Posted 03 Jun 2010

The entire system around which daily life is organized in the United States, undergirded by the Federal Reserve Note dollar, is crumbling. Both long-term trends and externalities, like the BP mess, are natural and predictable consequences. Inertia is such a strong force that the avoidable often becomes, in the macro, unavoidable. But individually you can starve the vampire squid institutions and organizations and in doing so likely increase your health, wealth and happiness.![]()

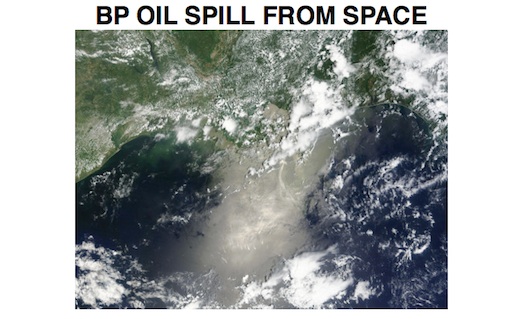

![]()

PUNISHMENT FOR NATIONAL SINS

[pullquote]In the grand picture this BP mess in the Gulf of Mexico is a tiny and immaterial result from using a fiat currency and fractional reserve banking system.[/pullquote]The Founding Fathers were a particularly contentious lot during the Constitutional Convention.

A major point of disagreement was slavery and the slave-trade compromise hinged on a clause found in the United States Constitution Article I Section 9 Clause 1 which contained an interesting word: dollar. Obviously, if the term dollar did not have a commonly accepted definition then this slave-trade compromise would not have been agreed to in the convention. But now the question What Is A Dollar? has no intelligible answer under federal law.

George Mason, a slaveowner, famous American Revolutionary Statesman, Delegate from Virginia to the Constitutional Convention and the "Father of the Bill of Rights" said,

Every master of slaves is born a petty tyrant. They bring the judgement of heaven upon a country. As nations cannot be rewarded or punished in the next world, they must be in this. By an inevitable chain of causes and effects, Providence punishes national sins, by national calamities.

The slavery issue, which could have been addressed and settled at the Founding, was instead, because of inertia, postponed until it erupted in a bloody crisis led by America's greatest despot. The monetary issue, in contrast, was settled at the Founding and has been steadily eroded since until the United States and the world now finds itself in a very difficult and dangerous predicament.

Individuals, cities, counties and States are using Federal Reserve Note Dollars as legal tender and this is unconstitutional. Of course, the United States Supreme Court has not and most likely will never address the issue and so it is left to fester and boil until an avoidable crisis becomes unavoidable.

Dr. Edwin Vieira in Pieces of Eight foresaw, chronicled and forewarned about all of this. It seems Seth Lipsky of the Wall Street Journal, like most in the Establishment, is a little late, ignorantly or deliberately? Inertia.

GOVERNMENT SUBSIDIZED OIL

Since Henry Ford refined the assembly line into an efficient factory the United States has been favoring oil through tax policy which has artificially stimulated demand. Now the entire American infrastructure has been built around this premise and as Dick Cheney says, "The American way of life is not negotiable." Just ask Saddam, Obama or Ron Paul.

[flowplayer src='http://www.runtogold.com/videos/obama-war-ron-paul.mp4' width=480 height=360 splash='http://www.runtogold.com/images/ron-paul-was-right.jpg']

Of course, a couple natural byproducts of this favorable tax policy for both supply and demand of oil, ranging from highway funding or the public school transportation system to the primary residence interest tax deduction or municipal bond tax exemption, is lower cost resulting in increased demand and the rise of special interest groups such as Big Oil.

Then supply which would most likely not ordinarily be produced is sought for production instead of substitute or alternative goods which often encounter legislative barriers to entry. Special legislation is enacted to protect suppliers against externalities so that the commodity can be provided at a lower cost which further feeds demand. The governmental intervention changes the economics; the economics guide the culture and ultimately impacts behavior.

Then, BAM! An externality black swan lands like the Exxon Valdez mess or BP's massive pollution of the Gulf of Mexico. Sure, Exxon probably does not intend to wreck the oil tanker but if they can privatize the gains and socialize the losses then it would create shareholder value.

While Exxon polluted Valdez on 24 March 1989 the case was finally heard on appeal to the United States Supreme Court on 27 February 2008, about 19 years later and the decision merely remanded the case back down to the 9th Circuit Court of Appeals and limited the punitive damages to the compensatory damages of $507.5M even though Exxon's behavior was 'worse than negligent but less than malicious'.

In the meantime, after the first verdict JP Morgan Chase created the first CDS for Exxon in 1994 because of the initial $5B punitive damage award and inflation has since eroded the vast majority of the value of 507.5M Federal Reserve Note Dollars. Thus began the rise of the derivative industry.

While President Obama is strutting around browbeating BP the outcome will likely be similar to Exxon's which is still unresolved even though three United States Presidents have completed five terms. For example, Exxon posted record profits of $45.2B in 2008. This is an example of privatizing the gains and socializing the losses. Likewise BP will probably privatize the gains with their average net income for the last three years of $21.316B while socializing most of the losses resulting from this massive corporate defecation in the Gulf. Inertia at work to sustain the unsustainable system which had its genesis decades ago.

CONCLUSION

BP's massive pollution of the Gulf of Mexico will have a tremendous negative impact on millions and millions of people. But BP, like the investment banks they are intertwined with, will likely be able to privatize the gains from oil production and socialize many of the losses. This is just a single example of 'an inevitable chain of causes and effects' that are driven by physical and economic law.

But if you think the pollution in the Gulf of Mexico is tremendous then I doubt you understand the scale of the damaging externalities resulting from the current worldwide monetary system.

In the grand picture this BP mess in the Gulf of Mexico is a tiny and immaterial result from using a fiat currency and fractional reserve banking system. Exxon Valdez, BP Gulf of Mexico, Chernobyl, Soylent Green, Union Carbide's Bhopal, the American military, the Health Care Bill, Monsanto's Food Inc, and etc.

[flowplayer src='http://www.runtogold.com/videos/food-inc-trailer.mp4' width=520 height=293 splash='http://www.runtogold.com/images/food-inc.jpg']

Using a sound money system as demanded by the United States Constitution while boycotting fractional reserve banking, in other words starving the vampire squid, is one way to protect and preserve both your personal health and the environment.

In other words, stop paying these institutions and organizations to kill you and destroy the environment! To the extent possible, move your money, support HR 4248, alter your habits, change your buying patterns, cancel your cable, buy gold, and boycott unethical, immoral and damaging companies. You will likely be healthier, wealthier and happier if you do.

DISCLOSURE: Long physical gold, silver and platinum with no interest the XOM, BP, the problematic SLV or GLD ETFs or the platinum ETFs.