Posted 14 Apr 2011

The precious metals have been on a tremendous upleg as I predicted. But for the past few years I have maintained that gold and silver are about average value and sometimes a little expensive. In other words, they are no where near as cheap as they were at the beginning of this secular bull market in 1999.![]()

Then my ears perked up when I heard Marc Faber on CNBC say, "I think maybe gold is cheaper today than it was in 1999 when it was $252."

Is Mr. Faber's subjective valuation of gold rationally optimistic, delusional or just plain insane?

[pullquote]Plus, one should be acutely aware of return-free risk.[/pullquote]HOW TO VALUE GOLD AND SILVER

When I am looking to buy or sell an asset, whether real estate, stock, bonds or precious metals, I generally use the 200 day moving average to determine its relative price and give a quick determination of whether it is cheap, average or expensive. On RunToGold I even have key ratios where one can easily view the DOW:gold or DOW:silver ratios based on the spot price or 200 day moving averages. I find these extremely helpful to get a quick assessment of current market ratios.

Despite being extremely bullish about silver and understanding the silver backwardation implications on the silver price I have nevertheless been extremely cautious because of the overstretched 200 day moving average; based purely on technicals silver looks very expensive and due for a correction to around $30. But these are just techniques and do not get to the fundamental issues. They are only as good as their underlying premises.

Many financial professionals struggle with valuing gold. This is because traditional valuation techniques and strategies focus on discounted future cash flows, discount rates, interest rates, risk-free rates, real returns, ROI, IRR, WACCs, etc. Distilled simply they base all of their premises and conclusions on a faulty premise: The 10 year US Treasury is the risk-free rate.

As a result, most people including almost all the gold bugs I know keep their balance sheets, income statements and cash flow statements using the FRN$ or Euro as the numeraire. Even among gold bugs I know it is only myself and Anthem Blanchard who seem to keep regular financial statements denominated in gold as the numeraire.

The truth of the matter is that the benchmark for 'risk-free' is subjective and a decision every investor should make for themselves. What one uses for a numeraire is a completely different issue from what one should buy, sell or hold, etc. Plus, one should be acutely aware of return-free risk. Here are a few of the factors that persuaded me to use gold as my prime numeraire:

1. Gold, an element in the periodic table, is a tangible physical asset with a constant definition.

2. There are large above ground stockpiles of gold which results in low relative changes in size and those changes are largely predictable.

3. Gold is a current asset with significant financial liquidity properties. It belongs in the cash portion of the balance sheet.

4. Gold has value in itself, is not subject to counter-party risk and can never become worthless.

5. Gold has a long-term relationship with other commodities. Professor Jastram in The Golden Constant explained on page 130,

As we have said, the purchasing power of gold depends on the relation of commodity prices to gold prices. A close scrutiny of this relationship over time discloses an affinity of a curiously responsive character. It could be called the ‘Retrieval Phenomenon’, meaning that the commodity price level may move away higher or lower, but it tends to return repeatedly to the level of gold.

6. When feeling insecure about the financial and economic conditions one can always pet their gold. Go ahead, pet your platypus.

[pullquote]Perhaps most shocking when one begins to perform this initial paradigm change is to see what I like to call the inversion of interest income; store of capital expense.[/pullquote]SWITCHING ONE'S LENS

Viewing the financial and economic world through the prism of the FRN$, Euro, Yen, Pound, etc. leads to gross distortions. Due to the gold price suppression scheme one's vision is only slightly improved, and definitely not to 20/20, by viewing through the lens of gold as numeraire. But the one-eyed man is the dodgeball God when playing among the blind.

To be honest, I do not really care if people disagree with how I assess value; I just kick their bum in the market and am rewarded with the purchasing power. It reminds me of what one of my banker's said about 10 months after we had closed on an acquisition, "You sure underpaid for that business." My response was, "We were buying, right?" Duh. Plus, the seller named his price so he got exactly what he wanted!

In nature, atrophy is the natural order of things. The fiat currency and fractional reserve banking system has resulted in a concave financial prism that results in a financial inversion. The natural order of things would have a negative, not positive, interest rate. Perhaps most shocking when one begins to perform this initial paradigm change is to see what I like to call the inversion of interest income; store of capital expense.

For example, if you have a batch of bananas or wheat you would not expect there to be more of higher quality tomorrow merely by the fact of putting them in a pile. In most cases, wealth does not just magically create and organize itself. In fact, most rational people would assume there would be less wealth because the bananas or wheat would spoil. So likewise with gold; there is a storage expense and insurance instead of earning interest.

Most people forget that interest is supposed to compensate for risk which has largely been cartelized and resulted in tremendous moral hazard that will be meted out under economic law with systemic collapse.

If you had 3,800 gold ounces, about $1,000,000 of value, in 2001 and wanted to store the capital until 2007 you could choose among many different tools. Let's assume you chose an interest bearing checking account and GoldMoney. The monthly store of capital expense for the bank account is about $1,500 while about $500 using GoldMoney. I should probably run the numbers to see if the fiat currency and fractional reserve banking system has gotten more expensive since 2007 but this is what Mr. Faber is asserting.

CONFISCATING CERTIFICATES OF CONFISCATION

[HTML1]

THE CURRENT VALUE OF GOLD

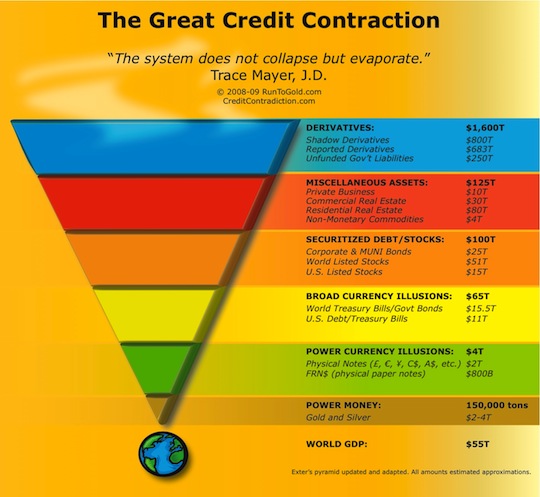

Over the past 40 years, the world economy has attempted to leave gold's orbit through the world reserve currency rocket of the FRN$ but it has ran out of fuel before reaching escape velocity and therefore been unsuccessful which has resulted in The Great Credit Contraction that has only just begun a few years ago with capital burrowing down the liquidity pyramid. The regression theorem reversed.

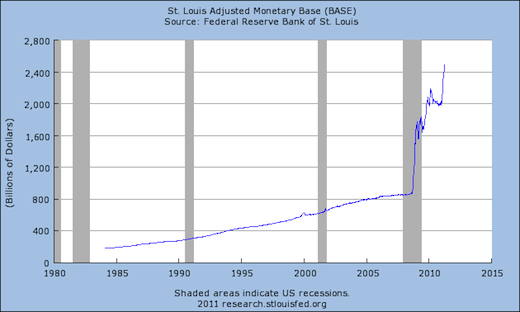

A tremendous portion of the liquidity pyramid, particularly with derivatives, has been created since 1999. Looking just at high-powered currency, the adjusted monetary base, relative to gold gives an interesting valuation metric. Supposedly the United States government has 261.5 million ounces of gold in Fort Knox.

Despite the gold having not been audited in over 50 years and rampant corruption, inefficiency, misstatements, lies and omissions by the United States and other governments on countless topics we will assume for the sake of argument that they really do have the approximately 8,000 tons of gold.

This chart from the Federal Reserve Bank of Saint Louis shows there was approximately $500B of adjusted monetary base in 1999 and about $2.5T in March 2011 with a corresponding 5.8x increase in the price of gold relative to FRN$. This places a ratio of adjusted monetary base to gold in 1999 of $1,912 and in 2011 of $9,478.

This chart from the Federal Reserve Bank of Saint Louis shows there was approximately $500B of adjusted monetary base in 1999 and about $2.5T in March 2011 with a corresponding 5.8x increase in the price of gold relative to FRN$. This places a ratio of adjusted monetary base to gold in 1999 of $1,912 and in 2011 of $9,478.

Reasoned analysis for Mr. Faber's valuation comes into focus. As Mr. Robert Landis asserted at GATA's 2005 event, "Any rational person who continues to dispute the existence of the rig after exposure to the evidence is either in denial or is complicit." GATA asserts that central banks have only 1/2 to 1/3 of the gold they claim which would yield a ratio of $28,434.

After all of the worldwide quantitative easing and competitive devaluation of the last few years what are the adjusted monetary base ratios of the ECB, Bank of England, Korea, China, Japan, etc. relative to their minuscule gold holdings? As Alan Greenspan said to the Council of Foreign Relations, "Fiat money has no place to go but gold."

[pullquote]When the crystal ball is clouded just hunker down at the liquidity pyramid's tip.[/pullquote]CONCLUSION

For the last several years I have thought that gold and silver were about average valued based on the current market conditions and their liquidity. But after hearing Mr. Faber's assertions that gold may be cheaper now than in 1999 and analyzing the changed market conditions such as the rise of the digital gold currency GoldMoney, increased gold hypothecation via JP Morgan, tremendous increase in the adjusted monetary bases of central banks around the world, failed quantitative easing policies, the exacerbation of the Greater Depression , lack of access to knowledge and facts concerning the true state of affairs which is exemplified by Bloomberg taking the Federal Reserve to the Supreme Court and negative business and entrepreneurial environment due to increased government regulation and taxation therefore I may be changing my view on the underlying valuation of the precious metals. Despite the massive secular bull market they may actually be getting cheaper!

The current metals prices may seem high in nominal terms but what is unseen is the change in fundamental value of the FRN$. I hate owning the precious metals because of the store of capital expense. I would much prefer to own a wealth generating business or real estate.

But for now I will continue to buy gold, silver, platinum and palladium only because I do not see any other better alternatives and the difficulty in discerning the financial and economic landscape because of the twilight zone induced effects from quantitative easing. In other words, when the crystal ball is clouded just hunker down at the liquidity pyramid's tip.

DISCLOSURES: Long physical gold, silver, platinum and palladium.