Posted 24 Aug 2009

Many people feel tremendous stress regarding financial matters and this often has detrimental effects on their relationships and is one of the leading factors for divorce. Like a doctor who elucidates an extremely negative diagnoses I somewhat dread explaining The Great Credit Contraction to people because of the massive effects it is having upon both the individual and the world. When I do take the time to explain it I am usually asked: What should I do?

Of course, the answer is unique to every individual based on their utility calculation but I think it is important to understand the different forces at work in the finance universe, have tools to measure your own financial vital signs and then build solid, healthy and strong personal financial statements as you enjoy the quality of life you desire.

Important principles to understand are (1) opposites, (2) self-sufficiency for survivalism in the suburbs and (3) preparation.

The American consumer has begun to strengthen their financial statements with a tremendous increase in the savings rate. While this is good for the American consumer it will continue to weigh on revenue, earnings and the general economy because of the nature of the debt-based monetary system.

YIN AND YANG

At the heart of many branches of classical Chinese philosophy and science is the concept of yin and yang. The yin and yang is used to describe how seemingly disjunct or opposing forces are interconnected and interdependent in the natural world and give rise to each other in turn. According to the philosophy yin and yang are complementary opposites within a greater whole. Everything has both yin and yang aspects which constantly interact and never exist in absolute stasis. An excellent example in Western culture is Star Wars with the Jedi among the Light side of the Force and the Sith among the Dark side of the Force.

So likewise in finance this principle of opposites is present:

| Light | Dark |

| Equity | Debt |

| Tangible Asset | Financial Asset |

| Cash-Flow | Capital Gains |

| Investing | Speculation |

| Gold & Silver | FRN$ & Euros |

| Commodity Currency | Fiat Currency |

| Freedom | Slavery |

| Bailment | Fractional Reserve Banking |

| Honesty | Fraud |

| Earned Income | Passive Income |

| Long | Short |

FINANCIAL VITAL SIGNS

In financial accounting there are a few basic ratios that are used to analyze financial health. Applying the principles behind these ratios to your personal situation can be extremely helpful in measuring your financial health.

Of course, this presumes you keep financial statements which I doubt the vast majority of Americans do, in written format, which is a primary reason they are in their current situation. One of the reasons the American consumer based economy has been shattered to pieces is because of the weakness of their balance sheets. Even worse is that most American's neither know nor understand the true state of their financial health.

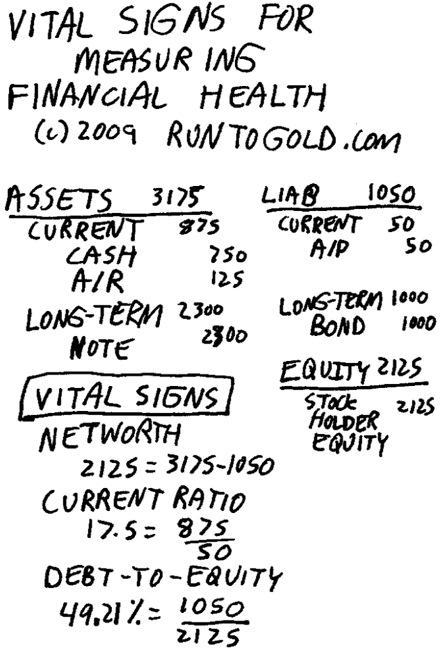

Companies usually issue annual financial statements and therefore assets and liabilities are generally divided into current or long-term. To distinguish current from long-term the standard is whether the transaction comes due within one year. Three important ratios are:

1. Net worth which is assets minus liabilities.

2. Current ratio which is current assets divided by current liabilities.

3. Debt-to-equity ratio which is total liabilities divided by stockholder's equity.

Because most individuals go through monthly financial cycles, such as paychecks, rent, mortgages, cell phone, cable, insurance, etc. I recommend shortening the standard for distinguishing current assets and liabilities from long-term; perhaps use 1, 3 or 6 months as the standard instead of a year.

The use of these ratios for financial vital signs will give a quick snapshot of your overall net worth, liquidity and leverage. You can quickly build a spreadsheet using Google Docs and have most of this automatically calculated.

IMPORTANCE OF GOLD AND SILVER

The FRN$ has no definition, is an illusion and merely a figment of people's imagination. Do you know the answer to what is a dollar? The owner's of FRN$ are guaranteed no purchasing power.

By contrast, an ounce of silver or half of a gram of platinum will purchase approximately 2-4 gallons of gasoline or a nice steak dinner and with tools like GoldMoney you can even pay for the good or service with the physical bullion as the currency. I recommend gold as the unit of account for the most accurate mental calculation of value.

Also, you will need to determine your own gold standard.

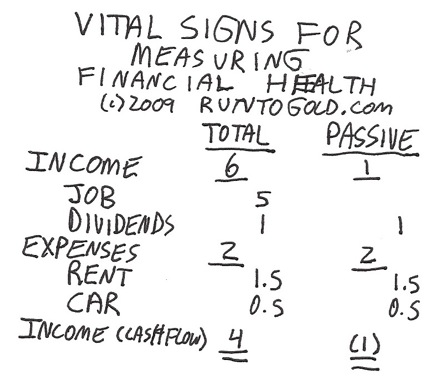

EARNED VERSUS PASSIVE INCOME

Work is a wonderful activity which can lead to personal development. Sometimes work can interfere with one's satisfaction, happiness and lifestyle balance.

When designing one's lifestyle there are many risks that responsible people plan for by using instruments such as life or fire insurance. The failure to plan can lead to financial destruction. So likewise it is wise to plan one's financial situation to include not only earned income but also passive or residual income.

Passive or residual income are earnings an individual derives from a rental property, dividends, interest payments, limited partnership and etc. in which he or she is not actively involved. If part of your income is derived from passive or residual sources then should you become incapacitated through injury or disease, decide to take a cruise around the world, etc. then your income would not cease.

Therefore, I think it is important to distinguish between earned and passive income when measuring one's financial vital signs.

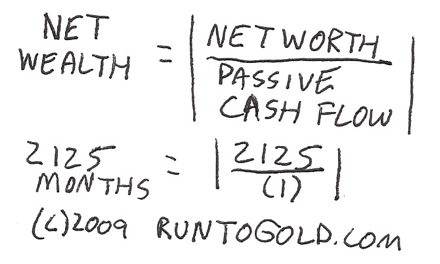

NET WEALTH

You can buy gold with time through your labor but you cannot use your gold to buy time because time moves on wings of lightening never to be returned. Likewise as Randy Pausch observed in his Last Lecture, "We do not beat the Reaper by living long but by living well."

When your financial condition is extremely solid then you can pursue those hobbies, activities, etc. that will bring you the fulfillment you seek.

Net wealth is a function of three variables, (1) number of months, (2) standard of living and (3) without 'working'. To determine your 'standard of living' you need to examine your current expenses to determine your total monthly expenses. Once your passive income or passive cash-flow exceeds your expenses then your net wealth can approach infinite but keep in mind that managing your financial condition will always require some of your time and attention.

PERSONAL APPLICATION

PERSONAL APPLICATION

Every individual will need to determine whether they want to measure their financial vital signs and what values they want to seek. As with our physical vital signs there is no one that cares as much about them as ourselves and each of us intuitively knows the true state of our condition.

Being fairly conservative, extremely debt adverse and having an affinity towards sound money, cash-flow investments and self-sufficiency my ratios may be different than others who may have less financial responsibility. I recommend (1) a positive net worth, (2) a current ratio greater than 10, (3) a debt-to-equity ratio below 10% and (4) net wealth in excess of 24 months. Achieving these type of financial vital signs may require significant discipline but it is possible.

There are many benefits such as the freedom to live location independent, protecting your financial privacy and personal privacy, having control over who, when and where you interact with others, etc. You also will have much more margin for error and not be in the financial condition of many Americans of being two paychecks away from insolvency. How stressful!

The issue is not whether working 100 hours a week as an investment banker is better than doing yoga, scuba diving in exotic caves or playing with grandchildren. Everyone has their own preferences. The issue is having the personal freedom and financial soundness to be able to do what you want, when you want, with whom you want and where you want.

CONCLUSION

The American consumer increasingly stressed over monetary matters and the economy. This is changing behaviors as evidenced by the rising savings rate will slow GDP and may turn into habits which last for years if not decades. A teenager whose parents get evicted will likely be permanently affected by the experience.

In your case I would recommend keeping financial statements and calculating ratios to track your financial vital signs. For those that want to have an extremely solid financial condition I recommend (1) a positive net worth, (2) a current ratio greater than 10, (3) a debt-to-equity ratio below 10% and (4) net wealth in excess of 24 months. Then you will be in better financial condition to weather The Great Credit Contraction.