Posted 01 Feb 2008

A Kondratieff Winter is the correction of a credit expansion. During an inflationary credit expansion capital moves up the pyramid. During the deflationary credit contraction, or Kondratieff Winter, capital burrows down the pyramid to safety.

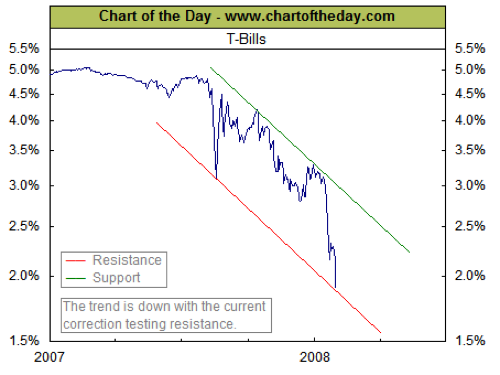

This is why stock markets have been crashing as investors flee into T-Bills. Ultimately, investors ensconce themselves within a deflationary but invincible and immoveable golden forcefield.

Alan Greenspan understands the risk a Kondratieff Winter poses to central bankers as they are impotent against stopping it. On Nov 6, 2003 he said, “Indeed, the Federal Open Market Committee has judged that the probability, though minor, of an unwelcome fall in inflation exceeds that of a rise in inflation from its already low level.”

Greenspan is not the only central banker who understands what is going on.

Legendary investor George Soros recently said in Davos, Switzerland, “"The current crisis is not only the bust that follows the housing boom, it's basically the end of a 60-year period of continuing credit expansion based on the dollar as the reserve currency. Now the rest of the world is increasingly unwilling to accumulate dollars."

Soros said, “I think we do have to rescue markets, otherwise we would go into a depression like we did in the 1930s."

There are hundreds of trillions of dollars in derivatives that are evaporating. Asset price deflation is intensifying. There are about $1,400 trillion of asset values but I doubt anyone can really accurately measure worldwide assets. Most of that notional value of both real and illusory wealth is in derivatives. The vast majority will evaporate during this deflationary credit contraction.

Of course, such intervention is what has gotten the world into this mess to begin with. If the United States followed the free-market money of the Constitution instead of establishing the Federal Reserve that manipulates the supply and price of money, always inefficiently compared to the market, then this financial train wreck would never have happened.

More government intervention and regulation will have the same effect as in the 1930s; more capital will retreat to gold in a deflationary spiral.

I think the current crisis is even larger than Soros does. The current world monetary and financial system has grown over 600 years into fiat currency and fractional reserve banking via an inflationary credit expansion.

The zenith was reached and a deflationary credit contraction has ensued and is intensifying. The tides have turned and what will likely result is a commodity currency and 100% reserve banking. The current system will not so much collapse as evaporate. Yes, it could take years or even decades or it could happen extremely quickly because of technological innovations.

For example, there are alternatives to the current system such as BitCoin or GoldMoney. As the current system continues its implosion alternatives will become more attractive because they are safer and more liquid. These types of services will become more prevalent as holders of capital seek safer and more liquid investments.

[HTML2]

[HTML3]

As the chart shows, investors are buying T-Bills no matter what the cost and accepting negative real returns. The negative real return marks the first snowfall of the Kondratieff winter. The next level down is either physical fiat currency or bullion. Unlike physical fiat currency the bullion has no counter-party risk.

[HTML1]

The earth (US$) revolves around the sun (gold). When Dr. Paul says the US is broke he is not referring to the $10T debt but instead Fort Knox being empty of gold because it has been sold to keep the US$ strong. This is the ‘strong dollar policy.’

The only truly safe and liquid assets are gold and silver. I like GoldMoney because it is an alternative to the current monetary system and eliminates payment and counter-party risk. To get a copy of The Great Credit Contraction eBook then click here.

The only truly safe and liquid assets are gold and silver. I like GoldMoney because it is an alternative to the current monetary system and eliminates payment and counter-party risk. To get a copy of The Great Credit Contraction eBook then click here.