Posted 23 Dec 2010

Regarding the regression theorem, can the grandson also be the great-grand father? Ideas can only be overcome by other ideas and words proffer the instruments to meaning.

The ability to wield words concisely, accurately and orderly is essential for communication and persuasion. Much of discourse, particularly from court economists, has devolved into sophistry and incomprehensible babbling.![]()

[pullquote]Can The Grandson Also Be The Great Grand Father?[/pullquote]FOFOA'S QUESTION

In an extremely verbose and conflated article the pseudo-anonymous FOFOA asks, "Does anyone have any evidence that silver is still money today?"

I find a few of FOFOA's assertions fairly odd, especially for a voice in the gold niche. For example,

Money is debt, by its very nature, whether it is gold, paper, sea shells, tally sticks or lines drawn in the sand. (Another shocking statement?) Yes, even gold used as money represents debt. More on this in a moment. ...

First, money. Money is always an overvalued something. Usually a commodity of some sort. But it can be as simple as an overvalued line in the sand, or a digital entry in a computer database. But the key is, it is always overvalued relative to its industrial uses! That's what makes it money! ...

Did you hear him at 6:35? "Only one metal in the world that fits the bill for money, and that's gold!" That's right Joe! Good job from the "Silverfuturist". There can be only one!

Mish has chimed in on many of FOFOA's fallacies.

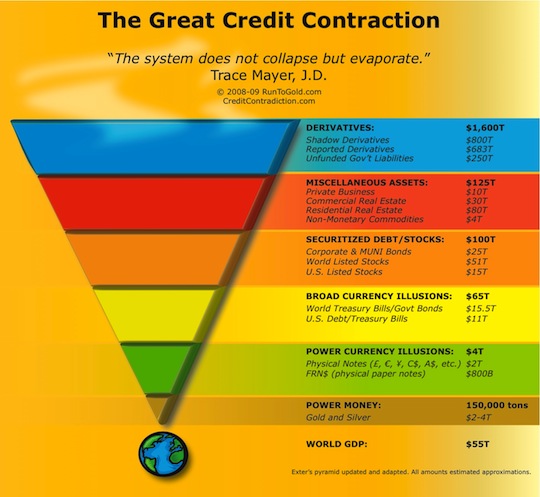

There is a reason Chapter One of my book The Great Credit Contraction is titled Word Games.

In that chapter, I present the two competing theories of money, market versus Chartalism, along with an example of the regression theorem and then distinguish money, money substitutes and illusions which can all function as either currency or legal tender or both. What is so odd about FOFOA's fallacious assertions is that they contradict basic principles of monetary science.

SCALPEL PLEASE - DISTINGUISHING TERMS

The conflation of the terms money, money substitutes, illusions, currency and legal tender is one of the greatest problems in understanding monetary science. Let's examine each.

Legal tender by government decree must be accepted if offered in payment of a debt. Currency can be examined either broadly or narrowly and in its narrow examination it is the medium of exchange most commonly used in ordinary daily transactions.

Illusions are figments of people's imagination and for our discussion we will consider them negotiable instruments that promise nothing. Staying within this same discussion, money substitutes are negotiable instruments that promise the payment of money.

[pullquote]Therefore, it follows that gold cannot be debt and is obviously a form of currency that is no-one’s liability.[/pullquote]THE REGRESSION THEOREM

This exchange between Dr. Ron Paul and Dr. Alan Greenspan centered the issue on the definition of money.

Congressman Ron Paul: So it is hard to manage something you cannot define.

Dr. Greenspan: It is not possible to manage something you cannot define.

First, it should be noted that Greenspan implicitly admits the faulty argument behind Chartalism. Second, a fairly basic theory of monetary science is the regression theorem, one of many contributions by Ludwig von Mises, and answers the question why do illusions, money substitutes or money have purchasing power? For those unfamiliar with the regression theorem, before continuing, you may want to read Bob Murphy's short article.

What is Mish's response? "Like FOFOA I believe gold is money. However, unlike FOFOA I think money is whatever the free market says it is. The problem is, we do not have a free market we only have government decree mandating the use of dollars, Pounds, Yen, Renmimbi, Euros, and Francs as money."

This answer from Mish regarding the competing theories of money is the only reasonable and rational response.

But I disagree with Mish's assertion that a free market does not exist. Individuals are sovereign and 'endowed by their Creator' with rights. The free market existed first and then the State was created. This is the same reason Chartalism is philosophically flawed.

Sure, the Statetrix is extremely strong today but most individuals still have freedom of movement which allows people to vote with their feet.

Until the free will of mankind is completely violated worldwide through the establishment of a new world order or one world government then a free market will exist. A new world order is not likely because of the failed fiat currency fractional reserve banking conspiracy. The Great Credit Contraction has begun and there is no stopping it.

Despite what most people think or feel; the State is dead, intellectually, morally, spiritually, financially and economically. Sure, some individuals in certain geographic areas, like North Korea or the United States of America, will face threats of collateral damage as the gigantic rotting corpses tumble to the ground causing great destruction.

But for a sovereign individual in a free market the management of political risk is just like managing any other risk; weather, contract, counter-party, performance, etc. I devote Chapter Six to Personal Practical Implementation like the five flag theory for managing political risk, geographic diversification and even second passports.

MISH'S MASSIVE MISAPPLICATION

But the regression theorem answers the question on how a medium of exchange can come into existence; it explains the origin of money.

Here Mish makes a critical misapplication of monetary theory. "While theoretically possible, in today's world silver has one huge drawback that gold does not have: Silver is used up. Gold is not. Silver is widely use in industrial applications"

This is the exact opposite of why the market has chosen gold and silver as money. The theory is already being applied. The reason gold is money and currency, a medium of exchange, is because people first valued gold for its commodity uses because they attached increased value to gold based on its expected purchasing power and the reason they were willing to hold cash balances in gold.

Under the theory of market determined money astute traders in a barter environment settle on a particular commodity or commodities that are currently trading in the marketplace as money because of their increased degree of saleableness, saleability, liquidity or marketability.

SILVER PRICE IMPLICATIONS

But silver is also valued for its industrial applications. The market searches for a cash balance medium with the lowest transaction and storage costs. As the silver price discovery occurs there are two large demand drivers: (1) industrial and (2) monetary.

But silver is also valued for its industrial applications. The market searches for a cash balance medium with the lowest transaction and storage costs. As the silver price discovery occurs there are two large demand drivers: (1) industrial and (2) monetary.

In this case, silver is widely used in industrial applications. Many of these are essential for the current standard of living for humanity such as medical, automation, high tech and etc. while small amounts of silver are actually used in each application so this results in the inelasticity of demand being fairly low.

Additionally, silver is valued for these reasons and is fungible, divisible, scarce, non-corrosive, portable and definable. A problem is the high ratio of about 50 ounces of silver per ounce of gold which along with the lower density results in higher storage costs for silver relative to a substitute good, gold.

Taken in totality these properties make silver extremely efficient economically to be used as a medium of exchange.

As The Great Credit Contraction continues holders of capital will continue seeking safety and liquidity.

As the monetary demand for silver increases then industrial and consumer prices will likewise have to increase or firms will face bankruptcy because they cannot sell for less than their costs and remain profitable. This can be particularly helpful in figuring out the implications between inflation or deflation.

But these individual preferences expressed through human action and being revealed through the current silver price does not constitute evidence of silver being overvalued as FOFOA asserts. That assertion rests on there being a proper valuation for silver. A proper valuation set by whom, the State? Chartalist! Plus, I would love for FOFOA to explain what types of industrial applications a digital entry in a computer database has.

[pullquote]Applying monetary science to Internet technology is not a simple task.[/pullquote]CURRENCY EVOLUTIONS

Being able to predict future market innovations from entrepreneurs is the work of often wrong science fiction authors. Could anyone predict a Ferrari in 1880? No, they thought about 'horseless carriages'. Could anyone have predicted the Internet fifty years ago? Fifteen years ago Google did not exist. YouTube and Facebook are barely over five years old.

The fiat currency fractional reserve banking system that has evolved out of a five hundred year old money substitute system is fundamentally unstable and everyone knows it. The lifeblood of the State is dead and decaying through failing quantitative easing. The 2008 financial crisis shook the financial community and worldwide population to the core. The search for a viable replacement is on like Donkey Kong.

Applying monetary science to Internet technology is not a simple task. The first 'horseless carriages', like GoldMoney, have begun to develop. Remember, what the telegraph company and IBM told Alexander Graham Bell and Bill Gates. GoldMoney allows gold, silver, platinum and palladium to circulate as currency in ordinary daily transactions while immunizing the holder of capital from both counter-party risk and illusion risk, the risk that the illusion currency unit will become worthless because of loss of confidence by market participants (hyperinflation).

CONCLUSION

Just like it is logically inconsistent for the grandson to also be the great grandfather so likewise it is logically consistent for the FRN$ to be currency with purchasing power only because gold or silver are money with industrial demand. When you apply the regression theorem it reveals that silver and gold were valued as commodities in the state of barter as a result of sovereign individuals making choices based on human action.

Therefore, it follows that gold cannot be debt and is obviously a form of currency that is no-one's liability. Sure, a money substitute like a gold certificate is debt but a money substitute is not money anymore than the GLD ETF is gold just like a FRN$ is not a US$ and a dollar is defined as 371.25 grains of fine silver. Silver and gold already possess currency market share though far inferior to the FRN$, Yen or Euro.

Evolutions in currency like the FRN$, credit cards, GoldMoney, frequent flyer points, gift cards, Yen, bitcoin, etc. will continue and hasten as we further transition to the Information Age.

To stimulate innovation and increase the standard of living through a more efficient currency market we should support Dr. Ron Paul's H.R. 4248 - Free Competititon In Currency Act of 2009.

The Internet is a relentless process of decentralization and like a rising sun the inefficiencies in the worldwide free market are being dispelled with the collapse of massive currencies like the broken Euro or FRN$ and their issuers which speaks to the currency market opportunity for entrepreneurs and resulting transition to a new world. There will no more be one currency to settle them all than there will be one world government to rule them all.

DISCLOSURES: Long physical gold, silver and platinum.