Posted 11 Mar 2010

The IMF gold has serious geo-political ramifications in the background because of the nature of foreign exchange reserves, credit default swaps and gold. Wikipedia:![]()

![]()

South Korea and Japan are both home to large numbers of United States troops and neither are going to invite a nuclear attack. The Kuomintang, which the US backed, retreated to Taiwan when they lost power and China still asserts their ownership over the tiny island and the US continues to honor their agreement to defend Taiwan.

Russia has been discharging dollars and acquiring gold while Brazil is bucking the buck. Neither China nor India have significant reported physical gold holdings; they need a hedge to the major currency illusions. In my book The Great Credit Contraction the liquidity pyramid represents the FRN$ will be the last major currency to evaporate.

The Euro's evaporation has increased and ultimately has only one outcome. Sure, Germany wants to retain its voice on the world stage and is faced with a Hobson's choice of bailing out Greece and eventually the other unproductive free-riding members of the Euro or let the Euro evaporate and lose their relevance on the world stage because Germany only matters if Europe as a whole matters.

CREDIT DEFAULT SWAPS

But the Damocles sword of credit default swaps, which is falling toward's Greece, can, ultimately, be measured only against gold because gold is no-one's liability. Just like the Chinese have feigned their interest in acquiring gold; many sophisticated investors have feigned ignorance of gold's monetary role.

Many sophisticated investors, like George Soros who broke the Bank of England doubled his gold position in Q1 2010, Paul Tudor of Tudor Investments, John Paulson, David Einhorn, Eric Sprott, Jim Rogers, Peter Schiff, John Embry and many others are likewise allocating their capital based on the premise that gold is a major world currency.

Even Janet Tavakoli, a former adjunct associate professor of derivatives at the University of Chicago's Graduate School of Business, and author of six books on derivatives recently wrote:

U.S. credit default swaps currently trade in euros. After all, if the U.S. defaults, who will want payment in devalued U.S. dollars? The euro recently weakened relative to the dollar, and market participants are calling for contracts that require payment in gold. If they get their way, speculators on the winning side of a price move will demand collateral paid in gold.

The market can create an unlimited number of these contracts very rapidly. The U.S. wouldn't have to ever default to trigger a major disruption in the gold market.

The fiat currency and fractional reserve banking system is merely a confidence game built on an illusion and fraud. Fiat currency is to be valued like the common stock of a government and in gold. As such the current system will end and holder's of capital will demand to be shown the money. Just ask Harry Reid about karma or learn some real Abraham Lincoln facts.

The price of gold in evaporating currencies would not so much create a disruption in the gold market as cause a serious loss of confidence in the current system which would result in a tremendous increase in gold's liquidity, hopefully through use by individuals in ordinary daily activities like what happened in Zimbabwe last year.

After all, who really needs to use fiat currency illusions and why? In this case, we are seeing both China and India demanding to see the IMF's gold, the Damocles sword jitters and there is only one protection. Assets with intrinsic value.

DISCLOSURES: Long physical gold, silver and platinum with no interest in the problematic SLV, Streettracks Gold ETF Trust Shares or the platinum ETFs.

By Jeff Clark, Senior Editor, Casey’s Gold & Resource Report

On February 24, Reuters reported that the Reserve Bank of India was “set to be a buyer” of the 191.3 tonnes (6.74 million ounces) of gold the IMF is selling. Although the bank wouldn’t comment directly on the possibility, they did say, “We are closely looking at the gold market... gold is a safe bet.”

The article then quoted an unidentified official from the China Gold Association as saying, "It is not feasible for China to buy the IMF bullion, as any purchase or even intent to do so would trigger market speculation and volatility.”

But the next day, Finmarket news agency in Russia reported that China “confirmed its intention” to buy the IMF gold. "Chinese officials have confirmed previous announcements from IMF experts and said that the purchasing of 191 tons of gold would not exert negative influence on the world market.”

While they’ve been silent since, both India and China have publicly hinted they want this latest batch of yellow bars from the IMF. There’s no way to know if a competitive bid would spring up between these two countries, but...can you imagine the ramifications if one did?

When India bought 200 tonnes of IMF gold last November 3, it set off a buying spree that saw gold rise 14.2% in 4 weeks. What if this time around, a couple central banks both want the gold for sale? What if China says to India, “Not so fast, guys. We’d like to bid on that, too...” and word of that clash leaked out?

Pure speculation, of course, but competing for gold purchases isn’t a far-fetched idea. This sale is not pre-arranged; it’s an open market sale. Also, there’s only so much to go around. These two countries have only a tiny amount of their reserves in gold. Throw in the fact that central banks worldwide are already net buyers.

A pretty delicious thought, wouldn’t you say?

The gold price dropped a tad on the IMF announcement, but is up 1.1% since then. It’s pretty hard to make a case that IMF sales will hurt the gold price. As I said a few weeks ago in another column, IMF sales tend to mark bottoms in the price and not tops. The World Gold Council reported that floor traders now consider $1,054 as a floor in the market. Why? That was the average price India paid for the 200-tonnes they bought from the IMF last fall.

Meanwhile, what is our government doing?

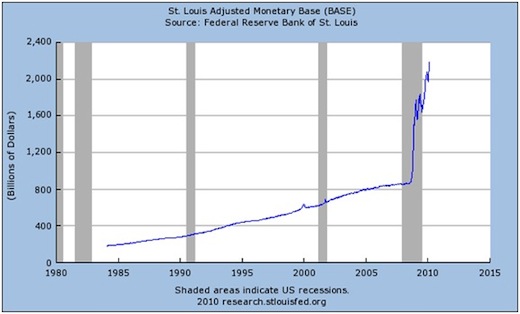

ADJUSTED MONETARY BASE

You’ll recall that that big spike in the U.S. monetary base in late 2008 was never before seen in history. The Federal Reserve basically doubled it overnight. Our economist Terry Coxon described it as “beyond unprecedented.”

So, they stopped that insane activity, right? Since December 2008, the monetary base has swelled from 1.69 trillion to 2.18 trillion, a 29% increase and another new record.

Printing paper money vs. buying physical gold. I don’t know about you, but I think I’ll follow China and India’s lead here, even if I have to compete for the price I pay for my gold.

For those interested in additional analysis from Casey’s Gold & Resource Report click here.