Posted 03 Feb 2009

Lately, there have been some strange happenings in the silver market. From Act 4, scene 1, lines 40-41 of Shakespeare's Macbeth, "By the pricking of my thumbs, / Something wicked this way comes".

My article on Gold In Backwardation objectively explains what happens in the markets when monetary commodities enter backwardation. Backwardation is a situation where the fiat currency price of a commodity is pregnant with a premium the buyer is willing to pay for immediate delivery.

The price of a commodity for future deliver is lower than the spot price. This is contrasted with contango where the spot price is lower than the futures price. Backwardation seldom arises in the monetary commodity gold or the quasi-monetary commodity silver.

Contango is supposed to exist because of silver's inherently negative interest rate. The future price of silver is generally the spot price plus the future value based on the currency’s interest rate and a premium for counter-party risk.

For example, if the interest rate is 12% APY and silver is $100/ounce then silver’s futures price for delivery in one month would be $101+CPR=$100+(.12/12*100)+CPR. As counter-party risk or the perception thereof increases, like an exchange’s potential failure to deliver, there is greater demand for present delivery of silver.

Without getting into yield curves, the lowering of interest rates by central banks are leading to some interesting developments in the monetary arena. The question becomes: If I earn no interest on my dollars, euros, yen, rupees, etc. and lose purchasing power from inflation then I have a negative real rate of return. If I have a negative real rate of return then why should I own national currencies instead of silver?

SILVER IN BACKWARDATION

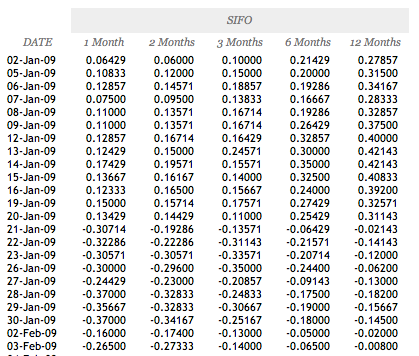

While the gold lease rate and silver lease rate have calmed down slightly, from 8 Dec 2008 to 23 Dec 2008 the SIFO (Silver Forward Mid Rate) were negative for 1 and 2 month and from 9 Dec 2008 to 12 Dec 2008 the 3 month. From 21 Jan 2009 until the present, 3 Feb 2009, the rate has turned negative for all months; 1, 2, 3, 6 and 12 months. This is a highly unusual event.

[caption id="" align="aligncenter" width="419" caption="LBMA Silver Foward Mid Rates"] [/caption]

[/caption]

What if silver trades in backwardation for an extended period? Well, I already answered this question earlier. It means individuals are unwilling to take the risk of holding national currency illusions or the risk of an exchange's failure to deliver. Potentially the national currency illusions could be pulled into the event horizon leading to the fiat currency graveyard. Watching the gold and silver prices in Euros and Pounds is getting exciting.

THE LOVE HATE RELATIONSHIP BETWEEN SILVER AND GOLD

Gold and silver are both monetary commodities.

Gold and silver are both monetary commodities.

If you think the gold bugs are kooks then you should meet the silver bugs. During the 1896 election both advocates proudly wore their respective pins to display their political preference. While gold and silver perform a similar function they are always in competition with each other.

At all times and in all circumstances gold and silver remain money. They are both immortal monetary instruments. Therefore, the only risk they are subject to is exchange-rate risk.

GOLD TO SILVER EXCHANGE-RATE

The gold to silver ratio is in getting interesting. Silver appears to be extremely cheap in terms of gold. The ratio tends to lower as the bull market progresses. Should the ratio lower to the 200dma then gold would be about $900/ounce and silver would be about $14/ounce.

If the ratio went even lower towards 50 then that would put silver around $18/ounce. Keep in mind that silver lies dormant most of the time and almost all of its gains are made in a very short period which is extremely difficult to predict.

INTERESTING NEWS IN THE SILVER MARKET

Silver is an odd monetary instrument because it is also consumed. Much of the silver in the world is in landfills after being used in cell phones, CDs, etc. Supposedly the SLV ETF hit a new inventory high of almost 7,500 tons but as mentioned earlier there are Problems With the GLD and SLV ETFs.

Indiains in India, being fairly smart, have a voracious appetite for both physical gold and silver. They are a lot smarter than most Westerners who clutch their paper instruments with such blind misplaced faith. The Indians are satisfied only if they get the cold, hard physical bullion in their warm hand.

Indians consume/import an estimate 3,000 tons of physical silver per year. Each year the central bank, the Reserve Bank of India (RBI), issues a circular wherein they give a license to banks to import physical gold and physical silver.

According to the India Times, for 2009 the RBI has renewed the license to import physical gold but not physical silver. Therefore, it appears most Indians will have to either purchase their physical silver overseas with a reputable source like GoldMoney, turn to the black market via smuggling or face shortages.

As I have quite a few extremely wealthy Indian readers I hope they are able to purchase all the silver they want. For those who have the ability to purchase silver you may want to reflect on value of that economic freedom. Given that an ounce costs about the same as a nice dinner and because the physical silver market appears very stressed why not pick up one or two ..... or a few thousand ounces?

The Cambridge House’s 2009 Phoenix Resource Investment Conference will be teaming up with the Silver Summit. This is a new show in Phoenix on February 20-21 will be much smaller than the usual Canadian shows.

As I will be presenting and the environment should be fairly small I will most likely be able to address many of your questions. While I have not chosen or prepared my topic yet I suppose ‘Silver’s Role in The Great Credit Contraction’ will be as good as any.

Disclosures: Long physical gold and silver.