Posted 21 Mar 2013

[pullquote]It will be fun to watch the price melt-up to that over the short to medium term so get out the popcorn to watch this rocket.[/pullquote]Cyprus have evaporated depositor's confidence around the world with the announcement of confiscating 10% of bank deposit balances to fund bailouts.

FinCEN released guidance on decentralized virtual currencies that will give VCs confidence to make significant investments into the Bitcoin space.![]()

As a result, the price of bitcoins has melted up from $48 to $68 in a few days. But the meltup has just started and probably has a long ways to go.

Meanwhile, due to last minute changes and because I would already be in Europe and thanks to Chalie Shrem, CEO of BitInstant, I had the opportunity to give an hour long objective presentation on Bitcoin to a group of significant players in the payments space including members of the Federal Reserve, Bundesbank and major banks or other service providers from the US, Europe and other parts around the globe.

PREVIOUS BITCOIN PREDICTIONS

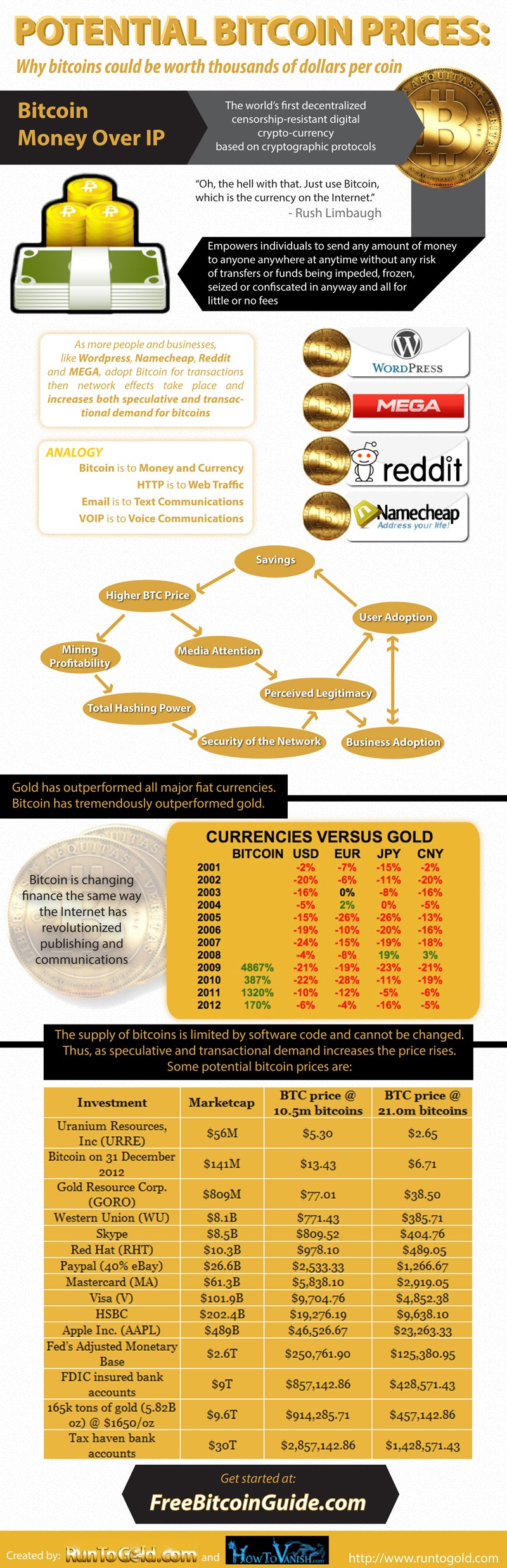

Let us put into perspective how the past performance of gold’s complete collapse relative to Bitcoin could affect your net worth.

17 January 2011 we recommend using Bitcoin to protect your privacy in Bitcoin – The Best Financial Privacy Is Probably Here … Probably. If you had traded one ounce of gold for bitcoins then today you could trade those bitcoins for 150 ounces of gold.

19 December 2011 in Solid Bitcoin Consolidation Finally Bears A Bitcoin Breakout I stated:

Taking the current price of $4.00, the 200 day moving average of about $8.50 and extrapolating this upleg with a 12x 200dma top we could see a price of around $80.00 per BitCoin. Is this speculative? Yes. Would I bet on seeing $80 per BitCoin by around June or July?

Maybe if the odds are around 5%. But I would take a bet for BitCoins to hit $7.50 by June or July at around a 50-70% probability.

If you had traded one ounce of gold for bitcoins then today you could trade those bitcoins for 21.3 ounces of gold.

31 December 2012 in During 2012 Fiat Currencies And Gold Collapse Against Bitcoin I wrote:

Therefore, holders of bitcoins continue to be beneficiaries of a tremendous wealth transfer from holders of fiat currencies, gold, silver, real estate, stocks, bonds and pretty much every other asset. Bitcoins have already turned out to be the trade of the decade for many of our readers and may likely be THE trade of the 21st century before these massive worldwide currency wars and collapses play out.

If you had traded once ounce of gold for bitcoins then today you could trade those bitcoins for 5.32 ounces of gold.

FinCEN GUIDANCE

On 18 March 2013 FinCEN released guidance on how to treat virtual currencies. It should be kept in mind that this guidance is neither an administrative ruling nor determinative.

In other words, it is not binding. But it does inspire confidence in VCs to make investments into the Bitcoin space because Bitcoin has undefined legal issues which cast a pall of potential litigation resulting in a chilling effect on investment.

Given the rule of lenity and this guidance therefore VCs can make investments with greater certainty that what they build will not be shut down, raided, seized or confiscated with the founders thrown in jail and prosecuted with no prior warning or due process. The guidance has distinguished groups, users, exchangers and administrators and outlined which rules, such as Money Service Business, applies to which groups and why.

[pullquote]Whether bitcoins are cheap or expensive?[/pullquote]CURRENT BITCOIN GROWTH RATES

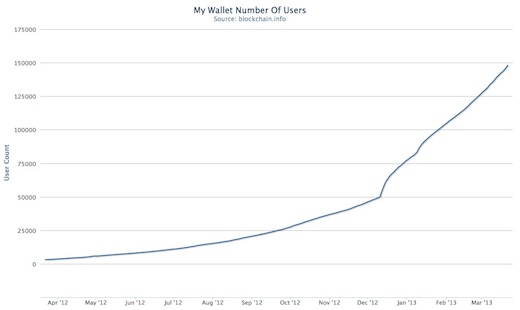

All indicators of Bitcoin growth point to significant adoption. There are all time highs with (1) Google searches, (2) Wikipedia traffic, (3) Reddit activity, (4) new wallet accounts being created, (5) MtGox having 4,000+ potential customer accounts awaiting AML/KYC approval while processing about 400 per day and (6) the 200 day moving average of transaction fees paid in USD.

All of this has filtered through to the exchange rate. Bitcoins are trading around an all-time high of $68. But despite the rise in price the wise investor would focus more on value as asked in whether bitcoins are cheap or expensive?

What is happening right now is that the positive feedback loop is starting to gain massive energy and momentum. This is leading to Bitcoin being able to begin teleporting on its own energy.

For example, Bitpay raised about $500,000 in January in a seed round. Assuming these funds were allocated into Bitcoin and this startup started hiring new staff, moved offices, bought supplies, etc.

then it would not be unreasonable to expect that despite spending funds to build out infrastructure, like the Bitpay Fulfillment By Amazon plugin (which was my idea by the way!), that Bitpay would actually have about $2m in the bank.

As the Bitcoin price rises it transfers wealth to holders of bitcoins and provides them with the capital needed to fund development which will provide more utility to Bitcoin and result in a greater value proposition for users.

BITCOIN PRICE MELT-UP

The price of bitcoins has risen extremely quickly over the past week from about $45 to nearly $70. Is this an unsustainable bubble, based on funds flow, or has Bitcoin been tremendously undervalued and the price is rising to a more fairly valued level?

In my opinion, on 1 Jan 2013 the fair value of bitcoins was around 30 bitcoins per ounce of gold based on the fundamentals and were undervalued because it took about 125 bitcoins to buy an ounce of gold. But that ratio closed to about 35 before Cyprus and the FinCEN guidance.

However, with the more predictable legal environment there will be a lot more capital allocated to this space. VCs will be buying more bitcoins and investing in more Bitcoin startups. These startups will build tools and infrastructure and products which will make Bitcoin more useable and a greater value proposition for consumers.

[pullquote]But the potential is there and the Bitcoin tsunami, while still far from shore, is racing with increasing speed and size.[/pullquote]NACHA CONFERENCE

I am very grateful for the opportunity to attend the conference and mingle with the leaders of the payments space. They were all extremely friendly, professional and gracious.

For example, there were no tables free at breakfast and the Federal Reserve's legal counsel invited me to join him and we had an cordial discussion that followed up on his presentation about Cyber Security; issues actors in the Bitcoin space have had significant experience with.

And I even got to have about a four hour discussion with one of the Federal Reserve attorneys over dinner. It was so interesting that we grabbed some drinks afterwards at the hotel to continue it. Given how complicated the Bitcoin subject is and how it is outside the realm of his usual experience therefore I was quite surprised at how well he understood it along with many of the economic implications. Clearly he is doing his job better than his 33 counterparts at the SEC.

But I can tell you from my two days at the NACHA conference with senior bank executives and members of central banks that the payments space is completely stuck in the mud. If anything I come away having a little more sympathy for the bank manager when my expectations are not met. I suppose the conference helped me lower my expectations on what to expect from them.

They have all types of problems and Bitcoin solves nearly all of them but is nowhere close, from a technical standpoint, to being able to be adopted by them. If anything they should use the technology for intra-bank settlements but there is so much inertia that will probably not gain any traction.

For example, there were very heated round table discussions about cross-border payments and legal or compliance issues. One representative from a large bank in the US complained about how there are no rules for the EU to which one of the EU people said we have very defined rules (like when settlements must happen by, fees, taxes, etc.) just that they are different for all 32 countries and in some cases in languages different from English. So the issue was not that there were no rules but that they were hard to find. In contrast, with Bitcoin the open-source software is easily discoverable and the mathematical rules of the software are easily implemented by the software developers who want to use it.

Another significant issue raised by one participant is that Fedex can track a $5 package but we cannot track a $500,000 wire. They want to provide real-time status on currency flows like bank wires, international ACH or debit services, mobile payments, cross-border transactions, etc. But there is tons of regulation, some of which attacks fees, and the end result is that a 500 year old money substitute and value transfer system is hobbled by regulation resulting in a lack of financial innovation despite the possibilities the Internet enables.

And then there is Bitcoin. The gracious program director asked that I show them how Bitcoin works and not be too salesly. So I started out my objective presentation by explaining how public key and private key asymmetrical encryption works and had BrainWallet.org on the projector.

Bitcoin is very abstract so the easiest way to get it is to use it. So after about 90 seconds of encryption explanation then the next step was to do a transaction in front of them. So I brought up an address on the projector using Blockchain.info, scanned the QR code with my iPhone, signed the payment and sent it. Within about 3 seconds it popped up on the projector as an unconfirmed payment.

I explained how it (1) went from my iPhone out to the Bitcoin network, routed around any possible censorship due to running at a lower level in the Internet where its traffic is indistinguishable from their encrypted traffic, (2) anyone could track the payment via the blockchain (3) it was non-revocable and (4) cost no fees to send.

Other parts of the presentation focused on backwards compatibility with ACH via Coinbase and with cash via Local Bitcoins or BitInstant. They found it fairly humorous when I said I would have to reevaluate my position on fulfilling orders in light of the FinCEN guidance. They were greatly surprised that in the last two weeks I had about ten orders from people who wanted to meet at Starbucks and buy $40,000 worth of bitcoins.

I showed them this chart of new wallet openings.

I explained the reason for the change in growth rate. Paypal started blocking legal file sharing websites so they started accepting bitcoins. I let them know that since Bitcoin is open-source that no users can be blocked and consequently Bitcoin would gladly accept with welcome arms any merchants they did not want to serve.

Then I showed them the 200 day moving average of Bitcoin's USD market cap.

This chart sure got their attention. One person questioned about the crash. So I explained how Senator Schumer brought attention to Bitcoin by explaining how it can be used to anonymously buy drugs online and called for a ban of the site Silk Road and an investigation.

Then I quipped, "We sure saw how that turned out. And since Bitcoin cannot block any particular users, like Paypal or Visa, that I did not appreciate Sen. Schumer's free advertising, despite bringing in plenty of users, because it made my job harder when dealing with people like yourselves and discussing how to use Bitcoin legitimately in the financial world."

Overall, I think they had a favorable sentiment towards the Bitcoin technology with a deer in the headlights type of impression. I do not really have any expectations for any of them adopting it anytime soon and I told them that it was not really in a position for that anyway. Bitcoin is still beta software after all and needs more work done before it can be ready for these types of organizations, institutions and enterprises. But the potential is there and the Bitcoin tsunami, while still far from shore, is racing with increasing speed and size.

CONCLUSION

So there is a lot going on in Bitcoinlandia. Based on current growth rates, resulting in increased speculative and transactional demand, the price needs to rise by about $3 per week compounded. How the inadvertent hard fork was resolved lends great confidence to the Bitcoin community. With the Cyprus and FinCEN news I think the general environment for the space has significantly changed in a way to provide greater confidence for VCs.

And greater confidence for VCs means higher Bitcoin prices. So where should the next target be? Well, given the fundamental state of the space as it currently is along with current growth rates therefore I think a fair value price for bitcoins is around 3-7 bitcoins per ounce of gold. It will be fun to watch the price melt-up to that over the short to medium term so get out the popcorn to watch this rocket. And if you still have not gotten familiar with Bitcoin then perhaps you should checkout the Free Bitcoin Guide which has had some significant updates lately.

NOTE: Due to time constraints and a meeting to attend I have published this quickly without the usual proofreading. So if you see any errors then please help me out by leaving a comment so I can fix it. Thanks!