Posted 17 Oct 2009

On 9 October 2009 I was interviewed (MP3) by Business News Network, Canada's premier financial channel, live from the NASDAQ in Times Square New York about the rise of gold.

[flowplayer src='http://www.runtogold.com/videos/BNN-9-Oct-2009.m4v' width=480 height=272 splash='http://www.runtogold.com/images/BNN-RunToGold.jpg']

BNN HOST: A note that caught our eye from RunToGold.com saying "Gold price rise pretends another round of the Credit Crisis. ... Gold in Q2 2010 $1,300.". Joining us to talk about that prediction, Trace Mayer, financial blogger and author of The Great Credit Contraction. He is in the city so nice the name that twice New York, New York. Very happy to be with us, Trace.

TRACE: Oh Thank You.

BNN HOST: You said the credit crisis has not been calmed but intensified. Why?

TRACE: Yes, one of the reasons is that the FASB mark-to-market has just obfuscated the toxic assets. So it is preventing the credit liquidation. So we still have the same bad assets that have not been liquidated in the market on the balance sheets. But people do not necessarily know where they are lurking.

BNN HOST: So the idea that the stimulus package and government back stops, things of that nature, have really delayed the inevitable more than anything else?

TRACE: Yes. They have delayed it and they have just pushed it off. And because people continue to make misallocations of capital because of that government intervention. It will only lead to bigger crisis later.

BNN HOST: Ok. When is later though?

TRACE: Well, we have been pushing this off for decades now. It seems to have really picked up in 2007 and the next round appears to be coming pretty soon. Mostly because of the move into gold. We see it closing at $1,050 this week and it now has a 3 week moving average above $1,000 and so there is a lot of strength. And a reason is because gold functions as a currency.

BNN HOST: Really the only currency that does not have obligations.

TRACE: Yes, it is a currency that at all times and in all places remains money. And there is a difference between money and currency. Gold is money because it can never become worthless. As you say it is no one's liability.

BNN HOST: What is really moving gold on a day to day basis though, more speculation than actual demand. Is that accurate?

TRACE: Yes, there is a lot of speculation along with the central bank gold price suppression scheme. Because gold is a competitor to their fiat paper franchises they have a heavy vested interest in interfering with the gold market. So in the short term we do see a lot of central bank interference. But now it appears that Greenspan's Call which is leasing gold should the price rise has been counteracted by the Beijing Put which appears to be putting quite a floor in the gold market.

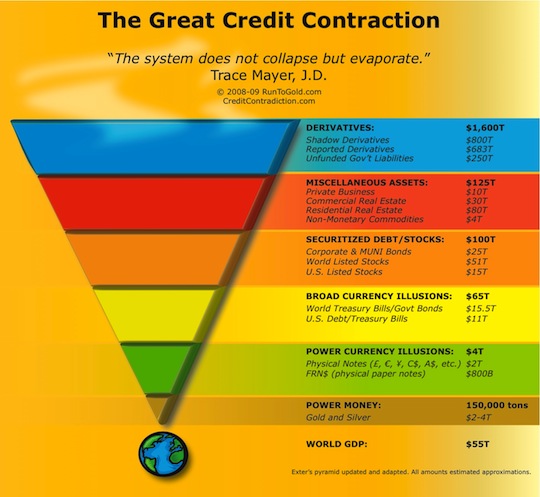

BNN HOST: You have an interesting graphic in the report of the Day, an inverted pyramid, explain this to us.

TRACE: Yes. This inverted pyramid is the liquidity pyramid and shows the different assets in the world economy. And what has happened over hundreds of years is capital moved up the pyramid into less safe and less liquid assets. And that was the great credit expansion. And now we have reached the top and economic law shows that capital moves down the liquidity pyramid. And that is the great credit contraction; capital moving into safer and more liquid assets.

For example, capital is moving out of auction rates securities or commercial mortgage backed securities and into Treasury Bills. And eventually it will move from Treasury Bills into the monetary metals. And the reason for that is that fit currency and central banking are barbarous relics that are not really needed in the Information Age. We could have gold and silver and platinum circulating as currency in ordinary daily transaction (Goldmoney). We do not need these archaic devices anymore. And it may take some creative destruction for that to happen. But I think that the market will pull through because there are more efficient ways of handling our currency in our ordinary day to day transactions.

BNN HOST: So as we get more and more concerned with the top of that pyramid, the derivatives play, you are talking about $1,300 bullion. How do you get to that figure?

TRACE: $1,300 bullion comes from looking at the 200 hundred day moving averages and where gold has consolidated and where it goes based on the usual uplegs. It looks like we are following the same thing that happened in 2004 with the rise in 2005, the consolidation in 2006, which went to the rise in 2007, and the consolidation in 2008, and it looks that it will lead to a similar rise in 2009 and 2010 which will take gold to $1,300 which should be a little bit above its 200 day moving average. But in the same trading ranges as we saw in 2005 and 2007.

BNN HOST: We have a 10 year chart on the screen but you look back even five or seven years ago; more so I suppose take it back 10 - 20 years. Looking at gold on an inflation adjusted basis and gold is dirt cheap by comparison.

TRACE: Yes. The reason for that, we hit on it earlier, was Alan Greenspans testified twice before Congress "that central banks stand ready to lease gold should the price rise." And the reason that central banks leased gold since early 1995 and onward, and actually before that they were in the market, is to keep the interest rates suppressed.

So we have had this inflation in the system and the consequences have been masked by the central bank gold leasing. But it seems that the central banks are now losing control over their physical bullion, the market is asserting itself and we are seeing this rise in price as a result. Because when you own gold in effect you are fighting every central bank in the world.

BNN HOST: Are we also not fighting the U.S Dollar. What is your expectations Trace for the green back?

TRACE: That is a very excellent question. The dollar is the world reserve currency but as Alan Greenspan and said, "This rise in the gold price is the first real step towards a move away from fiat currency.

And so we do not know how long it will take but the dollar has tremendous problems. And now it has appeared to become the carry-trade currency. So we are seeing a lot of people sell the dollar to fund purchases and buy other assets and that puts further selling weakness on the dollar.

BNN HOST: Trace, we appreciate...

TRACE: And will probably persist for a long time just like the Japanese Yen.

BNN HOST: Well, we are going leave it there. Thank you so much for your insights and all the best to the Columbus Day Long Weekend.

TRACE: Oh. Thank you.

BNN HOST: Trace Mayer, Financial Blogger and Author of The Great Credit Contraction.

DISCLOSURES: Long physical gold, silver and platinum with no position in the problematic GLD or SLV ETFs.