Posted 25 Oct 2009

On 22 October 2009 Reuters reported that Korea National Energy Corporation will purchase Harvest for C$1.8B or C$10 per unit. On 12 December 2008 I wrote, "For these reasons Harvest appears to be fairly cheap and a good opportunity." This article will examine the anatomy of the trade and opportunities for redeployment of capital.

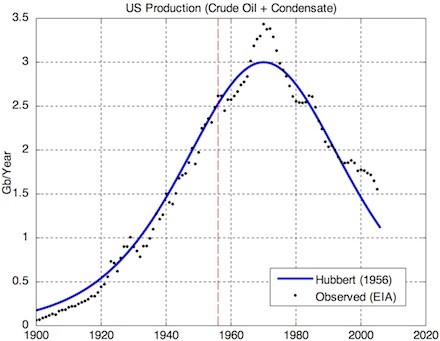

PEAK OIL

One of the underlying themes for my investment philosophy is Peak Oil. Many major oil producing countries have already passed their peak oil production; Germany in 1966, the United States in 1970 and shortly before the Nixon shock when he unilaterally defaulted on international gold obligations, Iran in 1974, France in 1988, in 1999 Argentina and the United Kingdom around the time Gordon brown sold massive amounts of England's gold, Mexico in 2004 and Kuwait is expected to peak in 2013, Saudi Arabia in 2014 and Iraq in 2018.

The prescient oil specialist and investment banker Matt Simmons, author or Twilight In The Desert, thinks OPEC has almost no spare capacity. The role of the monetary metals, particularly gold, is to perform mental calculations of value; pricing.

The sooner you begin to calculate value in terms of real things the sooner you will be able to understand the relationship between gold, oil and your stomach. Provident living principles include having excess energy; a monkey that gets margin called starves to death.

The United States, consuming 400% more than it produces, needs a reliable source to feed its addiction and Canada is the perfect candidate.

CANADIAN ENERGY TRUSTS

The Canadian energy trusts are generally high-yield going concerns that pay out distributions based on cash flow. Generally, under Canadian tax law they receive preferential treatment so long as the pay out ratio is above 50%. This special treatment will change in 2012 but many trusts have significant tax pools to shield income like Harvest with $3B.

When I recommended Harvest its price was FRN$8.68 per unit or about 0.33 grams of gold. The unit price of the Canadian energy trusts were decimated with the fall in oil and Harvest was no exception. For example, it fell to a low of $3, or about 0.10 grams of gold, on 9 March 2009.

HEDGE STRATEGY

The role Harvest played in my portfolio had to do with passive income according to provident living principles. Accordingly I followed my own suggestions I wrote in my article.

Worst case scenario oil prices continue to fall and the Federal Reserve Note Dollar continues to strengthen which will weaken Harvest’s extremely attractive yield from the current approximately 30% (depends on your tax situation). Long term put options can easily be purchased to preserve capital investment.

Despite the volatility in price I maintained significant monthly cash flow, a 30% cash-on-cash yield will do that, and actually significantly increased my position by purchasing additional units with the proceeds from the put options. Consequently, the new problem is to figure out where to deploy this capital so that the portfolio balance and lifestyle are not disrupted.

PENN WEST ENERGY

A comparable company to Harvest is Penn West Energy (PWE) although they produce over three times as much oil and gas, do not have a refinery and are not burdened with as much debt. At $17.67 per unit with a C$.15 per month distribution it currently yields cash-on-cash about .78% or 9.3% annually.

Like Harvest it implements a prudent hedging strategy that minimizes the impact of volatile commodity prices. Even with weak commodity prices in Q2 2009 they achieved $25.64 netback per barrel of equivalent which included a realized hedging gain of $5.46.

But Penn West has risen about 35% in the past two months. The goal is to buy low and sell high. While I think Penn West will make a good dairy cow for my herd it does seem a little expensive at the current price. Consequently, the open strategy will need to be a little more complex than a market order.

SELL STAGGERED PUTS

For a time horizon of a few years, which includes the tax pool advantages, Penn West appears a decent purchase around $16 per unit. It may even be worth paying a little extra in order to reduce US$ exposure with the cash balance.

A naked put, also called an uncovered put, is a put option whose writer (the seller) does not have a position in the underlying stock or other instrument. This strategy is best used by investors who want to accumulate a position in the underlying stock but only if the price is low enough. If the buyer fails to sell the shares then the seller keeps the option premium for bearing the risk.

Selling naked put options does entail significant risk. The maximum value at risk would be the strike price minus the premium received and would materialize in a bankruptcy that I would consider a black swan. A more likely risk would be a significant decline in the unit price like what happened with Harvest in March 2009. This risk has a higher probability because of the recent run up in price and coming seasonal weakness for energy commodities.

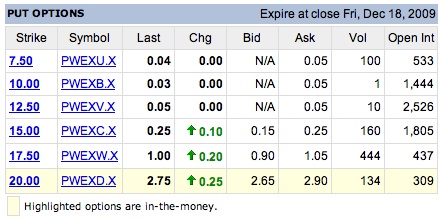

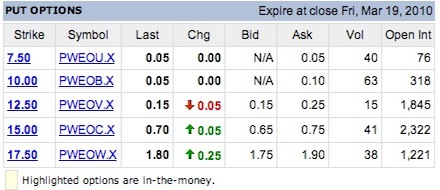

But I need a new dairy cow for my herd and am not very fond of my unemployed cash in this zero interest rate environment where the Federal Reserve will fail with quantitative easing. Consequently, I think opening some uncovered put positions on Penn West around the $15 and $12.50 strike prices for December 2009 and March 2010 will be a good use of the excess liquidity that has resulted from KNOC's tender offer.

If Penn West floats around its current price then the options will not exercise and I keep the premiums. For the March 2010 $15 puts that amounts to $65 per contract and depending on the margin requirements will take about $500-1,200 of excess liquidity for a very flexible stress test.

Of course, raising the bid to $.85 or higher, in a measured and staggered fashion, will help increase the return. Remember, you make money when you open the position not when you close it.

Thus, this strategy will be able to replace the lost passive income from Harvest. Excess capital can be used to reduce risk and expand one's wealth foundation by moving a significant portion of the unused capital into cash positions holding physical gold, silver or platinum bullion via GoldMoney.

CONCLUSION

The world has a very serious problem with its energy sources and consumption habits. While nations may do incredibly stupid things, like the Nixon shock or Brown's blunder, individuals can take calculated risk to protect, preserve and grow their capital according to provident living principles.

But even after acquiring good assets the markets can turn and therefore it is important to implement a good hedging strategy to preserve capital. Sometimes against your wishes the market will take your dairy cow to market and turn it into hamburger in which case it will be time to find a new dairy cow.

But there is a wide variety of investments available and sufficient tools to take measured risk. In this case, Penn West appears to be a slightly expensive replacement for Harvest and with an uncovered put strategy the acquisition of units will be at a better value than the current market price.

DISCLOSURES: Long HTE, physical gold, silver and platinum with no position in the problematic GLD or SLV ETFs and short put options on Penn West.