Posted 15 Oct 2008

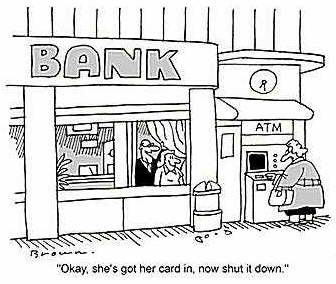

Have you ever wondered why bankers have such sticky fingers with your money? Is the money even yours?

The following example from the Russian bankers is becoming a common occurrence with their American counterparts.

“Emil Aliyev, vice president of Globex, said the measure [freezing deposit account withdrawals] was introduced after a spike in demand for early withdrawals of term deposits, "with many depositors explaining that they urgently wanted to transfer their money to VTB and Sberbank," Interfax reported. Both VTB and Sberbank are state controlled.

Garegin Tosunyan, president of the Association of Russian Banks, said the Globex decision, while severe, was "the correct action to take."

"When panic strikes, the banks need to take measures," Tosunyan said. "You need to pour cold water over people's head and say, 'Look, enough; let's stop panicking now.'"

A bailment is where a bailor leaves property in the care or trust of the bailee. Embezzlement is the act of dishonestly appropriating or secreting assets, usually financial in nature, by one or more individuals to whom such assets have been entrusted.

However, the perplexing case of Foley v. Hill and Others was decided in 1848 by Lord Cottenham who stated:

The money placed in the custody of a banker is, to all intents and purposes, the money of the banker, to do with as he pleases, he is guilty of no breach of trust in employing it; he is not answerable to the principal if he puts it into jeopardy, if he engages in a hazardous speculation; he is not bound to keep it or deal with it as the property of his principal; but he is of course, answerable for the amount, because he has contracted.

This ex-post-facto case legalized fractional reserve banking. The practice of fractional reserve banking is universal in modern banking. Fractional-reserve banking is the banking practice in which banks keep only a fraction of the value of their bank notes and demand deposits in reserve and invest the balance in interest earning assets while maintaining the obligation to redeem all bank notes and demand deposits upon demand.

This counter-party risk is getting increasingly expensive. During this Kondratieff Winter capital continues burrowing down the pyramid.

Mr. Tosunyan recommended treating customers with cold water on their head. The French had an interesting way of dealing with such bankers. In 1794 during la Grande Terreur about 20,000-40,000 of the political and banking class lost their heads to the guillotine. Likewise in America, the death penalty was an authorized penalty under the 1792 Coinage Act for currency counterfeiting.

Richard Fuld, former CEO of Lehman Brothers, was recently punched in the nose at a gym in retaliation to his nefarious, fraudulent and criminal actions. It appears civilization has calmed down a little in 200 years.

There is an alternative to the current system. GoldMoney is a licensed money service business but not technically a bank. They are a bailment based system. Your bullion is never on their balance sheet so there is no counter-party risk. Holding owners are protected by strong bank secrecy laws. Best of all holdings are free to open. They are the only reputable alternative I am aware of.