Posted 22 Apr 2009

Gregory Mankiw, professor of court economics at Harvard and economic advisor to President George W. Bush, proposed negative interest rates in a recent New York Times article. Mike Shedlock, a prominent financial commentator has appropriately weighed in 19 March with Time For Mankiw To Resign and again on 21 March with Economist Mankiw Defends Policy of Theft.

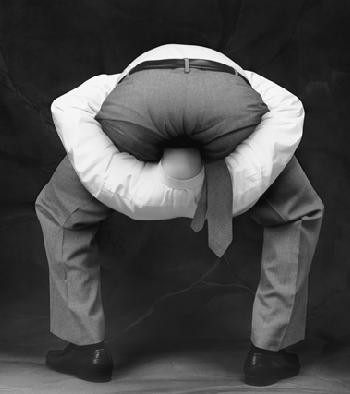

[caption id="" align="alignright" width="231" caption="Ivy-League Court Economist"] [/caption]

[/caption]

Interestingly Mankiw, a monetarist, appears to have the support of Paul Krugman, a Keynesian, who responded, "Greg Mankiw says yes. Since that was the answer I arrived at for Japan more than a decade ago, I have to say that it makes sense in principle."

MR. MANKIW'S PROPOSAL

"Imagine that the Fed were to announce that, a year from today, it would pick a digit from zero to 9 out of a hat. All currency with a serial number ending in that digit would no longer be legal tender. Suddenly, the expected return to holding currency would become negative 10 percent. ...

The idea of negative interest rates may strike some people as absurd, the concoction of some impractical theorist. Perhaps it is. But remember this: Early mathematicians thought that the idea of negative numbers was absurd. Today, these numbers are commonplace. Even children can be taught that some problems (such as 2x + 6 = 0) have no solution unless you are ready to invoke negative numbers. Maybe some economic problems require the same trick."

I will attack Mankiw's insane proposal from several fronts, missed by most commentators, but nevertheless extremely important. While I do agree with revoking legal tender status for all FRN$, not just 10%, I differ with his proposed procedure and underlying moral reasoning.

LEGAL TENDER

Notice that Mankiw suggests that 'the Fed were to announce that .... would no longer be legal tender.' This talk about the Fed determining what is and is not legal tender baffles me. Perhaps Mr. Mankiw should open up a copy of the Constitution and read it.

Under Article 1 Section 8 Clause 5 Congress is given the power to 'Coin Money, regulate the Value thereof'. Notice the Constitution does not say what money is only that it is something that is coined rather than printed. The Tenth Amendment states, "The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people." The Constitution operates on the principle that if a power is not specifically delegated then it is prohibited.

In this case the Federal Government is given no authority to make anything legal tender. The Federal Reserve Act was enacted by Congress creating the Federal Reserve. Because Congress does not have the power to declare anything legal tender and because the Federal Reserve was created by Congress therefore it follows that the Federal Reserve cannot declare anything legal tender.

The individual States do retain the power to declare things legal tender but are restricted under Article 1 Section 10 Clause 1 from making any 'Thing but gold and silver Coin a Tender in Payment of Debts'. The creature cannot exceed the creator.

NEGATIVE REAL RETURNS WILL FAIL

On 18 March 2009 I established the case for why the Federal Reserve's quantitative easing will fail. On 1 February 2008 I marked the first snowfalls of the Kondratieff Winter, or Great Credit Contraction, because of investor's willingness to accept negative real returns.

Mankiw's proposal will not work yet because although the US Treasury Bubble will burst and there are reasons how and why that will happen it has not happened yet. Most FRN$ exist not as physical tickets but as digital illusions.

Mankiw has gotten a little bit ahead of himself as capital will eventually move from digital illusions into physical FRN$ illusions because physical FRN$ tickets are safer and more liquid.

This has not happened yet although the US government has been placing restrictions to prevent it such as the filing of Special Activity Reports, etc. Nevertheless, the attempt by Mankiw and Krugman is to force capital up the liquidity pyramid while the natural economic law is bringing it down. They may as well attempt to order the sun not to rise.

MORALITY

Since individuals are "endowed by their Creator with certain unalienable rights" and because individuals form governments to protect property, life, and liberty, it follows that individuals are superior to their creation of government. Individuals can grant to their creation at most only those rights they possess.

No individual possesses the right to unjustifiably infringe on another individual's autonomy, and because individuals create governments, no government can possibly be justified in the possession of such a right. Therefore, legitimate government must act within the constraints of the Non-Aggression Axiom. Otherwise those actors are merely criminal gangs costumed in government regalia.

Government represents one of the most powerful forces on earth. Therefore, an individual's political beliefs reveal with perfect clarity his or her moral character.

In this case, Mr. Mankiw would use the brutal violence of government to arbitrarily steal 10% of anyone's savings and finds this repulsive behavior to be the philosopher's stone as 'some economic problems require the same trick'. Can there be worse psycho-sociopathic tendencies?

I wonder if Mr. Mankiw would recommend torture, invasion and genocide as good economic policies to get out of a looming recession because they would increase aggregate demand, stimulate the economy and increase GDP. Even Vladimir Putin revealed his understanding of these basic laws when he stated, "The only problem: your results were poor and this will always be the case because the work you do is unfair and immoral. In the long run immoral policies always lose."

Mr. Mankiw and Mr. Krugman are not engaged in the study or teaching of economics but political dogma. And so we see evidence of the true motive of these two influential court economists which is most likely: the sadistic desire to abuse the power of the State to engage in looting and killing.

CONCLUSION

The trick to get out of the current economic problems is really founded in morality. Decades ago Ludwig von Mises wrote in The Theory of Money and Credit, “It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments. Ideologically it belongs in the same class with political constitutions and bills of rights.”

The trick to get out of the current economic problems is really founded in morality. Decades ago Ludwig von Mises wrote in The Theory of Money and Credit, “It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments. Ideologically it belongs in the same class with political constitutions and bills of rights.”

The solution to the current economic problems is to be found by picking up an extremely short document, the United States Constitution, and strictly applying its powers and disabilities in accordance with the Non-Aggression Axiom. Of course, doing so would drastically limit the ability of those who desire looting and killing.

If you look at every single problem we are facing today almost all are the result of a lack of respect for the rule of law and the Constitution. The solution can only be applied if society changes its idea about what the role of government ought to be.

If society thinks that the role of government is to take care of individuals from cradle to grave and police the world by spending hundreds of billions of dollars on a foreign policy that cannot be managed then the greater depression will only exacerbate. Thus the true budget deficit and balance sheet deficiencies appear to be moral and not economic.

National currencies are like the common stock of nations. So long as the United States and its people continue violating these basic laws of morality and engaging in immoral policies the FRN$ will continue to decline.

The price of the monetary metals, gold and silver, will increase. But if you think the United States is a rogue elephant on the world stage now just wait until she is truly panicked.

Disclosures: Long physical gold and silver with no position in GLD, SLV, US Treasuries such as TLT, UDN or UUP.