Posted 15 Sep 2010

The negative effects of inflation on the economy from the Federal Reserve's monetary policy of quantitative easing has exploded the currency supply and lowered the average American's standard of living. But where are the negative effects of inflation showing up in the real world? Likely in the prices of your food and other consumable goods.

[HTML1]

COMPETITIVE DEVALUATION

As the Federal Reserve has failed with quantitative easing it has led other central banks to competitively devalue their currencies. Bloomberg reports that on 15 September 2010 that for the first time since 2004 the Japanese central bank has begun intervening in the currency markets to manipulate the Yen's value lower.

But for Japan to be successful with their goals they will need to continue intervening because other central banks will be carrying out similar monetary policy. Just look at India with its rupee down but GDP growing extremely fast. But to do so they will be fighting against economic law. Ultimately, they will fail.

[pullquote]These are all predictable negative effects of inflation on the economy.[/pullquote]NEGATIVE EFFECTS OF INFLATION ON ECONOMY

Many economists do not have a solid definition for inflation. The traditional definition and that primarily used by the Austrian school of economics is that inflation is an increase in the currency supply and deflation is a decrease in the currency supply. Many court economists, particularly from the Keynesian school, like to define inflation as a rise in prices.

But a rise in prices is merely a symptom of inflation much like wet streets are a symptom of rain. But to confuse wet streets for rain is to confuse cause and effect. But these court economists confuse lots of things; particularly their students. Are we in inflation or deflation? But the average person is beginning to feel the negative effects of inflation on the economy in their own life. Commodities are approaching record high prices and these costs are filtering through to consumable goods.

An example would be orange juice. Tropicana has recently changed their 64 ounce container to a 59 ounce container but there has been no corresponding decrease in price. When asked why the customer service representative responded, "Our consumer research shows that most shoppers, when given a choice between a price increase or slightly less contents, prefer to hold the line on prices."

Because wages have not increased approximately 10% therefore the volume decrease of 8% lowers the standard of living for the average American. Show me the beef! A lower standard of living is one of many negative effects of inflation to individuals in the economy. Thus, leaving the rat race becomes more difficult.

A decrease of about 8% seems to be low. For example, 7-Up decreased their bottle from 20 ounces to 16.9 ounces, or 15.5% decrease, and Scott toilet paper decreased the width of a roll from 4.5 inches to 4.125 inches or about 8.3%.

A decrease of about 8% seems to be low. For example, 7-Up decreased their bottle from 20 ounces to 16.9 ounces, or 15.5% decrease, and Scott toilet paper decreased the width of a roll from 4.5 inches to 4.125 inches or about 8.3%.

GOLD IS THE CASH KING

During deflation cash is king and gold is emperor. This is because gold is a tangible asset and can never become worthless through the hyperinflation like little colored coupons; Yen, Euros, Dollars, etc. On 15 September 2010 The New York Sun reports Alan Greenspan spoke at the Council on Foreign Relations and in response to a question about why gold was hitting new highs he said, "Fiat money has no place to go but gold. ...

If all currencies are moving up or down together, the question is: relative to what? Gold is the canary in the coal mine. It signals problems with respect to currency markets. Central banks should pay attention to it."

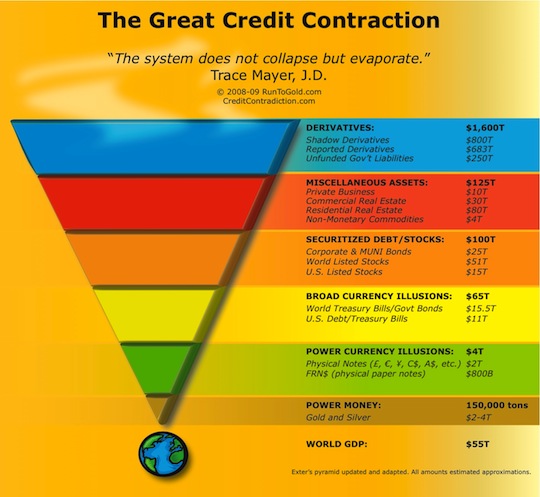

During The Great Credit Contraction which has only just begun eventually all little colored coupons will return to their intrinsic value which is worthless. Like newspapers, fiat currency, fractional reserve banking and central banks are barbarous relics in the Information Age and there are much more efficient forms of currency that will be invented and adopted.

As I wrote about in Gold And The Oil Majors Revisited:

At the current price of gold the $54.2B of stock repurchases from five measly companies will only yield about 1,432 metric tons of gold or about 359 less tons than the hypothetical. For comparison Venezuela is the 16th largest holder with 363.9 tons and the United Kingdom is the 17th largest holder with 310.3 tons.

Currently, the five oil majors have about $250B in current assets on their balance sheets. That would purchase about 6,232 tons of gold. At least with that much physical gold the oil majors would be assured of making payroll. Why they do not hold any of the precious metals on their balance sheets is truly baffling.

PLATINUM IS THE STILL THE DEAL

Gold and silver are within their normal trading ranges and currently of average value. I still really like platinum and it has recently broken out from being cheap to being of average value. So if you are going to buy any of the precious metals right now then I would recommend buying platinum. This next upleg in the precious metals will likely last until early Q2 of 2011 and the gold price could power through $1,500/ounce.

CONCLUSION

The extremely negative effects of inflation on the economy and the Federal Reserve's disastrous policies are exacerbating the Greater Depression. Real economic pain is being felt by those who are most impacted by the rise in consumables, particularly food, prices. Portions are being reduced, prices are being raised and standard of living is going down while the economy continues to die. These are all predictable negative effects of inflation on the economy and the Federal Reserve's hand in everyone's cookie jar.

DISCLOSURES: Long physical physical gold, silver, platinum and no position the problematic SLV or GLD ETFs or XOM, CVX, TOT, BP or COP.