Posted 08 Aug 2011

[pullquote]When the time for performance comes the time for preparation has passed.[/pullquote]Gold has powered higher at an incredible and, for many, unexpected rate going from FRN$1,658.75 in the 5 Aug PM London fix to FRN$1,761.50 at 6am 9 Aug London time. The DOW:GOLD ratio has plummeted to around 6.15. Hope you are strapped in because turbulence is ahead!![]()

I recently finished two weeks in London which ended with the GATA Gold Rush 2011 conference. I was in the room during the taping of the Jim Sinclair interview. How right has he been all along!

The flat I rented in London was about two tube stops from the Tottenham riots. Now I am in Athens headed to the islands for an enjoyable two weeks. With all the turmoil I often wonder: Do the riots follow me or do I follow the riots?

One common theme on RunToGold is to assess the probability and gravity risks, analyze potential solutions or plans and then take action with provident living principles which may lead to survivalism in the suburbs or some other form of life hedge.

UNITED STATES LOSES TRIPLE A RATING

In April Treasury Secretary Timothy Geithner was asked concerning the risk of the U.S. losing its triple-A credit rating: Secretary Geithner replied, "No risk of that."

Then the politicians bickered about the debt ceiling and came to a faux resolution. On 5 August 2011 the Wall Street Journal reported:

S&P removed for the first time the triple-A rating the U.S. has held for 70 years, saying the budget deal recently brokered in Washington didn't do enough to address the gloomy outlook for America's finances. It downgraded long-term U.S. debt to AA+, a score that ranks below more than a dozen governments'

Boom, Boom, Pow!

[pullquote]Those persuaded have likely ensconced themselves within a financial forcefield of silver and gold.[/pullquote]THE GREAT CREDIT CONTRACTION INTENSIFIES

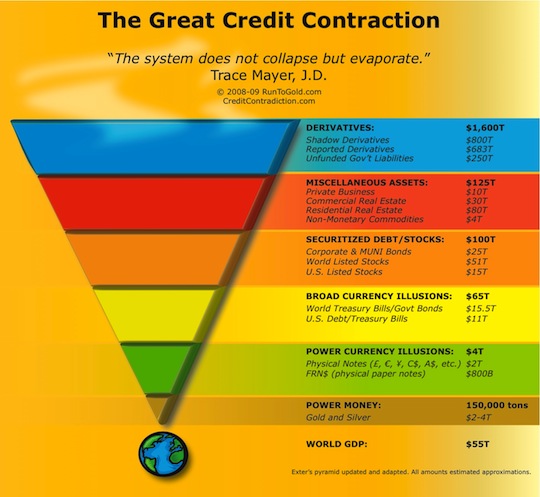

In 2009 Mr. Sinclair said of my liquidity pyramid: "A very good, simple and clear representation of the problem lacking a practical solution." Before his interview at the GATA conference I wanted to thank him for his gracious compliment. Regarding the liquidity pyramid Mr. Sinclair remarked, "Perfect."

PREPARATION, CONFIDENCE AND CALM

I have received a tremendous increase in comments and emails from readers and friends. They all seem to want expert advice from someone who knows what is going on. Why do you think I wrote hundreds of articles on Run To Gold? When the time for performance comes the time for preparation has passed.

I really wish I could provide some advice for those 'caught between a rock and a hard place' who are watching their pensions and retirement accounts evaporate. But I am off swimming in the beautiful islands of the Mediterranean Sea and do not have ready access to the phone.

Those darn crazy gold bugs do not look so crazy now. How right was Mr. Sinclair when he called $1,650 gold a decade ago when it was around $265? Good thing his thin skin is gold-plated.

But I have already written about the evaporating Euro, how retirement accounts could boost Treasuries and as I wrote in 18 January 2009 why and how the Treasury bubble will burst:

As the yields on Treasury Bills approach 0% they have the return of cash but do not have the benefits of cash as they may be impregnated with counter-party risk or have decreased liquidity. In other words, Treasury Bills and cash have the same benefit profile but not the same safety and liquidity profile.

The Wall Street Journal reported 4 August 2011 that "Bank of New York Mellon Corp. on Thursday took the extraordinary step of telling large clients it will charge them [0.13%] to hold cash."

Now the FRN$ moves one step closer to evaporating. Why pay 0.13% to hold FRN$ when you can pay a 0.18% storage fee to hold unencumbered allocated insured gold? Is it really wise or prudent to save five basis points to be in a potentially worthless fiat currency while being an unsecured creditor of an institution(s) that has needed trillions in bailouts? Treasuries are not looking so risk-free are they?

CONCLUSION

What is happening is no real surprise to those who understand monetary science and basic economic law. I laid out the case years ago in my book The Great Credit Contraction. Those persuaded have likely ensconced themselves within a financial forcefield of silver and gold.

As the storm rages and intensifies they feel no particular urgency or panic. They are prepared for Winter and can remain solvent much longer than the market can remain chaotic. After all, the melting point for gold is 1,947.52 °F which may be its FRN$ after this latest up leg.

For those who are new, I recommend Apmex for coins because of their A+ BBB rating and low premiums and GoldMoney if you want a third-party to store your metals.

DISCLOSURES: Long physical gold, silver and platinum with no interest in DOW, S&P 500, the problematic SLV ETF, gold ETF or the platinum ETFs.