Posted 09 Jan 2009

I received the following request from a reader. "Please comment on the following article from Rick Ackerman. I normally do not get alarmed as someone who holds a large portion of their net worth in gold and silver but with his track record my brow is raised on this. http://news.goldseek.com/RickAckerman/1231484460.php Thanks for your work and most interesting commentary."

On Wednesday I was at lunch with several extremely financially successful people. After introductions and our business was concluded we began to chat and for some reason they kept peppering me with economic questions. It is like I am some three eyed fish and they were poking me to see whether I would move. I suppose I should appreciate the compliment of 'most interesting commentary'.

Mr. Ackerman invites, "If any of you can explain how we’ll recognize the return of inflation, or perhaps the beginnings of a hyperinflation, I’m all ears. Click here and drop me a line, because I’d really like to know."

As a legal beagle lets play some simple language games. First, inflation and hyperinflation must be defined. As an Austrian I use part of the traditional definition from decades ago that inflation is an increase in the money supply. Of course, that begs the question of what the 'money supply' is. Unlike most commentators I am a lone three eyed fish and distinguish money, money substitutes and currency.

Currency is the medium of exchange used in ordinary daily transactions and can be either money, a money substitute or an illusion so long as there is confidence. Money must be a tangible asset so that at the time when transactions are engaged in they are 'extinguished' because 'value' exchanges for 'value'.

Currency is the medium of exchange used in ordinary daily transactions and can be either money, a money substitute or an illusion so long as there is confidence. Money must be a tangible asset so that at the time when transactions are engaged in they are 'extinguished' because 'value' exchanges for 'value'.

An example of money would be a gold coin, silver bar, quarter or dime. A money substitute is a debt based instrument that gives claim to money. An example of a money substitute would be an 1865-1921 gold certificate which bore the language, 'This certifies that there have been deposited in the Treasury of the United States of America __ Dollars in gold coin repayable to the bearer on demand.' An illusion would be a currency instrument that has no claim on money.

An example of an illusion would be the FRN$, C$, A$, Euro, Reich-mark, Continental Dollar or any other host of currency instruments.

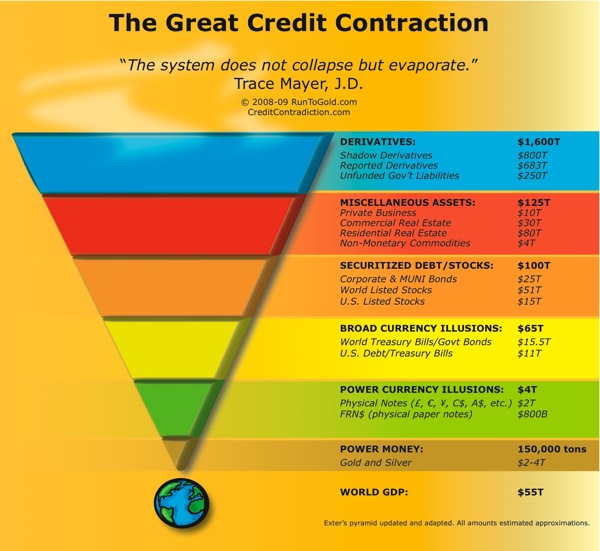

After having differentiated the currency terms now the application can be made to the 'money supply'. This is where my own original scholarly work appears. I look at 'inflation' and 'deflation' in terms of the 'currency supply'. Like M1, M2, M3, MZM, there are different cross sections available depending on their riskiness and liquidity profile. An easy way to visualize this is John Exter's Liquidity Pyramid.

Second, to yank on the tails of people like Mr. Ackerman in an August article I persuasively applied the International Accounting Standards to determine whether the US$ was in hyperinflation.

In conclusion, "Because of the flight from the US$ by a large segment of the population of the United States, the pricing of goods and services in foreign and metal currencies, changes in credit terms to account for purchasing power differences and a cumulative three year inflation rate of 105.3% therefore with gold as the presentation currency the US$ appears to be in a hyperflationary environment when applying IAS 29."

Third, with that foundation I will now attack arguments from 'Myron P' in Mr. Ackerman's article. Mr. Myron asserts, "And finally, the Doomsayers, rushing into Gold and other commodities as a safe-haven. And here is the main point of my thoughts: We will all be affected, and we will all eventually get to the same place: cash poor. ...

Then, when the willing money has invested, the big question arises: What good is gold when Cash is King? ... Cash is King today. ... Cash should remain King and will remain scarce. That being the case, for how long can Gold play out its endgame before it comes down, and hard?"

At all times and in all circumstances gold remains money. Gold is potentially the most powerful currency. Mr. Myron's assertion that gold is not cash is complete financial lunacy. Unfortunately, he is infected with the Financial Insanity Virus like most everyone and his lunacy has led him to believe that the sun (gold) revolves around the earth (FRN$).

As Henry Thornton, economist and Bank of England governor, observed in his 1802 An Enquiry into the Paper Credit of Great Britain ”We assume that the currency which is in all our hands is fixed, and that the price of bullion moves; whereas in truth, it is the currency of each nation that moves, and it is bullion which is the more fixed.” Gold is money and therefore cash.

The FRN$, Euro, etc. are illusions and therefore like-cash instruments. Just like Auction Rate Securities, Mortgage Backed Securities and Reich-mark Bonds were 'like-cash' for about 30 years and then suddenly evaporated as the tides turned from an inflationary credit expansion to a deflationary credit contraction and investors sought safe and liquid assets so likewise will the FRN$, Euro, etc. continue their evaporation through the currency event known as hyperinflation.

Fourth, because of technological advances there is a tremendous amount of 'creative destruction' going on. The Internet has radically altered the monopolistic music and movie industry. No longer are phonographs or vinyl records used but instead content is downloaded to a mobile phone.

The Internet has radically altered the monopolistic telephone industry with services like Skype and VOIP. The Internet has radically altered the journalistic industries as even the venerable New York Times is under extreme financial pressure.

The Internet pulls back the curtain and reveals the illusions rapidly resulting in the loss of misplaced confidence. We are living through historic times and are at the cusp of a turning of the tides. The inflationary credit contraction that started before the 13th century and the Medici with their fractional reserve banking has reached its zenith and the deflationary credit contraction, like a Kondratieff Winter, has begun. For those with a stake in illusionary currency and fractional reserve banking as Mr. Volcker succinctly phrased it, 'This current mother of all crises.'

![]() In but a few short years the Internet has radically altered the monopoly of money, money substitutes, illusions and currency just like it has altered the smaller monopolies of music, movies, communications and journalism.

In but a few short years the Internet has radically altered the monopoly of money, money substitutes, illusions and currency just like it has altered the smaller monopolies of music, movies, communications and journalism.

Digital gold currencies, 100% reserve banking based on commodity money, are exploding onto the scene through the viral nature of the Internet and these monetary evolutions are forever altering the path of humanity.

This creative destruction will probably result in as Niall Ferguson phrased it in The Ascent of Money, 'mass extinction' of the barbarous relics of illusion currency, fractional reserve banking, central banking and their pets the giant Welfare/Warfare States. How long this process of creatively destroying a 600 year old monetary system will take is anyone's guess but it is happening a whole lot faster than many expect.

As the velocity of digital gold currencies continues increasing and the velocity of FRN$ and other illusion currencies decrease the faster this currency transfusion for the global economy will take place.

Disclosures: Long physical gold. No position in the failing New York Times.