Posted 21 Dec 2008

Dell (DELL), Hewlett-Packard (HPQ), IMB (IBM), Microsoft (MSFT) and the runt Apple (AAPL) will all be fighting over customers this holiday season while Google (GOOG) will be directing the purchases. The indentured and strapped American consumer has been reigning in their purchases.

All the malls I have visited have been extremely sparse while those present were unencumbered by any bags. As the deflationary credit contraction intensifies holders of capital continue seeking safer and more liquid assets in which to allocate capital while prices nose-dive and economic activity grinds to a halt.

FOR THE CONSUMER

CIO reported on a case brought by the New York attorney general where Dell was recently found guilty of fraud, false advertising, deceptive business practices and abusive debt collection practices.

Stay away from rattlesnakes. There is extreme discontent with Microsoft's Vista and 92% of developers are simply ignoring it.

It seems no small wonder that the runt, Apple, has grown U.S. consumer market share to 21%. Apple's products are expensive. The ACSI has found an industry wide decline in consumer satisfaction but Apple and Google have defied this trend and recorded a new all-time high for consumer satisfaction.

I am not sure if the cause is whether Apple's products are getting significantly better or whether Windows-based machines keep getting more and more painful to use. For those who do make the switch the Genius Bar at Apple stores provides service on moving one's data and information and for the truly sadistic Windows can be run on Apple's computers.

These fundamentals bode well for Apple but it still appears overpriced at a 16.8 P/E. If the P/E gets around 7 and if it maintains these strong fundamentals then Apple may appear as a buy.

Likewise, Google providing free and superior tools like Google Docs which integrate into Apple's iPhone may pose a threat to Office which is one of Microsoft's cash cow.

CASH RICH

Dell has repurchased $12.8B of shares over the past three years and has still seen their share price fall from $33 to around $10. IBM is perched atop $53B in current assets and only $44B of current liabilities while having repurchased about $28B of stock.

Microsoft, the free cash flow king, over the past three years has repurchased about $47B of stock, paid over $11B in dividends, hoards about $43B in current assets and has helplessly observed their share price fall from about $27 to $19.

Hewlett-Packard's accounts receivables appear bloated and their change in cash equivalents was ($5.6B) in 2007 but nevertheless appear very healthy with $47B of current assets and $50B of total liabilities. All of these international companies appear cash rich in the current environment. As the liquidity crisis intensifies

GOLD IS A CHEAP INTERNATIONAL CURRENCY

At all times and in all circumstances gold remains money and therefore is the most important currency in the world. As required under the International Accounting Standards gold is a monetary commodity. For example, footnote 14 of the 2007 Annual Report for the Bank for International Settlements states, ‘Gold is considered by the Bank to be a financial instrument.’ Gold is carried in the cash section of the balance sheet.

On May 20, 1999, Alan Greenspan testified before Congress, “Gold is always accepted and is the ultimate means of payment and is perceived to be an element of stability in the currency and in the ultimate value of the currency and that historically has always been the reason why governments hold gold.”

During the 1990’s Mr. Rubin had devised the gold leasing scheme with the intent being elucidated by Dr. Greenspan’s testimony in 1998, “Nor can private counterparties restrict supplies of gold, another commodity whose derivatives are often traded over-the-counter, where central banks stand ready to lease gold in increasing quantities should the price rise.”

GATA’s alleged central bank gold price suppression scheme may include the COMEX’s participation. Mr. Robert Landis, a graduate of Princeton University, Harvard Law School and member of the New York Bar, has asserted that “Any rational person who continues to dispute the existence of the rig after exposure to the evidence is either in denial or is complicit.”

GATA alleges that the central banks have less than half the gold claimed.

The sophistries weaved by the derivative illusion has greatly affected gold's price. Gold is not a portfolio asset; everything else is. For example, the $700B bailout represented approximately 20% of the all the gold ever mined in the world.

When there is a real liquidity crisis there are no TARPs, TAFs, TALFs and other CRAPs which are intended to confound, confuse, deflect and misdirect. Former Federal Reserve Govenor Lyle Gramley has suggested a revaluation of the Federal Reserve’s gold.

A revaluation from the current $42 per ounce to Gerald Celente’s suggested $6,000-10,000 is not unreasonable given the condition of the Federal Reserve’s current tumescent balance sheet. This would also bring the DOW towards its twice historic lows of about one ounce of gold.

HOARD THE CASH

The computer majors, or anyone else for that matter, can purchase gold and put options. Then they can protect themselves from the ultimate liquidity crisis by sending their armored trucks to the COMEX, having them loaded up with the supposed gold and hauling it away.

Taking physical delivery is extremely important because there are approximately 140 ounces of ‘paper gold’ for every ounce of physical gold. This is a key reason why the oil majors should truck away their gold instead of using problematic ETFs such as GLD or SLV (GLD) (SLV). Someone will be left holding the bag of worthless paper gold.

The COMEX currently has about 1.3M ounces of gold or about $1.1B. The entire eligible COMEX stockpile represents an immaterial 0.61% of the current assets or about 1% of share repurchases over the past three years of DELL, HPQ, IBM and MSFT. Why buy back stock when gold is available to be trucked away?

Owning the gold would function as a hedge against the increased counter-party risk and insulate against potential bank failures such as Wachovia, Washington Mutual and IndyMac while shielding them against adverse credit market conditions resulting from Bear Stearns, Lehman Brothers, etc.

As these large international corporations already own multiple currencies, owning and possessing physical gold, the ultimate international currency, would provide an anchor to their balance sheets during this time of economic turmoil.

CONCLUSION

Because (1) the entire banking system is unstable, (2) their own shares are plentiful, (3) gold is extremely cheap money and in short supply relative to the size of their balance sheets, and (4) to reduce counter-party risk therefore the major computer companies should just buy and take delivery of physical gold instead of buying back their own shares.

There is extreme instability in the worldwide monetary and financial system accompanied with the counter-party risk of the banks. The large computer companies, or you for that matter, can easily eliminate counter-party, Herstatt and settlement risks with gold clause contractions under 31 U.S.C. 5,101-5,118.

There is extreme instability in the worldwide monetary and financial system accompanied with the counter-party risk of the banks. The large computer companies, or you for that matter, can easily eliminate counter-party, Herstatt and settlement risks with gold clause contractions under 31 U.S.C. 5,101-5,118.

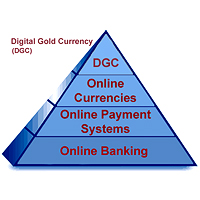

The evolution of currency in the Information Age has provided and individuals are using credible transparent and reliable digital gold currencies. These eliminate the economically inefficient fractional reserve banking and its attendant risks.

Bullion hoards are turned into convenient functional currency for ordinary daily transactions either with international parties or domestic employees.

As the economic pain from the current system intensifies then more rational market participants will seek out alternatives and eventually substitutes, as they are with Apple and Google, to the current monetary system which will only increase the velocity of gold and its perceived value.

Those companies which embrace the new monetary systems first will be best positioned with solid balance sheets based on real and solid assets. Who better than the technology companies?

Disclosures: Long MSFT and GOOG. No other positions in IBM, DELL, AAPL, HPQ, GLD or SLV.