Posted 19 Sep 2011

[pullquote]The balance sheets of banks have derivative singularities sucking in any equity that passes near the event horizon.[/pullquote]The world is in commotion but the precious metals markets are in forward motion like never before. Both the Eurocrat's totalitarian dream and Euro are evaporating while the Damocles sword of credit default swaps hang over the countries' heads.

The next round of The Great Credit Contraction has started in Europe with Greece in the target sight. While the world scrambles for liquidity capital is burrowing into and oscillating between FRN$ and gold.

This consolidation in the gold price and silver price is laying the foundation for the next major up leg.![]()

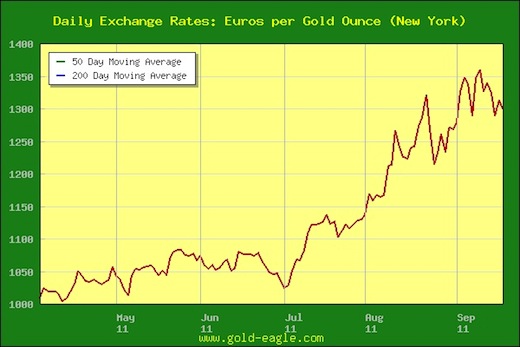

200 DAY MOVING AVERAGES ARE RISING

200 DAY MOVING AVERAGES ARE RISING

The 200 DMA acts like gravity on the price of assets allowing for the relative comparison over time which helps to filter out the daily trading noise.

The recent melt-up in the gold price since July has added nearly FRN$300 or €300 that needs to be digested into the 200 day moving average. Keep in mind that 200 days ago was the beginning of March and the gold price was a mere $1,420 per ounce. The 200 day moving average for gold is now at FRN$1,511.69 and increasing at approximately FRN$1.85 per day.

The silver price is also consolidating its recent gains. With a current silver price around FRN$40 and a 200 day moving average around FRN$35.76 and adding about four cents per day. So, two more months of consolidation and then the next move up.

The silver price is also consolidating its recent gains. With a current silver price around FRN$40 and a 200 day moving average around FRN$35.76 and adding about four cents per day. So, two more months of consolidation and then the next move up.

Gold is currently consolidating its price 10% faster than silver and is confirmed with the relative price at 1.1133 for silver as compared to gold's relative price of 1.1771. Of all the precious metals gold appears to be the most expensive. The real value seems to be in palladium which is trading at an extreme discount of 0.9224x its 200 day moving average.

Gold is currently consolidating its price 10% faster than silver and is confirmed with the relative price at 1.1133 for silver as compared to gold's relative price of 1.1771. Of all the precious metals gold appears to be the most expensive. The real value seems to be in palladium which is trading at an extreme discount of 0.9224x its 200 day moving average.

Gold has likely seen a great increase in monetary demand from Europeans who do not want exposure to counter-party risk from bankrupt and insolvent. The banking crisis is far from over and for holders of capital that is at risk it must be extremely scary.

Sitting in allocated gold or other precious metals held in segregated, audited, secure and insured storage, like with GoldMoney, would be a much more comforting position than in Societe Generala, UBS, Unicredit, etc. As Bloomberg reported on 19 Sep 2011, "A gauge of banks’ reluctance to lend to each other in Europe rose for the first time in a week amid renewed concern Greece is headed for a default."

This is likely one of the reasons platinum and palladium are priced so cheaply. Monetary demand has flowed into gold and somewhat into silver. Forecasted industrial demand is anemic. Less cars and other goods will be demanded and produced. So the price of inputs, like platinum and palladium, fall. Or so the argument goes.

[pullquote]The specter of price inflation should begin an increasingly aggressive haunting of savers and holders of capital.[/pullquote]PLATINUM AND PALLADIUM ARE CHEAP

Platinum and palladium are a great deal right now. Like gold and silver they can never become worthless and, if held correctly, are not subject to counter-party risk. The supply is much smaller and if there is a significant increase in demand, perhaps from investors looking to preserve capital, then their price can increase significantly.

Additionally, although platinum is significantly more rare than gold it is, unusually, cheaper in FRN$ terms and palladium is currently an even better deal!

The platinum to gold 200 day moving is currently 1.19 compared to the current price of 1.00. The price of platinum in terms of gold has not been this cheap since shortly after the first round of the credit crisis when Lehman Brothers collapsed.

The platinum to gold 200 day moving is currently 1.19 compared to the current price of 1.00. The price of platinum in terms of gold has not been this cheap since shortly after the first round of the credit crisis when Lehman Brothers collapsed.

Palladium is a little more difficult to discern through the golden lens. Like platinum it has not been cheaper since the Lehman collapse.

Palladium is a little more difficult to discern through the golden lens. Like platinum it has not been cheaper since the Lehman collapse.

Currently its 200 day moving average is 0.51 compared to the current palladium price in gold of 0.40. This makes palladium slightly cheaper than platinum with the current price in gold about 78% its 200 day moving average compared to platinum's 84%. Palladium also has a significantly cheaper relative price in FRN$.

THE SPECTRE OF PRICE INFLATION

Central banks the world over have followed the Federal Reserve and created tremendous amounts of liquidity in an attempt to stave off the first round of The Great Credit Contraction. Round two is beginning to materialize and they are continuing.

In an 18 Sep 2011 NYT editorial Paul Volcker sent a warning shot to Ben Bernanke about inflation and how once inflation becomes anticipated and ingrained its stimulating effects are lost.

Consider that over the past three months the Federal Reserve has increased M1 by 36.7% and M2 by 23.3%. The specter of price inflation should begin an increasingly aggressive haunting of savers and holders of capital. One place they can seek refuge is gold and silver. Another place to go is platinum, palladium or oil.

CONCLUSION

The Great Credit Contraction is destroying wealth, both real and illusory, at a tremendous rate. The balance sheets of banks have derivative singularities sucking in any equity that passes near the event horizon.

This should be the real driver for precious metal demand like gold, silver, platinum and palladium; the lack of counter-party risk.

To make matters worse the stewards of fiat currencies have infected the printing presses with their incontinence. When it comes to safeguarding price stability of fiat currencies those like Ben Bernanke who have succeeded bulldogs like Paul Volcker are lesser men of greater sires.

DISCLOSURES: Long physical gold, silver and platinum with no interest in DOW, S&P 500, the problematic SLV ETF, gold ETF or the platinum ETFs.