Posted 30 Nov 2008

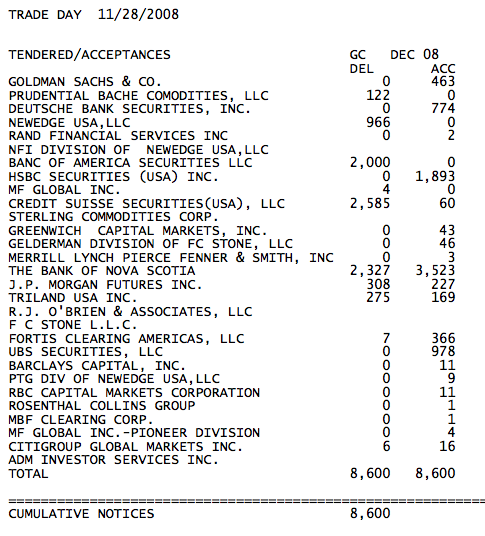

Earlier I wrote about a potential default of the COMEX for the December gold contract. November 28, 2008 was the first day to notify or take delivery.

For comparison the October contract had a total of 11,554 contracts delivered. When the LME defaulted on delivery and nickel went into backwardation it happened about two weeks into the delivery process. COMEX contracts are for approximately 100 ounces of gold.

Total registered category ounces - 2,804,270 or 28,042 contracts

Total eligible ounces - 5,713,922 or 57,139 contracts

The following shows an interesting development:

It appears from the above list that Germany, Swizterland, China and Sprott? are demanding their gold. When the run on the London Gold pool happened it climaxed at 400 tons in a day when President Nixon closed the gold window.

It appears from the above list that Germany, Swizterland, China and Sprott? are demanding their gold. When the run on the London Gold pool happened it climaxed at 400 tons in a day when President Nixon closed the gold window.

With about 27 tons demanded this could get interesting. I find GoldMoney a much easier way to get physical bullion than the COMEX. Last I heard they were pulling off several tons of gold per month for their clients and are currently having no delivery problems with LBMA bars.