Posted 09 Apr 2008

Mr. Adam Curry on the April 7, 2008 Daily Source Code #744 asked the following questions:

Adam asks, “Have a couple of tips. Give the Charlie heads some tips on what to do with their money.”

So, I took off a couple hours this afternoon to write this blog to help out all my fellow like-minded Charlie Heads for whom I care for them so much. Because all the Charlie Heads have unique situations such as assets, jobs, residence, citizenship, etc. I would prefer to speak in general principles and not specific investment advice.

Where legal I recommend having a three month storage of the foods regularly consumed by the Charlie Heads and their families. The riots going on over the price of rice are disturbing. Inflation leads to shortages and shortages lead to rationing. Most of us like having food to eat.

In a similar vein, I recommend reducing the layers of institutions and risk (counter-party, payment, performance and exchange-rate) between people and their purchasing power. Right now counter-party and payment risk appear the most threatening. Tangible assets have intrinsic value and are subject only to exchange rate and performance risk if you use a custodian. Financial assets do not have intrinsic value and are subject to all four types of risk. The entire fiat monetary system is based on confidence and built on an illusory and unstable foundation.</div>

For example, someone could purchase food, silver or gold coins and be subject to only Exchange Rate risk. They could use GoldMoney and be subject to only Performance and Exchange Rate risk (although currency balances are held in savings accounts with the Jersey branches of either Barclays or Royal Bank of Scotland which are generally regarded as two of the most solid banks in the world).

They could take possession of their share certificates and eliminate the counter-party risk with the brokerage.

Here is a recent and unfortunate example from April 3, 2008. “David Reganspurger took out a margin loan for a $100,000 with Opes Prime [note: a brokerage like E-Trade] last year, using his $300,000 share portfolio as a loan guarantee.

He has since paid off the margin loan, but was told last week, when the company collapsed, that he no longer owns his shares. ...

I've got nothing. We have about $,5000 in the bank and that is it. Everything's gone.”

For example, the FDIC insures bank account balances up to $100,000. Likewise SPIC insures portfolios with participating brokerages like E-Trade up to $500,000. Why would you need insurance if there was no risk (counter-party)? Is the insurance trustworthy?

Notice how the insurance is in US$ not in ounces of gold or barrels of oil. No purchasing power is guaranteed. The US$ has Payment and Exchange Rate Risk. The US$, Euro, Pound, etc. can all go to the fiat currency graveyard and become worthless. Portfolios and bank deposits can be insured but purchasing power cannot be guaranteed.

Thus, E-Trade or Bank of America could collapse, you could lose your shares or deposits, stand in line at the FDIC or SPIC (or similar institution in another country) and by the time you receive your insurance payout in fiat currency it could have been debased (printed out of thin air to meet all the other insurance claims) and your purchasing power could have been drastically reduced.

The current weakening condition of the US banking system is very perilous. Those with funds in checking or savings accounts in US banks are counter-parties and unsecured creditors. Is your cash safe?

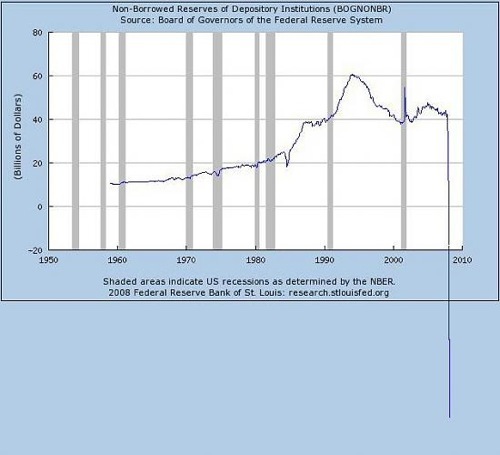

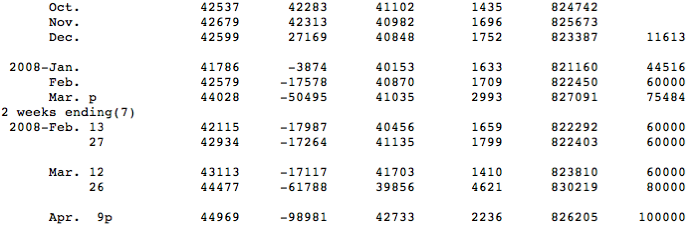

The official Federal Reserve H.3 report. The new numbers really mess up the chart’s presentation.

Adam asks, “How does that work? What percentage of that big trillions of dollars number does one need in reserves to be seen as a healthy counter-party?”

Oh boy is this a big question. A healthy counter-party is one with the financial ability to pay out the claims against them when those claims are due. A good example of a healthy counter-party, in my opinion, is Berkshire Hathaway. There are some others but they are few. Confidence and trust are rapidly evaporating.

The problem is most counter-parties are unhealthy. As such they exchange risk with each other to present the illusion that they are healthy. For example, Company A will bear the risk of Company B who bears the risk of Company C that bears the risk of Company A. All of those contracts were written and the bonuses paid out to the underwriters long before the risk may materialize. These incestuous relationships increase the probability of systemic risk. Because of the nature of the Federal Reserve System it functions as one big bank.

If any single large counter-party, like Bear Stearns, were to fail it would cause the failure of the entire system. Thus, the Federal Reserve will massively debase the currency to bail out these large counter-parties while those who wrote the contracts continue to drive around in their Maseraties. Eventually these costs will make the effort to switch to alternative currencies or monetary platforms profitable.

As such, reserves for banks or derivative counter-parties are pretty much fairy tales. Most demand deposits are sweep accounts and therefore not subject to reserve requirements. Of the remaining deposits that are subject to reserve requirements the banks just borrow what is required.

As I began blogging about on Jan. 22nd the Non-Borrowed reserves of depository institutions (banks) in the US collapsed to -$62B. US Banks are borrowing from the Fed to meet their required reserve ratios.

Derivative counter-parties are no better. For example, JP Morgan is estimated to have over $93T of derivative risk exposure with their $123B of equity. That is risk of almost 400% larger than the entire worldwide GDP and leverage of 756:1.

Derivatives multiply faster than rabbits. On Dec. 10th Bloomberg reported, “Derivatives traded on exchanges surged 27 percent to a record $681 trillion in the third quarter, the biggest increase in three years, the Bank for International Settlements said.”

In the 2002 Annual Report on page 15 Warren Buffet describes derivatives as “In our view, however, derivatives are financial weapons of mass destruction, carrying dangers that, while now latent, are

potentially lethal.”

The only real alternative is a completely new monetary system to replace the current 300 year old system of money substitutes. GoldMoney can function in this role but their ability to handle the magnitude of transactions is questionable and they need to prove themselves but for the seven years of their existence they have performed excellently.

Nevertheless, at first they can function as a backup, second complimentary with and finally as a replacement for the current system. Therefore, I encourage everyone to at least open a free account and get it verified so they can transact in the currency.

One way I use GoldMoney is to keep cash balances there. If I think the timing is good I will purchase some physical metals. Should I need the cash for some reason I can sell the metals and wire the funds to my bank account (to pay my credit card for example).

Although WaMu appears fairly unstable they did raise $7B and offer free international wire transfers which reduces transaction costs of wiring funds to GoldMoney.

Also, as a heads up some US citizens may be subject to reporting requirements with GoldMoney with the TD F 90-22.1 form. As always, consult competent legal counsel.

Remember the first rule of panic:

DO IT FIRST!!