The Dtcc and Market Liquidity

Posted 10 Aug 2009

Market liquidity is a business, economics or investment term that refers to an asset's ability to be easily converted through an act of buying or selling without causing a significant movement in the price and with minimum loss of value. As market liquidity dries up then the bid and ask widen.

The depth and breadth of United States financial markets has provided significant liquidity which has resulted in tremendously inflated illusory asset prices.

This will be an introduction to The Depository Trust and Clearing Corporation along with a brief analysis about how by its very nature market liquidity can evaporate extremely quickly which would destroy your value and purchasing power and what you can do to protect yourself.

The DTCC

The Depository Trust And Clearing Corporation, or DTCC, plays a primary role in preserving liquidity in US financial markets.

The DTCC, through its subsidiaries, clears and settles transactions for money market funds, general equities, corporate bonds, municipal bonds, mortgage-backed securities and even the nefarious over-the-counter derivatives. Subsidiaries include the National Securities Clearing Corporation, The Depository Trust Company, Fixed Income Clearing Corporation, DTCC Deriv/SERV LLC, DTCC Solutions LLC, EuroCCP Ltd. and a joint venture, Omgeo, which 'plays a critical role in institutional post-trade processing, acting as a central information management and processing hub for brokers, investment managers and custodian banks.'

The DTCC is the largest depository in the world. It provides custody for more than 3.5 million securities issues from the United States and 110 other countries around the world.

The DTCC has custody of approximately $40,000,000,000,000 of assets. A shareholder under corporation law is someone who is registered on the stockholder's list. Being a shareholder can impart many rights under corporation law. The DTCC, through 'Cede & Company' is, in many cases, the only shareholder of many publicly traded corporations. This is accomplished through an indirect holding system.

As Professors Baums & Cahn observed in their working paper "The Rise And Effect Of The Indirect Holding System: How Coprorate America Ceded Its Shareholders To Intermediaries" on page 23

The ultimate goal in this model is for all issuers to cede control of shareholder data to a single entity, which would then conduct all of the market's transactions on its books, just as if all securities in circulation on the market had been dematerialized.

Today, in fact, it is likely that a listed company will have only one registered shareholder, appropriately named "Cede & Company", the nominee of the Depository Trust Company (DTC), which is a subsidiary of the Depository Trust and Clearing Company (DTCC), the entity whose group clears and settles almost all transactions entered into on organized markets in the United States. The rules of DTC require that Cede be registered as holder for all deposited securities.

For shareholders, such as Cede & Company, there are several advantages for corporations having only one shareholder. A few examples include, (1) clearing and settlement of shares can be accomplished quickly which provides increased liquidity (so long as there is confidence in the system), (2) shareholder derivative lawsuits brought by minority shareholders are more difficult to prevail with, (3) under the Uniform Commercial Code §8-207(a) there may be a rebuttable presumption that provides that an issuer (corporation) may have the right to deal solely with registered shareholders, (4) under corporation law a duty generally arises that provides for corporations to give notice of annual meetings, voting, dividends, etc. to shareholders, and (5) shareholders should be able to contact each other directly and the shareholder manifest contains the contact details.

DTCC Operational Activities

On 9 June 2009 Larry Thompson, General Counsel for the DTCC, testified before the United States Congress' Subcommittee on Capital Markets, Insurance and Government Sponsored Enterprises, that

Now many of you may not have heard of the DTCC before. That's purposeful. We have traditionally kept a low profile, given the nature of the role we play in U.S. financial markets. Last year DTCC settled $1,880,000,000,000,000 in securities transactions across multiple asset classes. We essentially turnover the equivalent of the U.S. GDP ever three days - and we provide the post-trade processing efficiency and low cost that attracts investment capital that helps fuel the U.S. economy. [emphasis added]

According to the DTCC 2009 annual report the company had $1.4B total revenue, $127.6M of net income, paid $22.8M in income taxes and had an $11.4B increase in cash and cash equivalents.

DTCC Board of Directors

The DTCC's board includes 20 directors. For those who have read The Creature From Jekyll Island or Secrets Of The Temple many of the institutions will be familiar. It is interesting to see the correlation between firms that have received bailout funds and members of DTCC's board of directors. So, for those who have wanted to put faces with those who have received bailout money. Perhaps making off with all those millions in bonuses is why they are all smiling?

|

Art Certosimo | Senior Executive Vice President | Bank of New York Mellon |

|

Norman Malo | President and CEO | National Financial Services LLC; Fidelity Investments |

|

Stephen P. Casper | Partner | Vastardis Capital Services |

|

Gerald A. Beeson | Senior Managing Director & Chief Operating Officer | Citadel Investment Group, LLC |

|

Louis G. Pastina | Executive Vice President | NYSE Operations; NYSE Euronext |

|

Donald F. Donahue | Chairman and Chief Executive Officer | The Depository Trust & Clearing Corporation |

|

William B. Aimetti | President and Chief Operating Officer | The Depository Trust & Clearing Corporation |

|

J. Charles Cardona | CEO of The Bank of New York Mellon - Cash Investment Strategies | President of The Dreyfus Corporation |

|

Randolph L. Cowen | Co-Chief Administrative Officer | The Goldman Sachs Group, Inc. |

|

Norman Eaker | Chief Administrative Officer | Edward Jones |

|

Timothy J. Theriault | President - Corporate & Institutional Services | Northern Trust Company |

|

Neeraj Sahai | Managing Director and Global Business Head | Securities and Fund Services Citi |

|

Gerard LaRocca | Chief Administrative Officer | Americas Barclays Capital |

|

David A. Weisbrod | Managing Director and Risk Executive | JPMorgan Chase Bank |

|

Stephen Luparello | Vice Chairman and Senior Executive Vice President of Regulatory Operations | FINRA |

|

Mark Alexander | Managing Director, Global Wealth & Investment Management - Bank of America Merrill Lynch | Head of Technology Operations - Broadcort Clearing |

|

Ronald Purpora | President | ICAP Securities USA LLC |

|

Robert Kaplan | Executive Vice President | State Street Bank & Trust Co. |

|

Michele Trogni | Managing Director and Global Head of Operations | UBS Investment Bank |

|

Ian Lowitt | Administrative Officer | Lehman Brothers |

Disadvantages of Consolidation

The more consolidation the more risk of a systemic failure. Should there be a systemic failure, or even the perception of a system failure such as the firesale which formed the plot of the movie Live Free or Die Hard, then market liquidity would quickly dry up in this interconnected and increasingly location independent world.

Should there be actual damage to the records held by the DTCC then sorting out who owns what could get particularly interesting. There would be a lot up for grabs all at once. Like with the bailouts the environment would be ripe for fraud. The DTCC is a member of the Federal Reserve System; that same system which has been funneling trillions of dollars of bailout money to private financial interests without due process.

Reduce Risk

Simple actions can be taken to reduce your risk. You can eliminate as many layers of institutions and organizations as possible between you and your assets. Wealth takes two primary forms as either a tangible or financial assets. Tangible assets have intrinsic value. Financial assets derive their value from underlying tangible assets.

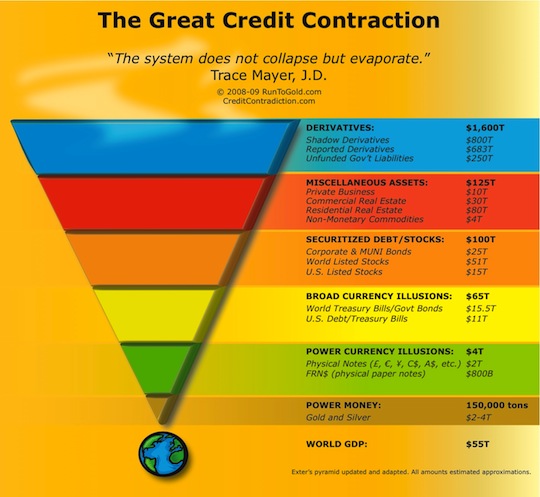

During The Great Credit Contraction capital has continued to seek the safest and most liquid assets. For example, as capital migrated down the liquidity pyramid from Auction Rate Securities into Treasuries the ARS market evaporated. So likewise major events, real or fabricated, like the crisis during the fall of 2008 can quickly dry up liquidity.

The quoted price for assets is becoming increasingly illusory because of the fake liquidity which will learn how to vanish. For example, the NYSE reported, "Due to an NYSE system error, Goldman, Sachs & Co. was inadvertently omitted from the chart of most active firms, but the firm's program activity was included in the total level of programs as a percentage of NYSE volume, which remains unchanged at 48.6 percent."

Given the large degree of illusory liquidity currently in the market and the control by a single institution, who is of course represented on the board of the DTCC, the risk of illiquidity is increasing as the share of volume increases with those institutions.

Of course, if you want to reduce as much risk as possible you can move your capital to the safest and most liquid asset and just buy gold. To diversify you could buy some silver or even purchase platinum. You can eliminate debt with the intrusive loan disclosures.

You could also take possession of your share certificates and be entered on the shareholder manifest. Mr. Warren Buffett also prefers shareholders of Berkshire Hathaway, whom he views as long-term partners, to take physical possession of their certificates instead of being held by "Cede & Co." or via some other intermediary. Prior to 2003 he would make a contribution to a recognized of the shareholder's choice for each 'A' share they had taken possession of and those held in via intermediaries forfeited the charitable contribution. In the 2003 Berkshire Hathaway Annual Report Warren Buffett wrote, "We recommend that you use certified or registered mail when delivering the stock certificates and written instructions."

Conclusion

The corporate governance of U.S. publicly traded companies has been increasingly weakened as shareholders have been ceded to intermediaries. The DTCC, through Cede & Co., is the sole shareholder of record for many, if not most, publicly traded companies. The board of directors of the DTCC are from many institutions which United States Congresswoman Marcy Kaptur warns that 'high financial crimes have been committed'. As a result, much of the American public's wealth is held in custody of these intermediaries and exposes them to an increased degree of risk.

If you think the financial assets you think you own in brokerage account are actually there, unencumbered, or otherwise as safe and secure as possible then you may be mistaken. During these tumultuous and precarious economic times it is particularly prudent to remove as much risk as possible between you and your investments.

Disclosure: Long physical gold, silver, platinum with no position in Berkshire Hathaway or the problematic GLD or SLV ETFs.