Posted 07 Feb 2011

In the monetary metals there has been sustained gold backwardation and silver backwardation. This esoteric subject distills into two main elements: (1) interest rates and (2) risk management.

The backwardation implies abnormalities in the interest rate structure and/or heavy demand for physical bullion driven by either averseness to counter-party risk or exchange rate risk that could result in the currency event of hyperinflation or the paranoid gold and silver bugs have recently mutated into much larger organisms.![]()

READER QUESTION - WHERE ARE YOU?

I have not written for a few weeks and received a rather funny email from a reader: "Did you call this about 15 months ago? POT NYSE You sly Mofo. Where are you? Did someone threaten you like Lindsay Williams was?"

I figure the response may be helpful to all. Yes, about 18 months ago on Business News Network in Canada I did make a buy call on Potash Co. (POT). It has since rocketed higher. I have been bouncing around in the clouds flying around tiny islands, including Saint Kitts and Dominica, with Bill Rounds, my co-author of How To Vanish.

I was only threatened by one person, an attractive female Customers and Border Patrol agent in Puerto Rico. Because ATC diverted us around a military exercise we were late arriving and I did not call. Then on the way back through Puerto Rico I failed to call again and while searching our plane she actually got out a Geiger counter, seriously! What is it with women always wanting you to call them back?

So, next time I am headed through Puerto Rico and since my smile did not work to appease her if anyone knows where I can get a cell phone like Gordon Gekko so that I can call CBP next time I would be extremely grateful.

SILVER BACKWARDATION AND INTEREST RATES

The monetary metals have an interest rate which is the percentage difference between the future price and spot price. Currently the market treats only gold as a primarily monetary commodity. Silver, platinum and palladium are treated as quasi-monetary commodities. Gold is produced primarily to be hoarded while most silver, platinum and palladium demand is for a wide variety of industrial uses like a Gordon Gekko cell phone.

In early 2009 I wrote about the silver backwardation. James Turk, Chairman of GoldMoney, made several insightful observations about silver's backwardation in his 4 December 2010 article about the Scramble For Physical Metal.

These supply and demand differences is a primary reason why I am extremely bullish on platinum and recommended accumulating it in July 2009 around $1,118 per ounce. My opinion is that during The Great Credit Contraction the monetary demand for silver, platinum and palladium will increase for all the same reasons why gold functions as money. It will no longer be fiat currency, such as FRN$, Euros, Yen, British Pounds, etc. versus only gold but instead versus gold and every other commodity.

This paradigm shift from a debt-based consumption cycle to an equity based savings cycle will be a sea change like an upside down house to many. The real interest rates of the commodities are a function of their storage and attrition costs. Thus, silver, platinum and palladium will have tremendous advantages over alternative commodities like rice, corn, oil, etc.

The New York Sun reported Alan Greenspan's 15 September 2010 remarks to the Council on Foreign Relations:

If all currencies are moving up or down together, the question is: relative to what? Gold is the canary in the coal mine. It signals problems with respect to currency markets. Central banks should pay attention to it. ... Fiat money has no place to go but gold.

Like Mr. Greenspan I favor using gold as one's numeraire but my prognostication is a little broader. Not only does fiat currency have gold to move into but also silver, platinum and palladium unless he knows something about future worldwide monetary policy that has not been publicly released.

With quantitative easing and the zero interest rate environment the fiat currency interest rate structure is extremely distorted. This increases demand for silver in the immediate term because the cost of fiat currency is so low while demand is waning and storage fees are perceived to be less expensive than the estimated counter-party risk cost. It takes a bailed out zombie to know a bailed out zombie!

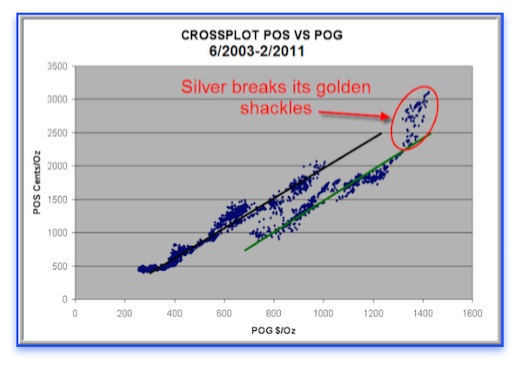

The net effect are negative real interest rates. So long as negative real interest rates are persistent the gold bull market, with silver and platinum having an R-squared correlation coefficient of about 98%, will remain intact. But as Adrain Douglas has astutely observed if there is increased monetary demand for silver then this correlation can be disrupted or change completely.

INCREASED SILVER MONETARY DEMAND

So an important issue becomes has there been a material increase in silver's worldwide monetary demand?

The United States Mint recorded January 2011 sales of American Silver Eagles to be 6.42 million which easily surpassed the previous monthly record of 4.26 million in November 2010. This increase in demand was in spite of the price of silver increasing by about $2 per ounce in November while it declined about $3 per ounce in January.

Increased demand for silver in India was about 70 million ounces in 2010 while China went from exporting about 40 million ounces in 2009 to importing 40 million ounces in 2010. Then there is John Embry's revelation that it took about two months to stock the Sprott silver trust. Additionally, there appears to be shortages developing for 100 ounce silver bars.

Because of the increased demand for silver as a monetary instrument by Americans in the form of legal tender coins and 100 ounce bars, the incredible increase in demand from India and China of about 150 million ounce difference between 2009 and 2010, about 25-30% of worldwide production, and the creation of the Sprott silver trust (PHYS) therefore it appears that there is a material and consistent increase in the worldwide demand for silver as a monetary instrument.

Because of the deficiencies of the GLD ETF and similar unusual activity with the SLV ETF it is interesting to note that significant redemptions are being made which implies the ETFs are being tapped as a source of physical bullion to meet immediate delivery demands.

The aboveground stockpiles of silver are tiny compared to gold. On the other hand, central banks around the world have created $20-50 trillion of new currency digits over the past few years. To remain liquid and risk-free in terms of either (1) counter-party or (2) hyperinflation, the value represented by these imaginary units sometimes printed on colored coupons have primarily nowhere to go in regards to monetary commodities but gold, silver, platinum and palladium.

CONCLUSION

Monetary demand for silver is primarily from savers who consume less than they produce and want a liquid and safe store of value while they are engaged in other activities, like flying around in the clouds.

The current interest rate structure is likely causing headaches for the arbitrageurs dealing in large amounts who are attempting to squeeze profits off a penny or two per ounce because of the tremendous amount of risk they expose themselves to as savers demand delivery physical metal.

With the worldwide bailout of the financial system, the Irish central bank printing billions of Euros, the Federal Reserve engaged in quantitative easing and general competitive currency devaluations worldwide it appears the current fiat currency and fractional reserve banking system has been duck taped together and is not at significant risk of imminent failure; largely because there is no significant alternative.

With demand from the American and European public, India, China and the Sprott silver trust therefore it appears that the gold and silver bugs have mutated into much larger organisms and are preparing for currency upheaval and perhaps even a new worldwide currency system. There is a high probability that gold, silver, platinum and palladium will continue to increase in price relative to fiat currencies.

After all, fiat currencies are merely a confidence game and it is hard to have confidence in a figment of the imagination that is being rapidly increased in amount.

Thus, a prudent saver should continue accumulating the monetary metals on a regular and consistent basis from reputable firms like Apmex or GoldMoney as gold, silver, platinum and palladium have become performing insurance against fiat currency failure.