Posted 10 May 2010

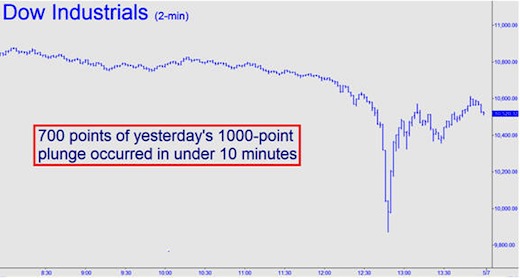

On 6 May 2010 the DOW dropped a massive 600 points in a mere seven minutes and at one point was down 998.50 points which is the largest nominal drop ever. One of the reasons for this increased volatility is the knowledge of all major market participants that their assets are neither safe nor liquid yet the greed to engage in speculation.

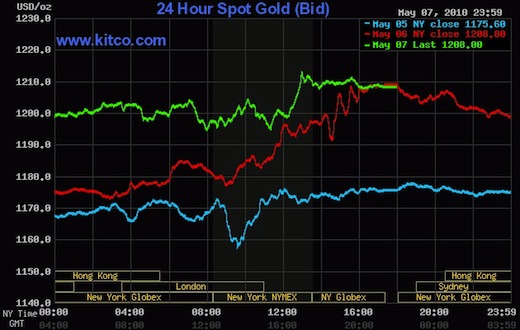

As the true state of the worldwide financial markets and their fake liquidity increasingly permeates the zeitgeist more and more individuals will simply withdraw their capital and store it is the monetary metals.![]()

![]()

Those who have followed RunToGold for a while have been adequately warned. For example, on 9 October 2009 I was interviewed on BNN and suggested that gold would reach $1,300 in Q2 2010 as the credit crisis intensifies.

Now gold is within striking distance. On 7 February 2010 I warned of the approaching Laboon of sovereign debt default and Euro evaporation. Now it is happening. On 27 July 2009 I warned of the coming market crash. While the market is crashing when priced in gold it has still remained fairly orderly and but for The President's Working Group On Financial Markets it would be a lot more chaotic.

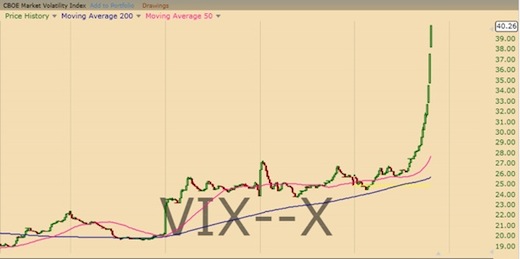

VOLATILITY

When the financial markets experience unusual palpitations then those closely involved often flee for safety and liquidity. With high frequency trading powered by computer algorithms the result is a gigantic electronic herd moving at the speed of light. The result is an explosion in the VIX or CBOE Market Volatility Index.

[pullquote]... value and price are completely discrete.[/pullquote]The higher the VIX the more difficult it is for the entrepreneur, the individual that creates real wealth by providing the goods and services the economy desires, because making mental calculations of value becomes more difficult and therefore decisions to allocate capital become based on more arbitrary premises. In this current economy, value and price are completely discrete.

The end result is that holders of capital, instead of taking risk and buying an ice cream machine or building a new factory, buy gold, silver and platinum while waiting for calmer days. When the devaluation of intrinsically worthless fiat currencies happens it will likely be extremely quick.

[flowplayer src=http://www.runtogold.com/videos/RKFast.m4v, width=520, height=390, splash=http://www.runtogold.com/images/runtogold-video-play.jpg]

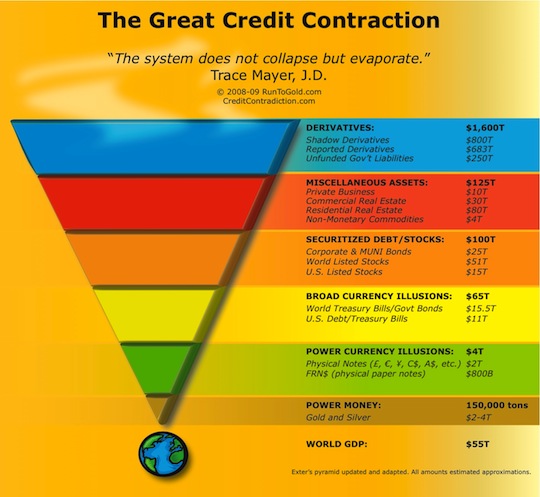

THE GREAT CREDIT CONTRACTION

I really wish this liquidity pyramid could accurately convey all I want but it gets the main point across. During a credit contraction capital, both real and fictitious, burrows down the pyramid into safer and more liquid assets. The illusory capital evaporates.

I really wish this liquidity pyramid could accurately convey all I want but it gets the main point across. During a credit contraction capital, both real and fictitious, burrows down the pyramid into safer and more liquid assets. The illusory capital evaporates.

[pullquote]... the riots in Greece are the prelude not the encore ...[/pullquote]What happened on Thursday? Capital burrowed into FRN$ Treasuries and gold. Gold is now perched atop a near record all-time high around $1,210 per ounce.

As reported by Bloomberg, the EU's $645B fund to fend off the 'wolfpack' will be like a decrepit brontosaurus trying to fend off 100+ hungry velociraptors.

Europe is too old, too beauracratic, too slow and fighting economic law to be able to mount a sufficient defense. The little baby velociraptors, hatched with the merger of bank, currency and state through ignoring Article 1 Section 10 Clause 1 of the United States Constitution and the establishment of the unconstitutional Federal Reserve, have now grown up and they have unlimited avarice to feed.

[flowplayer src=http://www.runtogold.com/videos/velociraptors.mp4, width=480, height=385, splash=http://www.runtogold.com/images/velociraptors.jpg]

But I think the real value is to be found in buying platinum which, during the past week, got cheaper when priced in gold. A likely scenario will be a summer consolidation or pullback in gold, silver and platinum and then starting in August the trek towards $1,650 gold with the bulk of the upleg happening in November.

There will come a time to buy the S&P 500 and real estate with one's monetary metals but that time is still a few years away. In the meantime, the name of the game is to retain the capital and purchasing power already accumulated. Keep in mind, the riots in Greece are the prelude not the encore and will be coming to a city nearby before The Great Credit Contraction is over.

CONCLUSION

The entire worldwide financial and economic system are built on an illusion. Neither I nor other prepared individuals really care if the stock market crashes 700 points in ten minutes.

What is going on is fairly simple economic law which I discuss in The Great Credit Contraction. While the time to buy the precious metals at a good value was earlier there is still incredible reasons to at least have some material portion of one's net worth allocated to them.

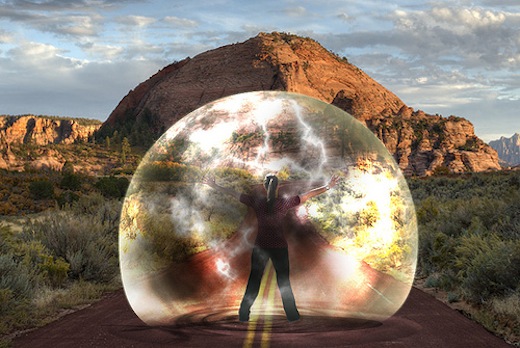

After all, whether the fire of inflation or even hyperinflation or the ice of deflation that freezes the global economy in its tracks a holder of capital will be protected when ensconced within a golden forcefield. And the monetary metals can do wonders for reducing blood pressure when watching Iceland, Greece, New York or LA on television.

DISCLOSURES: Long physical gold, silver and platinum with no interest in DOW, S&P 500, the problematic SLV ETF, gold ETF or the platinum ETFs.

DISCLOSURES: Long physical gold, silver and platinum with no interest in DOW, S&P 500, the problematic SLV ETF, gold ETF or the platinum ETFs.