Posted 28 Oct 2009

The recent gold bull upleg is in the midst of a predictable slight correction and consolidation. When that finishes it is highly probable, based on seasonality and technicals, that the next part of the upleg will commence. The Federal Reserve and Washington are only making matters worse through their extremely damaging policies.

Back on 9 September 2009 I wrote:

200 day relative price of gold is at 1.08x ... Based on seasonal trends gold and silver will be strengthening, with the strongest months in September and November

This upleg in gold and silver will have significant strength because of the long period of consolidation just like in 2004 and 2006 which provided the foundation for the uplegs in 2005 and 2007 that took gold from $400 to $700 and $650 to $1,000, respectively. If the current upleg is similar to the previous two then the 200 day relative prices for gold and silver at the top of this upleg would be about 1.5x and 1.7x, respectively.

This puts $1,300 gold and $25 silver within range without greatly exceeding previous trading norms

Back then the price of gold was $996 and the 200dma was about $920. Today gold's price is about $1,030 with a 200dma of about $950. While the probability for a profitable trade is not nearly as high as it would be should the price relative to the 200dma be significantly below the 200dma there is still room for the price to run as we enter winter. The October intermission is likely coming to a close.

OCTOBER INTERMISSION

Dr. Greenspan testified in 1998 that, ”Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise.”

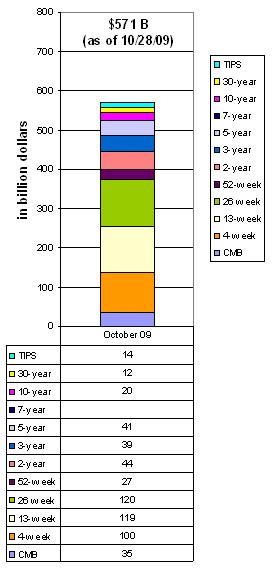

One of the key reasons to keep the price of gold suppressed through central bank gold leasing is to keep interest rates low. This will be particularly helpful for the $182,000,000,000 of certificates of confiscation that will be sold during the week of 26-29 October 2009. Another reason is that NYMEX November options expired 27 October 2009.

PHYSICAL PREMIUMS RAISED

The physical coin dealers are fairly wise to the machinations of Wall Street. When the paper price of bullion falls precipitously then the dealers often raise the premiums.

For example, a reader asked me a few weeks ago when would be a good time to buy gold American Eagles.

I suggested after the next drop and if lucky then he may be able to acquire them around $1,025 spot but the premium would likely increase. He reported his shopping to me a couple days ago after the recent drop in price and informed me the premium had been raised from $37.95 to $41.95 per coin.

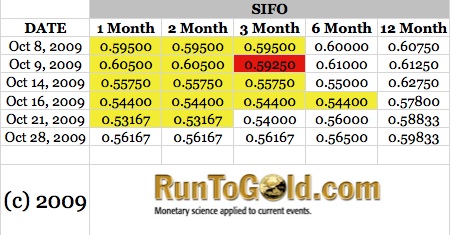

On 12 September 2009 I observed that "the London SIFO, the Silver Forward Mid Rates, have been trending towards backwardation." It is interesting to observe the continuing trend and brief entry of silver in backwardation in the LBMA on 9 October 2009. It seems like the physical silver market is getting a little tight.

QUANTITATIVE EASING

QUANTITATIVE EASING

The big issue is whether the Federal Reserve will be able to, as Ben Bernanke said on 8 October 2009 in The Federal Reserve's Balance Sheet: An Update, 'tighten the stance of monetary policy and eventually return our balance sheet to a more normal configuration?' Back in March 2009 when Bernanke started this lunacy I asserted that The Federal Reserve Will Fail With Quantitative Easing.

Bernanke asserts:

Although the Federal Reserve's approach also entails substantial increases in bank liquidity, it is motivated less by the desire to increase the liabilities of the Federal Reserve than by the need to address dysfunction in specific credit markets through the types of programs I have discussed. For lack of a better term, I have called this approach "credit easing.

What Bernanke is trying to do is get capital to take on additional risk by moving up the liquidity pyramid. But The Great Credit Contraction has begun. While there may be differences in the velocity at which capital moves down the liquidity pyramid the overall direction has not changed. Washington and the Federal Reserve are tiny actors compared to the total size of the market.

Their policies are aimed and designed to grant special privilege to banks like JP Morgan and Goldman Sachs. Through government assistance the banks are able to move their capital down the liquidity pyramid. In effect, they have privatized the gains and socialized the losses. While there may be a case for a rise in the FRN$ in the short term the ultimate destiny is known: the fiat currency graveyard.

EXACERBATING THE GREATER DEPRESSION

As Murray Rothbard observed on page 18 of his 1963 America’s Great Depression:

It is true that credit contraction may overcompensate, and, while contraction proceeds, it may cause interest rates to be higher than free-market levels, and investment lower than in the free market. But since contraction causes no positive malinvestments, it will not lead to any painful period of depression and adjustment.

Mr. Rothbard continues the observation that government policy can hobble the adjustment process by: “(1) Prevent or delay liquidation, (2) Inflate further, (3) Keep wage rates up, (4) Keep prices up, (5) Stimulate consumption and discourage saving and (6) Subsidize unemployment.”

In the present case, mark-to-market rules, like FAS 157, are not implemented, delayed, ignored or willfully violated. The financial markets are now undergirded by fair-value lying standards. For example, Section 132 of the Emergency Economic Stabilization Act of 2008 is titled “Authority to Suspend Mark-To-Market Accounting” and restates the SEC’s authority to suspend the application of FAS 157.

The Austrian definition of inflation is an increase in the money supply. The Adjusted Monetary Base, the very lowest layer of power money, shows a tremendous increase over the past year. The effects are most likely masked by the tremendous slowing in the velocity of money.

In an effort to stimulate consumption and discourage savings that will result in keeping prices and wages high the Obama administration has unveiled a $1 trillion stimulus package. The Geithner toxic asset plan will only serve to hasten the destruction of wealth from the economy as the system evaporates.

The Federal minimum wage rose in July 2009. Unemployment will be subsidized by extending benefits for 13 weeks and delaying the income tax payments.

Legacy industries, like the auto industry, are receiving bailout money to keep wage rates up and people employed doing nothing all day long because of the huge over capacity of automobiles. With Cash-For-Clunkers automobiles which have value are destroyed to reduce supply of alternative goods to new cars made by Government Motors. This is a prime example of what Washington DC is: A giant wealth destruction machine.

Therefore, like heroin to cure a hangover the quantitative easing from the Federal Reserve and the lunatic policies from Washington are not improving the situation for average people but instead exacerbating the greater depression. Now is the time to Raze The Fed and while doing the spring cleaning who needs Washington?

CONCLUSION

The current correction and consolidation of gold appears to be within trend and expected based on the seasonality. November is the strongest month and this recent correction on low volume is laying a strong foundation for a large move upwards.

The Federal Reserve's quantitative easing programs have not been helping the situation but instead exacerbating the greater depression. All in an effort to save the inefficient, barbarous and archaic relics of a fiat currency and fractional reserve banking system that is destined for extinction and replacement. The Crash of 2008 was just the start of The Great Credit Contraction and it will last for decades.

DISCLOSURES: Long physical gold and silver and no position the problematic SLV or GLD ETFs.