Posted 16 Dec 2009

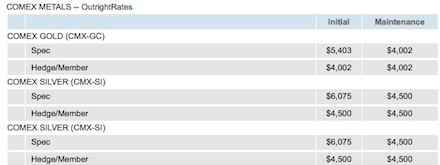

The COMEX has raised the margin requirements for gold and silver futures contracts. Additionally, gold is trading in minor backwardation but this is probably not serious. The margin requirement rise validates the strength of the bull market. There will likely be additional margin requirement increases during this upleg.![]()

![]()

MARGIN REQUIREMENT

A margin, or performance bond, is collateral that the holder of a position in futures contracts, securities or options has to deposit to cover credit risk. The use of margin greatly amplifies either the gain or loss with a position. The higher the margin requirement the more capital is required to control the same amount of the underlying asset.

One consequence that can result from using margin to purchase assets is a margin call. If the margin posted in the margin account is below the minimum margin requirement then the broker or exchange issues a margin call. The investor has to either increase the margin deposited or close the position and can be accomplished by selling the securities, options or futures if they are long and by buying them back if they are short.

If they do not do any of this the broker can sell his securities to meet the margin call. If the exchange is unsuccessful in executing margin calls and receiving enough capital then the exchange could fail.

The COMEX has recently raised the margin requirements for gold and silver contracts.

The result of these increases in the margin requirements will likely be somewhat bearish for the metals in three to six months. This is because it will require more capital to control the same amount of the commodity and will serve to dampen some of the speculative hot money which has been flowing into the metals lately.

Margin requirements and other exchange rules are what put a damper on the Hunt brother's plans. Overnight the rules were changed without notice and it resulted in tremendous losses and margin calls to the Hunts. The effect of margin requirements on the instruments of the gold price suppression scheme does cause some questioning. For example, are they even subject to the requirements?

GOLD AND SILVER BACKWARDATION

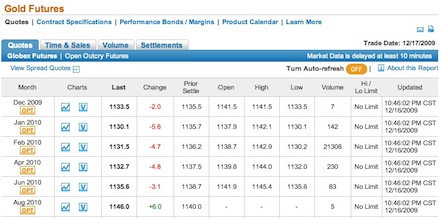

As of 16 December 2009 there has been some minor backwardation appearing for both gold and silver. For example, gold for delivery in December 2009 was higher than the January, February and April contracts.

Likewise the LBMA silver forwards have been showing some particularly interesting activity since about 24 November 2009. For example, the SIFO for one month was higher than all other months on 15 December 2009. The 16th showed similar unusual activity. Silver only recently slippped out of significant and prolonged backwardation in June 2009.

This bout of both silver and gold with backwardation is likely minor or immaterial. With gold it is likely due to delivery considerations. With silver there would need to be a prolonged condition to merit much more attention. Either way this is a condition to observe. Backwardation in the monetary metals implies loss of confidence in the paper instruments and both the desire and ability to take immediate possession without the use of margin.

PRECIOUS METALS BULL

As the gold, silver and platinum precious metals bull continues gaining intensity it will gather in more capital. With their use as currency in ordinary transactions, through services like GoldMoney, it will continue to increase the percentage of the total market that is owned outright. Already, most physical gold bullion is owned outright without any attaching liabilities in jewelry, coin or bar form by either individuals or massive central banks. This adds stability to the market because when an asset is owned outright then the owner cannot be margin called.

By analogy one of the reasons the US residential property market, which is heavily purchased on margin, is in such dire straits is because of the constant 'margin calls', the surplus inventory which is put on the market after foreclosure which results in further declines in market prices and more margin calls. In contrast, real estate in Argentina is 93% owned outright with only 7% encumbered. This adds tremendous stability to prices.

The increase in margin requirements on the precious metals will only serve to strengthen the bull market. But in the short term the effect could be to depress the price because of margin calls to speculative hedge funds.

CONCLUSION

There is old advice that the market can remain irrational longer than you can remain solvent. But this advice applies if margin is used. Gold, silver or platinum that is completely paid for becomes sovereign wealth, cannot be margin called and therefore the owner can hold it indefinately without fear of insolvency.

Unlike with a margin call there is no forced selling. Holding the monetary metals in such a way is in harmony with provident living principles and a safe way to buy gold.

DISCLOSURES: Long physical physical gold, silver, platinum and no position the problematic SLV or GLD ETFs.