Posted 22 Jul 2009

Humans eat or humans die and with the Peak Oil specter looming this issue is becoming very pressing for about 923,000,000 people. The Internet is an amazing series of tubes.

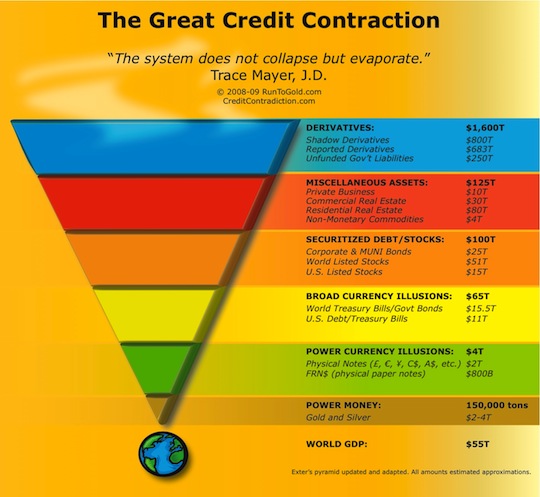

A friend told me that Nate Hagens, MBA, former Managing Director at Salomon Brothers, Lehman Brothers and editor of The Oil Drum, used my liquidity pyramid near the end of his presentation at the June 2009 Oil Drum/ASPO Conference in Alcatraz, Italy.

The presentation was extremely interesting. Continuing the theme on 8 July 2009 he authored an article: CFTC - Futures Position Limits On Energy?

INFORMATION AGE

Mr. Hagens has some key insights.

Let's return to a central theme: that finite resources are being quantified by infinite money. ... Unfortunately, this 'speculation' issue is one of many red herrings that ignores the widening fundamental disconnect between financial and real assets. ...

As long as energy and resources were cheap, more long term gearing/profits were to be had from the vanilla 'derivatives': stocks and bonds (these are derivatives of our real capital: natural, built, social and human that underpins them), than from the commodities themselves.

This is one of the reasons Brazil and Russia have such positive prospects is because of their tremendous endowment of real assets.

The Industrial Age allowed for obfuscation of information and inefficiencies of epic proportions. Ironically during the Information Age there will be a return to all things real. This is because the Internet pulls back the curtain and exposes with bright luminescence everything formally hidden in the darkness at the speed of light.

Additionally, stocks are in a long-term secular bear market while commodities are in a long-term secular bull market. Like the seasons on Jupiter; these take a couple decades to completely cycle through. As commodities represent the antithesis of financial assets this is likewise a vote of no confidence in the political structures of the earth.

And why not when Bloomberg reports that Neil Barfosky, special inspector general for the TARP, says 'US taxpayers may be on the hook for as much as $23,700,000,000,000 to bolster the ecnomy and bail out financial companies'. The European banking system is worse condition.

PRICING

Mr. Hagens continues:

As we are mired in a deepening recession, the roots of which lie in the generation long replacement of tangible things with paper and digits, the logical human reaction to oil moving back from $40 to $70 is to blame someone, in order that it retreat some and not act as economic headwind. ... So what does this mean? Energy, particularly liquid fuel, is the hemoglobin of modern civilization. Price signals based on the marginal unit create long term distortions for utilities and energy policymakers.

I agree that the world has a very serious problem. Because it has used a fiat currency with no definition for nearly 100 years and because oil production was constantly increasing during that time the effects of unwise capital investment were masked.

Energy Return On Energy Invested (EROEI) calculations were not performed and because of the central bank gold price suppression scheme it was probably impossible to accurately do so. But the damage to the economy has already been done and is a sunk cost. What can be done going forward?

UNTENABLE SOLUTION

Mr. Hagens wrote, "Like M. King Hubbert, I am in favor of an energy based currency and no futures trading at all other than for producers and those taking delivery." After some digging around I think I found Mr. Hubbert's plan which involved 'energy certificates'.

On this basis our distribution then becomes foolproof and incredibly simple. We keep our records of the physical costs of production in terms of the amount of extraneous energy degraded. We set industrial production arbitrarily at a rate equal to the saturation of the physical capacity of our public to consume. We distribute purchasing power in the form of energy certificates to the public, the amount issued to each being equivalent to his pro rata share of the energy-cost of the consumer goods and services to be produced during the balanced-load period for which the certificates are issued.

These certificates bear the identification of the person to whom issued and are non negotiable. They resemble a bank check in that they bear no face denomination, this being entered at the time of spending. They are surrendered upon the purchase of goods or services at any center of distribution and are permanently canceled, becoming entries in a uniform accounting system. Being nonnegotiable they cannot be lost, stolen, gambled, or given away because they are invalid in the hands of any person other than the one to whom issued. [emphasis added]

This solution is not practical because it is immoral and inefficient at allocating resources.

First, I am not sure who Mr. Hubbert intends the 'we' and 'our' pronouns to refer to. There are only individuals endowed with certain unalienable rights such as the right to live and by extension the right to eat their food.

Second, the use of energy certificates in this manner would amount to a price control or form of rationing. It is basic Austrian economics that price controls cause shortages with Zimbabwe being the latest tragic example. How would 'we' implement these 'energy certificates' based upon 'identification' that are 'non-negotiable'? With a barrel of a gun.

Even Vladimir Putin understands what happens: "The only problem: your results were poor and this will always be the case because the work you do is unfair and immoral. In the long run immoral policies always lose."

The issuance of energy certificates whose use is enforced with the barrel of a gun is immoral and will always fail. Also because it relies on force to implement along with identification, price controls and currency controls it is an inefficient solution to allocate energy resources. What would be a tenable solution?

TENABLE SOLUTION

A fiat currency attempts to sustain the unsustainable while a commodity-based currency employs the strict laws of reality to ensure the unsustainable is not encourage. At one of the Cambridge House investment conferences while talking with a CEO of a mining company I asked some questions on this topic. He succinctly responded, "Mining is converting energy into metals."

The storage and spoilage costs of the metals is far lower than wheat, cattle, oil, lumber or other commodities. Consequently, using metals as currency in ordinary daily transactions seems like the most efficient option.

During the Industrial Age the middle class survived and thrived but taxation exploded and concepts like economies of scope and scale led to bloated Welfare State governments. As Mr. Hagens wrote, "We have a monumental problem - a system whose claims on the future are higher than its real assets."

Governments around the world will massively default on their promises; Social Security, Medicare, Medicaid, the Pension Guaranty Benefit Corporation and the equivalents in Europe, Australia, etc. What is needed is not larger organizations and institutions but smaller ones.

Individuals are like the plankton of the investment world they will likely consider how to buy gold or silver to protect themselves from the insidious inflation tax which is a surreptitious form of confiscation without due process of law and is a prime reason to Raze The Fed.

Plus, the Federal Reserve's quantitative easing is failing.

Digital commodity currencies, like GoldMoney, which allow gold, silver and platinum to circulate as currency in ordinary daily transactions are tremendous monetary evolutions made possible by technology in the Information Age.

Like Facebook, Twitter, Google, etc. they will explode into world commerce. They are tremendously more efficient than the fiat paper franchises.

For example, from 2001-2007 the cost of storing $1,000,000 of capital in gold versus T-Bills was approximately $1,254 per month lower. Second, the use of these private currencies is voluntary and does not rely on the barrel of a gun via legal tender laws or capital gains taxes to remain competitive.

Third, as a result the market would choose, voluntarily, commodities as currency and civil liberties would be protected. There is a great book on this topic by Jörg Guido Hülsmann called The Ethics Of Money Production.

PRECIOUS METAL AND OIL VALUATIONS

As of 20 July 2009 there is slight gold backwardation, again. When I chronicled the chronic nine week silver backwardtion we watched the spot price rise from FRN$11 per ounce to almost FRN$15 per ounce or a 36% rise. Usually the summer is very weak for gold but it appears to be trading primarily as a currency right now so the backwardation situation is intriguing.

Additionally, as I recently recommended buying silver around FRN$12.50 and buying platinum around $1,115; those who followed the advice may need a snorkel to breath because of the ~10% gains in less than a month. The speculator may want to take some gains and wait for the last pullback before this fall.

While the gold to oil ratio does matter perhaps it will not return to previous patterns but instead normalize to a higher price in gold. But even with perpetually higher average energy costs this autumn and winter will likely see a tremendous fall in the price of the DOW in gold because of the relationship between unemployment, gross revenues, net incomes, PE ratios, etc.

In September the first batch of unemployment benefits expires out for about 500,000 people. Then each succeeding month the numbers will continue piling up just like the job losses which began 18 months ago.

Perhaps because we are 70 years removed from the Great Depression we think of it as an event; but in reality it took place over a couple decades and the first few years of it were marked by increased unemployment which caused people to burn through their savings before they became destitute.

A great book is Wealth War and Wisdom by Barton Biggs. Mr. Biggs, former chief global strategist for Morgan Stanely, advises ”you want your sanctuary to be remote enough to be inaccessible to the dispossessed hordes. Assume a breakdown of the civilized infrastructure. Your safe-haven must be self-sufficient and capable of growing food. It should be well-stocked with seed, canned food, wine, medicine, and clothes. There should be a stash of automatic weapons that you know how to use in case roving bands of hungry barbarian brigands show up." (p. 347-8)

CONCLUSION

The world has a very serious problem regarding energy and food production. The Information Age will continue to reveal the inefficiences and flaws in the current monetary structure with barbarous relics known as central banks. As I assert in my book, The Great Credit Contraction, capital is moving down the liquidity pyramid seeking safety and liquidity and it has only begun. There will likely be less capital available for metal or oil investment.

But there are digital commodity currencies that function in ordinary daily transactions. Each ounce of silver will likely buy a nice steak dinner. A couple ounces of gold will usually pay rent on a nice abode while 50-70 ounces of platinum will purchase a nice house. Based on historical averages the gold to oil ratio should decline.

In the meantime you may want to prepare for survivalism in the suburbs.

The role of the monetary metals, particularly gold, is to perform mental calculations of value; pricing. The sooner you begin to calculate value in terms of real things the sooner you will be able to understand the relationship between gold, oil and your stomach.

How will this all play out? I do not think anyone really knows. The collapse of the gold rig will not be a garden variety exchange rate adjustment but the collapse of a worldwide monetary system.

The decline of supply of cheap and abundant energy, the 'hemoglobin of the world economy', will have tremendous implications for every cell in the food chain. It would be nice if humanity acted morally. But have you ever watched a pack of hungry wolves on the Nature channel? Keep in mind that governments need less hungry mouths and lower unemployment.

Disclosures: Long physical gold, silver and platinum.