Posted 27 May 2010

While gold, silver and platinum are risk-free the precious metals industry contains both sterling actors and unscrupulous shysters. All are trying to make a profit which, if done morally, is commendable. The Glenn Beck and Goldline issue raised by Mr. Weiner is nonsense. But as a purchaser I want to get the best value. Oftentimes an ounce of prevention is worth a pound of cure.![]()

![]()

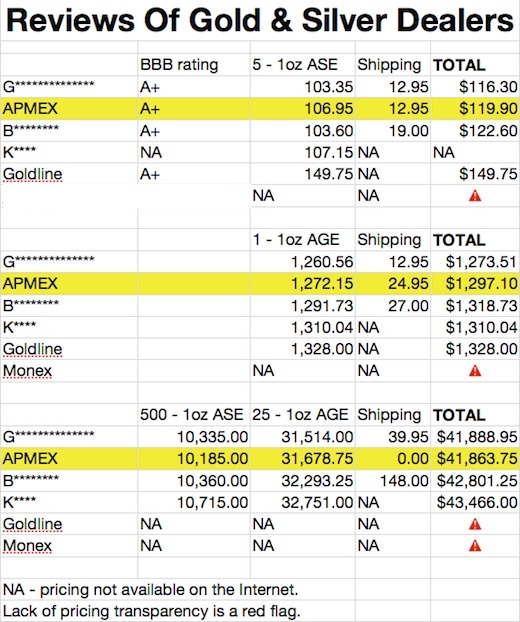

After thorough research I am confident you will find the best value with Apmex for the vast majority of transactions and get more ounces than when buying from any competitors like Gainesville Coins, Goldline or Apmex.

GLENN BECK AND REPRESENTATIVE WEINER

Representative Anthony Weiner was first elected in 1998 to the New York 9th District and roosts on the Energy and Commerce committee and Judiciary committee. His top campaign contributor is ActBlue at $44,500 and his #2 campaign contributor is M&R Management with $19,200. ActBlue describes themselves as 'the nation's largest source of funds for Democrats'.

CBS News recently reported,

Weiner accused Beck and other conservative spokespeople (among them Mark Levin and Fred Thompson) of using "their shows to prey on the public's fears of inflation and socialist takeovers while actively promoting the purchase of gold coins as insurance against this purported government overreach." ...

Weiner, who is on the House Subcommittee on Commerce, Trade and Consumer Protection, says Beck "should be ashamed of himself." He has written letters to the SEC and FTC asking them to investigate Goldline and is proposing legislation to force the company to "fully disclose their dishonest business practices" by showing consumers "their astronomical markups, and deceitful promises of profitability."

Mr. Weiner may want to tame his defamatory tongue where he is asserting that Goldline engages in 'dishonest business practices' and 'deceitful promises'. If these assertions are false and a reasonable investigation would cause the reasonable person to conclude that Goldline were not involved in dishonest business practices or deceitful promises then Goldline should consider suing Mr. Weiner for defamation. Think of all the free publicity!

After a reasonable investigation the facts appear to reveal that Goldline's customers are pleased with the company's business practices and there appears to be no evidence of anyone, besides Mr. Weiner who is probably not a Goldline customer anyway, claiming that Goldline has acted in a dishonest or unscrupulous way.

But perhaps this is to be expected language from those defaming ilk like Mr. Weiner. Where does ActBlue get their funding? One example is Martin Matthews the Director of Government Affairs for Merck & Co. who gave ActBlue $750. And what does Merck & Co. do for business?

But perhaps this is to be expected language from those defaming ilk like Mr. Weiner. Where does ActBlue get their funding? One example is Martin Matthews the Director of Government Affairs for Merck & Co. who gave ActBlue $750. And what does Merck & Co. do for business?

On 6 October 2004 The Wall Street Journal reported,

Merck & Co.’s arthritis drug Vioxx may have led to more than 27,000 heart attacks and sudden cardiac deaths before it was pulled from the market last week ... citing a study by the Food and Drug Administration, said that from Vioxx’s approval in 1999 through 2003, an estimated 27,785 heart attacks and sudden cardiac deaths

WebMD Health News citing a recent study published in the Archives Of Internal Medicine asserts 'Merck should have known Vioxx was deadly years before they pulled the drug from the market, a study of Merck's own data suggests." And where did those profits from Merck's sale of Vioxx go? Into Mr. Weiner's campaign pocketbook. And how does he use them? As a bully pulpit against profitable companies with a sterling BBB reputation.

GOLD AND SILVER DEALER REVIEW

[pullquote]best value being (1) credible and reputable and (2) having the best prices.[/pullquote]While I consider RunToGold a fun hobby I also require it to be self-sufficient since that is the only way to ensure it will be sustainable. While it is fun I will not allow it to be black hole on my balance sheet. Fortunately, sales of The Great Credit Contraction and donations from readers like you have been sufficient to provide for the thousands of dollars of cash costs associated with its operation. Free speech can be quite expensive!

Over the years with RunToGold I have been approached by many gold and silver dealers, including Goldline, about advertising but I never found the right fit. While I had my own sources for purchasing bullion, not numismatic coins, and I recommended those companies when asked; for the most part I have shied away from publicly endorsing any particular company besides GoldMoney because to do so requires me to stake some creditability and why should I?

But I am finding that many readers are reporting back to me with both good and bad accounts of interactions with gold and silver dealers. Consistent with the ounce of prevention rule I have undertaken to pool the collective experiences of my readers along with my own so that I can direct new readers who decide on buying gold, silver and platinum towards a provider that offers the best value being (1) credible and reputable and (2) having the best prices. This is an example of what I found:

APMEX OR GAINESVILLE COINS REVIEW?

So who is Apmex? I have ordered from them for years now. They have been in business for over 30 years, have extremely competitive prices and an A+ BBB rating.

My Gainesville Coins review distinguishes their service from others by them being a fairly new gold and silver dealer. Although new they have a good reputation and happy customers. I have made significant orders from them and been satisfied.

CONCLUSION

Owning gold, silver and platinum is something every responsible person should do. When deciding who to buy bullion from I can now confidently recommend Apmex if you want possession or GoldMoney if you want a third-party storage service. I think both forms are wise.

Additionally, I would shy away from taking any advise from Mr. Weiner. So long as the transaction is voluntary, unlike those Mr. Weiner engages in like voting YES on the Health Care Bill to give Merck more money from involuntary premiums, I am more concerned with the number of ounces the buyer gets.

With Apmex I am confident you will, in the vast majority of transactions, get more ounces than when buying from any competitors. Of course, do your own due diligence.

DISCLOSURE: Long physical gold, silver and platinum with no interest the murderous Merck (MRK), problematic SLV or GLD ETFs or the platinum ETFs.

| ANTHONY WEINER | |