Posted 27 Apr 2009

On 24 April 2009 I was a guest judge on Canada's national business channel Business News Network's show Stars & Dogs with host Andrew Bell and Boyd Erman and the exchange is available. The company under discussion was Potash Corporation and I realize some may be wondering what potash is.

Potassium carbonate, or potash, has been used since antiquity in the manufacture of glass, soap, and soil fertilizer.

Potash is important for agriculture because it improves water retention, yield, nutrient value, taste, colour, texture and disease resistance of food crops with wide application to fruits, vegetables, rice, wheat, grains, sugar, corn, soybeans, palm oil and cotton, which all benefit from the quality enhancing properties.

Potash Corporation of Saskatchewan Inc. (POT) engages in the production of potash from six mines in Saskatchewan and one mine in New Brunswick and the sale of fertilizers and feed products in North America. The company controls approximately 22% of worldwide potash capacity. Obviously, if you own a lot of something it makes sense to engage in behavior to drive its price up which is precisely what Potash Corp. does.

Nevertheless, during The Great Credit Contraction capital has sought the safest and most liquid assets. Like during the Great Depression capital has stampeded into the safest and most liquid assets resulting in tumbling commodity prices and decreased decline for potash with rising stockpiles which are now 56% above the 5-year average. After Boyd presented the bull case and Andy presented the bear case then I was asked for my opinion.

BEARISH OUTLOOK FOR POTASH CORPORATION

I found Boyd's argument about 'when' the economy recovers leading to increased use of potash in essential staples like rice to be unpersuasive. The nature and scope of The Great Credit Contraction is too large, fair value lying with single digit midget banks is rapidly evaporating any remaining confidence and unemployment numbers are soaring. Their midlife is likely well passed. Because of the leveraged nature of earnings with commodity producers the bottom line is horrifically affected by dissipating top lines. Therefore, I sided with Andy the bear.

WHEN WILL POTASH CORPORATION BE A GOOD VALUE?

I did state that we do not know how low Potash Corporation will go but that I would consider purchasing it for between 3-5 ounces of gold per 100 shares. There were some interesting acknowledgements when I briefly explained my reasoning for performing the mental calculations of value using the golden currency.

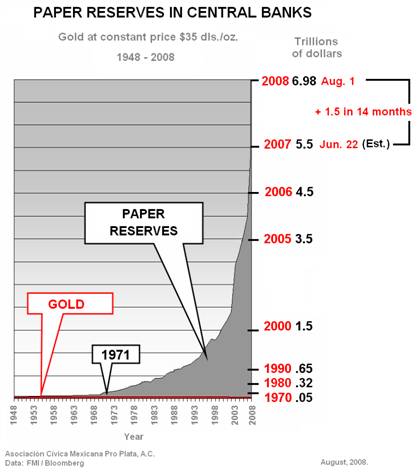

Notice how steep the price decline was from 20 ounces to 10 ounces per 100 shares? If you own a lot of something, like potash, why run a cartel to keep the price suppressed? The central bank's ability to issue what everyone uses as currency is infinitely more valuable than the price of a portfolio asset. The gold price suppression scheme is ending.

On 8 April 2009 in Global Quantitative Easing I wrote, "The IMF gold sales will be like a single piece of sushi appetizer to a starving dragon." Since that time China has announced an increase in gold reserves from 600 to 1,054 tons. Given my analogy to Japan with official gold reserves of 765 tons; I was slightly off on my calculations but the balance sheets of the various central banks are not very transparent or China has not reported their entire gold reserves.

If gold were treated as a mere portfolio asset, which it is not, then the case could be made that it is getting fairly expensive at the current price level. Given its seasonality and tendancy to lag during the summer I may even agree.

If gold were treated as a mere portfolio asset, which it is not, then the case could be made that it is getting fairly expensive at the current price level. Given its seasonality and tendancy to lag during the summer I may even agree.

But as I explain in The Great Credit Contraction political currency illusions are doomed to either implode in a deflationary depression or explode in hyperinflation. Significant amounts of political currency illusions need to evaporate in the coming inferno. The FRN$ is doomed.

The mainstream Western press such as Bloomberg reports that the IMF "is working on a plan to sell bonds to several developing countries as Brazil and China seek more power over its decisions."

But the real news comes from the East where "India and China may press for the sale of the entire gold reserves of the International Monetary Fund (IMF) to raise money for the least developed countries. The IMF holds 103.4 million ounces (3,217 tonnes) of gold that, if sold, can fetch about $100 billion."

CONCLUSION

It appears that stealthy China has been preparing for the coming inferno for many years and has now publicly blasted the clarion call on the golden trumpet signaling the next gold rush. China is not satisfied with flimsy ineffectual substitutes like GLD or SLV which have problems but demand the physical metal. When fiat currency illusions lose confidence it can happen with blinding speed.

While there may be some short term gains to be made by briefly venturing up the liquidity pyramid I would not recommend it. The Great Credit Contraction has only begun and preserving capital in these times will be hard enough.

During the end of the interview on BNN I said, "If cash is king then gold is emperor in this particular environment." The time may come when gold will not be for sale at any price so for now just hoard it and make sure you get cold, hard real physical gold and silver.

Disclosures: Long physical gold and silver with no position in Potash Corporation, TLT, UDN or UUP.