN 2013 merchants can begin adding a surcharge for using credit cards.

The IRS and gas stations have done it for year. Now it will likely be coming in force to merchants near you. And if your favorite merchants do not then ask for a discount if you pay with cash. After all, there is a sweet sound of cash and a reason why we offer products at about a 40% discount if paid with Bitcoin.

So encourage your local merchants to talk with BitPay about accepting bitcoins.

[pullquote]As the currency wars escalate the currency controls will get increasingly onerous.[/pullquote]GERMANY DEMANDS GOLD REPATRIATED

On 16 JAN 2013 Telegraph reported that Germany would repatriate 674 tons of physical gold to the Homeland because 'A growing chorus of lawmakers in the Bundestag has demanded a return of all Germany’s gold in case the financial crisis escalates.' Germany can sense that the capital controls are going to intensify.

Argentina has already shown by example why one should look for ways to avoid credit cards. Jon Matonis wrote about how 'A 15 percent tax surcharge will close some of the gap between the regulated official rate and the black market rate'. So, if you have an Argentinian bank issued credit card and use it outside Argentina then the Argentine government has a 15% tax tacked onto your bill.

As the currency wars escalate the currency controls will get increasingly onerous. If a currency or payment method is censorship-prone, like Argentinian bank issued credit cards denominated in Argentine pesos, then it will be subject to such controls. This means you could take a large financial loss.

[pullquote]But historians are good at stating facts from the past and not creating the future.[/pullquote]MONETARY HISTORIANS VERSUS MONETARY VISIONARIES

Historians really have it pretty easy since they read about what has already happened. But to be a monetary visionary requires so much more.

James Turk, founder of GoldMoney, is one of the more prominent monetary historians. In this interview on 17 JAN 2013 Mr. Turk referenced my work on the tangibility of Bitcoin but oddly did note give proper credit. Why a monetary historian would not give proper credit to a monetary visionary baffles me. But James is just one of many I have directly influenced since I began publicly recommend Bitcoin in its infancy.

For examples from articles, interviews and etc., Robert Wenzel of Economic Policy Journal, Chris Powell of GATA, Lew Rockwell, Anti-War.com, Jeff Berwick of The Dollar Vigilante,The Silver Vigilante, John Rubino of Dollar Collapse, Jason Burack of Wall Street For Main Street, BrotherJohnF, Michael of The Daily Paul, Max Keiser, James Turk of GoldMoney, Kerry Lutz of the Financial Survival Network, Daniel Ameduri of Future Money Trends and many others off record have all been influenced early on by myself and persuaded to use and accept bitcoins.

But the point is that four years (someone may want to tell Mr. Turk who stated two years in the interview ... maybe that was the first time he heard about it) after Bitcoin was released to the public GoldMoney has finally started to mull Bitcoin integration. Sure, a true monetary visionary would already have the gold vaulting service integrated with Bitcoin. But historians are good at stating facts from the past and not creating the future.

Because what customers need is to have their bullion integrated with a censorship-resistant currency that will be much more malleable as currency controls are ratcheted up. You can bet that more restrictive currency controls and capital controls will be placed on gold if a real monetary crisis appears. A crisis Germany is preparing for by taking physical possession of the gold.

CONCLUSION

Bitcoin, with a pitbull like grip, has attached itself to Leviathan's carotid artery. Bitcoin, a sophisticated cryptographic protocol and the largest distributed computing network in the world, is immune to force. Threats of regulation, which are really just threats of force, are idle because of these Sebastian Shaw-like characteristics.

Germany is preparing for a major currency crisis by repatriating 674 tons of physical gold. Currency controls will only raise the cost of using credit cards which are currently far more expensive than Bitcoin in terms of time, money and privacy.

And when currency controls are ratcheted up it will be Bitcoin that allows holders of capital to have monetary sovereignty and portability.

Sure, gold is collapsing against Bitcoin but the real question is why are Bitcoins trading at a mere $21. Perhaps the monetary visionaries need to do more work teaching, training and influencing the monetary historians and others? To start, check out pages 72-78 of the February edition of Open Skies, the Emirates Airlines magazine. You will get to read it before millions of wealthy businessmen stuck on transoceanic flights who are used to being economically censored.

Get a copy of the Free Bitcoin Guide (recently updated), see you in San Jose and bring quesitons!