Posted 27 Nov 2010

In this exclusive interview with David Morgan topics discussed include the silver manipulation, concentration of derivatives, differences between paper silver products and what thankfulness. A few of the articles referenced are high frequency fake trading, Reg Howe's discussion of gold derivatives contracting and concentrating, the GLD and SLV ETFs, Ted Butler and GATA.![]()

Please keep in mind that as the 200 day moving average shows on the price chart that silver is currently very expensive and it appears that silver and gold are consolidating for the next upleg in the new year. However, silver is the restless metal and about 90% of its price movement happens in 10% of the time. Consequently, it can make a particularly exciting speculation at the present moment.

But keep in mind that you are playing against some of the largest money in the world who have, it appears, the regulators and court system on their payroll. The safest way to play is to buy silver and take physical possession. Then you can remain solvent longer than the market can remain irrational. If you apply leverage in any way then you can either be forced out of your position or the exchanges or regulators can simply change the rules without notice like they recently did with margin requirement increases or to the Hunt's.

NEW BOOK FOR SALE

For those who have not heard a new book went on sale last week called How To Vanish. This is co-authored by Trace Mayer and Bill Rounds. It is an extremely helpful tool for protecting your personal and financial privacy. You may want to check it out. Please stay safe during this holiday season and enjoy your family and friends!

EXCLUSIVE INTERVIEW WITH DAVID MORGAN (14:46) (YouTube version)

[flowplayer src=http://www.runtogold.com/videos/david-morgan-27-nov-2010-wm.m4v, width=520, height=390, splash=http://www.runtogold.com/images/david-morgan-silver-investor.jpg]

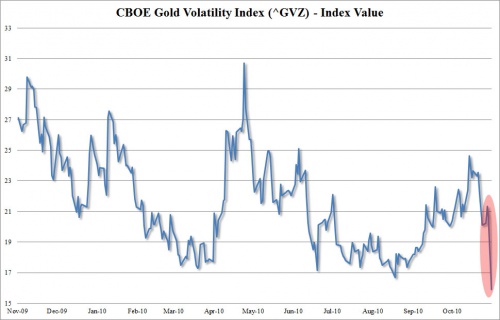

As mentioned in the interview, the GVZ has declined precipitously in after hours trading on 26 November 2010 despite the massive volume of about $272M of gold for February 2011 delivery.

Trace: Welcome back to RunToGold, I was just wishing one of my friends a happy Turkey Day, David Morgan from silver-investor.com. Welcome David!

David: Well, thank you Trace.

Trace: We decided to why not do a quick interview for the listeners over at RunToGold, and David’s one of the premier experts in the silver market, and so we wanted to talk a little about the Big Happenings that have been going on with the silver manipulation, mainly between HSBC and JP Morgan.

So David, can you give us a little of an overview of what has happened just over the last month or so on the silver market?

David: Well absolutely and before I start I think I really ought to give credit to Ted Butler because Ted was instrumental in leading this campaign and has been for years. Ted and I actually met very early on as he will attest to, I am sure. And I was taking up the gauntlet with him, so to speak, very early, but I saw that it was basically Ted’s passion, and mine was more directed to the overall silver market, so Ted has definitely led the charts there and his monumental efforts have really paid off here in recent times.

So, there are several lawsuits pending. I’ll just go briefly over a few of them. One is a spoof trading, this is where the bids are pulled so you have a lot of people out there that are purporting to make a trade at a higher price, then all of a sudden they pull off their bids, and in other words there are no bids left, and the market falls down. This isn’t taking place as much as it was in the past.

And the reason for that -- it’s my belief but not proof yet- that the authorities are watching the trading in silver more intently than they ever have in the past. And so the big banks that are used to doing these manoeuvres are reluctant, I think, to pull them off as much as they have. Now, certainly there has been a sell-off commitment or trader-wise recently, yet it isn’t to the huge degree that we saw, that was reported at the CFTC hearing where basically 25% of the world’s silver supply was sold in one trade, which obviously took the price of silver down massively.

Another one is what happens with an auction’s expiration. this is when an I’ve taken out fairly often that it’s impossible for the price of silver and gold to go down every single time o an auction’s expiration, and it hasn’t the last few months, but up until that point you could almost set your watch on the fact that you were going to get a sell-off in the auctions market. Now I know that there are reasons for that, I know how Delta Hedging works and how these banks go in and continue to load the boat on one side until they make it happen, but regardless there’s a lawsuit about that as well.

Lastly, there’s a class-action lawsuit and the law-firm that has taken this one has actually had a very good track record going into these kinds of suits with the future industry.

And so I am, very cautiously, optimistic that all three or one or more of these suits will come to fruition in the side of the plaintiffs, but to be cautious I’m going to state that it’s extremely difficult to prove intent, which is what you do when you in a manipulation case. It’s very difficult when you are before a judge to say well, why did you sell off such a massive amount of silver, and the point is, well to move the market down and to make a profit.

And they could actually make this statement in court, and I’m not sure if the judge would rule that that’s manipulation. Now, obviously to me it is. But it is very difficult to prove. Trace, you probably could comment on that because of your legal background, so I’ll pause here and let you give our viewers what your thoughts are on being able to absolutely prove manipulation. I think it’s going to be extremely difficult.

Trace: Yeah, the standards that you have to reach in these types of cases are much higher but another problem is who you have sitting as judges. One of the judges was put in by a republican congressman and he told the congressman that he wasn’t going to let any suits go through, and in the entire tenure of that judge, any of the small investor lawsuits pretty much always got kicked out. You look at the rule of law that has been eroded in the United States. We might have these standards, but how do we know or how can we even trust that the CFTC or the SCC is properly enforcing them? They probably are just watching porn on their computer, like they were instead of prosecuting Madoff.

I mean, we really can’t trust these people anyways, which I think is what you see happening in the end collapse of an empire or other large system, is the official and recognised trust institutions and things like that begin to lose their credibility and their authority and then private markets begin to step in and fill the void. We’re seeing that with the silver derivatives, we mentioned it just briefly, this greater concentration among the less parties and another effect that’s coming out of that is -- you know we’ve talked about the ETS before- well, the paper of somewhat dubious quality; its beginning to trade in what you could say is somewhat of a backwardation type event.

And so, you’ve got the paper of lesser quality, and you have got the bullion that’s in a better legal structure and more trust, it’s trading with greater premiums like Sprott’s ETF, for example or gold money. James Turk, he just filled an 8 million dollar order for physical silver for one of his clients.

That’s kind of fun, isn’t it?! We’re talking about standing for physical delivery because people don’t trust the courts, you know, because when you buy gold you’re fighting every central bank and government in the world. You don’t trust the courts...

I mean, you’re like “here, stick it in my truck so I can drive it away to my own vault”. I mean, that’s what you do when you don’t tryst the legal standards, when you don’t trust the judicial system because they are operating like banana republics. Well, the gold bids on Friday had a massive selloff of 15, and what that seems to imply is that there’s going to be a large hedge fund standing for physical delivery on the gold contracts, so that’s kind of exciting.

But getting back to these 2 –before the call, we talked about the Comex contracts and then the banks silver certificate contracts that you have with various banks. Can you give us a little bit of an overview about what that is, the contracts behind them and why they are such a big issue with these silver certificate programs?

David: Absolutely, and before I do that I just wanted to digress slightly. On the manipulation issue, as important as it is, I have always maintained that regardless of what happens in the court systems or eventually, this thing is going to unravel on its own merit because the demand for silver, physically, is going to be so great that it will overpower all these paper plays. So I wanted to get that statement out there.

On the concentration I agree, the more concentrated this becomes, the more the bad guys are stuck in a corner. But lastly, the point that you bring up is that on the Comex it’s very clear that if you read the contract, and unfortunately most people don’t because it’s very cumbersome in legalese, they have several ways out. The bottom line is the worst case scenario, if they can close the exchange; I mean that is written in black and white.

Trace: Oh, but that’s not a problem because we can always settle on cash!

David: That’s right! You can always settle on cash, just like the SLV. I mean, the SLV is the vehicle that settles on cash 100% of the time. So, what are these vehicles? Well, they are derivatives. And they are derivative is based on, as you call, paper bugs. The paper bugs can produce the paper to settle! And that’s what the contract says. So, you know if there’s a problem with you entering into a contract with the SLV or the Comex, then the problem is basically yours, meaning that you have the obligation to adhere to the contract.

Now, I want to be specific here because it is important, especially when you are dealing with legal terms, but if you have a warehouse receipt and it has your bar numbers on that certificate, then you are fine legally, as far as I am concerned. I mean, basically your silver is paid for, or gold and it is resting in a vault that is in an approved Comex warehouse, which is really a bank.

Now, in those cases you are fine, so I don’t want to startle anyone, and I don’t want to be anything but totally ethical and have full integrity on what that means, but if you are in the future’s market itself and you don’t have those bars fully paid for, you’re in a different scenario and you could be settling in cash.

Ok, now moving on to a point that really isn’t brought up that much are these direct certificates that are on deposit with various banks, usually bullion banks. And this is a piece of paper that have in that bank, or its some facility maybe issued by a different bank, silver and/or gold that is being held for you and with this certificate you can exchange those pieces of paper for physical gold or physical silver in 30 days.

Well, the problem is that there a lot more of those pieces of paper flying around then there are silver and gold to back it up. And that’s an issue that really I think is at the heart of the matter, because there is no settlement in cash on those. They must be settled for the physical metal.

Now I realise that his must be cumbersome for some people because the people that have some of that paper all have massive quantities of that, and I certainly am not going to bring up any of my clients names but one of them, one with one of the most successful websites on the internet sold it for a very, very large sum of money and he is a silver bug, and has been so for at least the decade that I have known him and he has an account with a very large brokerage house and certainly the amount of silver he has would fill my office from floor to ceiling. So, he doesn’t have it all. Some he holds physically, but a lot of it is with this brokerage firm on deposit and he’s got a piece of paper verifying that.

Now, I’m not saying that this particular case is not going to be fulfilled, what I’m suggesting is that not all of them can be. And this is something where the rubber meets the road, and this is something that is not often brought up because that’s a different contract.

A contract that says that this, sir, is good for silver is different than a contract on the future’s market that says it can be settled in cash. Son once some people with a massive amount of silver or gold, and I say silver particularly, decide to cash in and move it to a different facility, which really isn’t that difficult to do, we might see a further price appreciation for the physical realm for silver.

Again, what’s going to happen is what you have already witnessed. You’re going to see a very big spread between real silver and paper silver. Again this happened in the financial crisis of 2008, and as you pointed out Trace, and I’ll reiterate it. What you see for the silver trust by Sprott where you can actually take your silver off of the trust and actually put it in your own vault, has a higher premium than the SLV, why is that? Well, because everyone that pays attention knows that that’s a different contract. You actually have physical in one case and the other one you settle on a paper price.

Trace: Yeah, and this kind of reminds me of an interview I did back in early 2008 I said, you know there’s about a 100 to 140 of paper ounces for every 1 ounce of physical that people have claim on. It’s the oldest trick in the book; you got to sell the same thing 100 to 140 times.

And then hitting on what to be thankful for during this season, I’m thankful for Ted Butler and the work that he’s done. I noticed the GATA thing in your background for the great work that they have done over this last decade. We’ve got lots of paper bugs, and you’re going to have lots of paper, you know.

Or, you can take physical delivery of your silver coins. So I’m just grateful that I have got physical delivery of lots of different coins and things, because in this turmoil that we’ve have got there’s a lot of uncertainty, people don’t necessarily know what’s going to happen, and we have such a complex world economy, we really can’t have this central planning on this with such a complex economy.

We’ve got to be able to provide food for people and during the Lehman Brothers’ collapse you had CFO’s of Fortune 500 companies calling treasuries saying that they wouldn’t be able to make payroll because of the money market funds going down. You know, what happens when the Walmarts or Exxons don’t make payroll, we’ve got 45 million people on food stamps, how do they get their calories everyday? So I am very grateful that at least I am in a position where I’m not as anxious about these sides of things because I’m prepared and I’m sure that you are also in a similar position.

You have got your physical silver, you’ve been warning on these things for a long time and you know that’s a somewhat tireless and thankless job to do, because it’s something that nobody wants to hear but at the same time it's, I think, important when you are prepared you’re not as worried about these things that can play out, because as you said, it’s going to play out. The silver market manipulation, the gold market manipulation, it’s going to play out. It will fail to market forces, and we don’t necessarily want to be collateral damage when that happens.

So is there anything else that you would like to add, in the last 30 seconds about what you are thankful for this holiday season?

David: Well, I am thankful for my wife and my family and of course all the blessings that we have in a free market which is less free than it used to be, but I still believe in the power of free speech and internet is going to take back our freedoms a little at a time and over the long run it’s going to come back to basically the principles that have made this country so great.

But I have to one-up-man-ship on you on the paper thing, these are the trillion, and I have a new video coming out very soon. It’s aimed more at the young people that are looking at the difference between this kind of stuff and this kind of stuff. So thank you for the interview, Trace, blessings to you and yours. And we’ll do another video soon.